The Great Recession has led to the Great Restructuring.

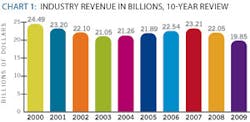

Fiscal 2009 marked the biggest 1-year decline in vending sales and the first double digit drop in the industry’s recorded history. According to the Automatic Merchandiser State of the Vending Industry Report, vending sales fell 10 percentage points in 2009, sending aggregate sales to just below the $20 billion mark.

The decline, fueled by the record unemployment that afflicted almost every sector of the U.S. economy, began in late 2007, gained momentum through 2008, and reached its apex in the third quarter of 2009. The nation’s jobless rate more than doubled from 4.5 percent in early 2007 to 10 percent in late 2009.

The aggregate 15 percentage point fall in aggregate vending industry sales for the last 2-year period reversed nearly 15 years’ worth of vending industry sales growth.

Operators responded with a slew of profit protection measures, first reported in last year’s State of the Vending Industry Report and continuing through 2009. As a result, operators posted healthier profits in 2009 than 2008, according to the National Automatic Merchandising Association (NAMA) 2010 Profit Report, which measures 2009 performance.

The NAMA report, which unlike the Automatic Merchandiser survey examines operating ratios, found that operators improved gross margins in 2009 which allowed them to improve pre-tax profits over 2008. The NAMA report noted that the ability to maintain margins in the face of declining sales was the major reason firms were able to improve profits in a down market.

The NAMA report is based on a more limited operator base than the AM survey. However, both surveys found the sales decline was larger in 2009 than 2008, and that the decline affected all key product segments.

The NAMA report found that pre-tax profit margin for a “typical” firm doing more than $2 million in sales was 1.5 percent in 2009 compared to 0.5 percent in 2008.

The AM State of the Vending Industry Report is based on returned email questionnaires sent to more than 9,000 operators in the magazine’s subscription list, which generated a 13 percent response.

Unemployment hurts sales

High unemployment not only decimated work place populations, it also caused those workers who were not laid off to cut back on spending.

Hence, vending sales took a hit on two fronts: fewer people to buy products, and those who did buy bought less.

Vending, being primarily a work place service, suffered more from the employment fallout than foodservice in general. The National Restaurant Association (NRA) reported overall foodservice sales fell 2.9 percent in 2009 in inflation-adjusted terms, marking the worst loss since NRA began tracking sales in 1971, but less than a third the loss suffered by vending. Hence, vendors had to compete with channels that faced less bottom-line pressure.

operators raise prices

The Great Recession has ushered in the longest period of vending price increases in recent history, even though the gains fell far short of making up for the unit sales declines. In 2007, 2008 and 2009, operators raised prices in all product segments.

Raising prices was the most common profit improvement measure operators took in both 2008 and 2009, as indicated in chart 6.

Operators raised prices on candy and snacks more than any other category and more than in the previous year, despite the fact that there were fewer manufacturer price increases in 2009 than 2008.

With costs rising in other areas, such as payroll, vehicles, benefits and equipment, operators recognized they needed to be more aggressive raising prices than they were in the past.

Operators found location managers more accepting of price increases than before the Great Recession, but consumers remained resistant, even though other retail outlets charged more for comparable products.

Operators absorb higher costs

Absorbing the cost was the second most common profit improvement measure in both 2008 and 2009. The fact that cost absorption ranked so high among profit protection measures demonstrates how few choices operators had to meet the challenges they faced.

Reducing service frequency was the third most common measure in 2009, whereas in 2008, reducing unprofitable accounts was number three.

In 2009, culling unprofitable accounts ranked fifth.

One explanation is that operators identified most of their unprofitable accounts in 2008.

An analysis of survey data revealed that while sales declined more in 2009 than 2008, the number of accounts served on average was level with the prior year.

Payrolls cut, but in different areas

Staffing cuts continued in 2009 at a similar level as 2008. Layoffs of delivery personnel were less common in 2009 as in 2008. Operators reduced routes more in 2008, and in 2009 they sought other areas to cut. More cut sales, warehouse and repair positions in 2009.

Medium-size vendors hurt the most

The medium-size operators, those with $1 million to $5 million in annual sales, continued to lose sales to small (under $1 million) and large ($5 million to $10 million) competitors in 2009, as indicated in chart 2. Where medium-size operators once did more aggregate sales than large operators, the overhead for a medium-size operation has increased to the point that more sales are necessary to cover the overhead.

Rising unemployment fed vending startups in 2009, driving up the number of small operators. Small operators enjoy the advantage of lower overhead.

In 2009, pricing pressure from small operators who could offer lower prices (if not the best service) was as fierce as ever.

The extra large companies, while having more capital resources to invest in salaries, equipment and technology, suffered from the fallout in manual feeding more than other companies in 2009.

Manual feeding took the biggest hit of all product segments in 2009, declining 17.8 points, as indicated in chart 10. This explains the loss of market share of the extra large companies, which do most vending-related manual feeding.

Technomic, a foodservice research firm, also reported a double digit percent drop (10 percent) in business and industry foodservice sales in 2009.

Following is a summary of the main product segments.

Cold drinks: the market changes

Vending operators raised cold beverage prices more aggressively in 2009, driven by supplier price increases. However, unit sales declined due to fewer machines and consumer resistance to price increases. Operators began pulling machines in 2008 in response to declining population counts. This trend continued in 2009.

Operators also continued to face a consumer that resists paying the same price for a product from a vending machine as at a retail store.

Consumer price resistance once again drove more vending operators to switch from 20-ounce bottles to cans, continuing a trend that began in 2007. Operators hold mixed views about offering cans instead of bottles. Many operators believed that cans offer a better perceived value to a more cost conscious customer.

Some further noted that government agencies levied deposit fees on 20-ounce bottles that did not apply to cans.

The majority of operators did not make the switch to cans, however. Many noted that while the profit margin was better with cans on a percentage basis, the dollar margin was lower.

Glassfronts increase more slowly

Mitigating the decline in cold beverage sales once again in 2009 was the continued expansion of glassfront beverage machines, which typically offer more variety and better merchandising. However, the glassfront expansion in 2009 lost momentum compared to prior years since cold drink bottlers, which provide most glassfronts to vending operators, cut back on their equipment expenditures.

Glassfronts allow vending operators to capitalize on the more diverse consumer preferences that the beverage industry has developed in recent years. However, in order to determine the best product selection, operators must be able to track line item sales. This requires a higher level of sophistication than is required for machines with limited product selection.

Many of the new beverage preferences are driven by perceived health and functional benefits, the most obvious example being bottled water.

While most operators have cited bottled water as a strong seller in recent years, in 2009 operators gave mixed views about what impact newer consumer preferences were having on their sales.

According to the New York City-based Beverage Marketing Corp., the rapid growth in bottled water sales of the last decade began to reverse in 2008 and 2009. Vending operators gave mixed views on this trend.

Some vending operators noted that customers have asked them to remove bottled water due to concerns about the bottles’ impact on the environment. These operators were in the minority.

Operators also gave mixed reports on the success of energy drinks, which according to Beverage Marketing Corp. (BMC), is one of the fastest growing beverages at retail. Some operators say these products sell well in locations catering to young people. One concern is they do not vend in every type of machine.

In some cases, beverage suppliers required vendors to carry energy drinks as a condition of providing free machines.

Some accounts asked operators to remove energy drinks, worrying they are being mixed with alcohol; some energy drink bottles resemble products that come mixed with alcohol.

Energy drinks were among the highest priced beverages that vending operators offered, commanding price points in excess of $2.00. However, the high price point is believed to have contributed to the segment’s slowdown in the current recession due to consumer price resistance.

Candy, snack and confection prices rise

The candy, snack and confection segment fared better than other segments in 2009 due to continued aggressive operator price increases. Operators were spared the manufacturer price increases that characterized the previous three years. Hence, in 2009, operators were able to recover some of the profit margin that this category lost in the three prior years.

Data provided by Management Science Associates (MSA), which tracks line item revenue and unit sales in this segment, indicated that dollar sales outperformed unit sales for most candy, snack and confection products. This demonstrates that operators were able to compensate for declining unit sales to some degree with higher prices.

Operators raised prices on their better selling items more in 2009 than in 2008, as indicated in chart 14D.

Candy, which lost market share to snacks in the previous three years, did not lose as much market share in 2009 as it did in 2008 and 2007. This indicates that the candy category, which has long been the most profitable portion of the candy/snack/confection segment, is making a recovery from the loss it suffered in recent years.

Beginning in 2006, candy manufacturers began raising prices faster than operators could pass them on to customers. Consumers resisted the price increases and sales suffered. The decline caused operators to reduce their candy facings, further hurting candy sales.

Industry observers noted that because candy products generate faster turns than snacks, the move to snacks undermined the overall candy/snack/confection segment.

Snack manufacturers responded to this opportunity by introducing snacks that fit in candy spirals, beginning in 2007.

The decline in candy sales was partially offset in 2007 by the introduction of large size candy bars with higher price points. However, when candy manufacturers raised prices for the large size candy bars, operators found customers were not willing to pay more than $1.00, which most felt they needed to charge to make a reasonable profit.

Hence, large size candy bar placements took a hit in 2009 following gains in 2007 and 2008.

Operators did find some success with large bag candy in the higher-priced pastry row.

Where none of the top 15 placement gainers in the candy/snack/confection segment were candy products in 2008, two candy items made the list in 2009: Masterfoods USA’s 1.63-ounce M&M’s Peanut and Boyer’s 1.6-ounce Boyer Mallo Cup.

Another noteworthy development was the market share gain in gum and mints in 2009. The vending industry has lagged other retail channels in capitalizing on the popularity of newer gum and mint packages in recent years. One gum product, Cadbury Adams Dentyne 1.41-ounce Cinnamon Gum, was among the top 15 distribution gainers in 2009.

In 2009, a new glassfront snack machine, the Merchant 6 from Crane Merchandising Systems, offered a new row for gum and mint products. In addition, aftermarket specialist Vendors Exchange International Inc. offered a retrofit kit for these items.

Recession trumps health and wellness

Health and wellness continued to be a public issue in 2009, but the impact on the candy/snack/confection segment was not significant. Vending operators claimed consumers were more interested in getting the best value for their money than in wellness during a recession.

Operators noticed manufacturers offered more products with health association, including more that are not too expensive. However, many operators remained dissatisfied with the variety available and the pricing.

Nutrition snacks — which include breakfast bars, cereal, fruit snacks, functional bars, nutritional pretzels, granola bars, rice cakes, trail mix — gained market share slightly in 2009.

Nuts and seeds, which are not categorized by MSA as nutrition snacks but are believed to be associated with wellness, lost market share in 2009, even though the number of nuts and seeds stocked in machines increased. One contributing factor was a nationwide peanut recall early in 2009 that caused operators to remove products containing peanuts for a few weeks.

Food snacks, including meat sticks and meat and cheese sticks, posted strong gains in 2009.

Also noteworthy was the sheer number of products introduced to the candy/snack/confection segment in 2009: 245 products were introduced, more than double the previous year.

Hot beverage vending falls

The hot beverage segment continued its decline in 2009 as operators found more locations were unable to justify the expense of having a hot drink machine. The loss in hot beverage vending sales has been more than matched by the growth of OCS in recent years. Since 2007, vending operators have generated more revenue from OCS than from hot beverage vending, as indicated in chart 10 on page 36.

Hot beverages sales fell more than any product segment besides vend food and manual feeding in 2009.

Even in locations that were large enough to justify hot beverage machines, vending operators found that sales declined. This was largely due to the consumer’s greater access to high-quality, freshly-brewed coffee at coffee shops, fast food restaurants, convenience stores and coffee kiosks.

Those operators who did report success with hot beverage vending noticed that profit margins were lower than they used to be due to the higher cost of product, equipment and maintenance.

Vending operators who wanted to succeed in hot beverage vending found machines capable of offering more variety and better quality product.

But even with better coffee, vending operators found it necessary to go out of their way to make consumers aware of this due to widespread negative attitudes about vended coffee.

Some operators accomplished this by offering free coffee periodically from their machines.

Vend food keeps struggling

The vend food segment, which has been declining for years due to worksite downsizing, took its biggest hit ever and the biggest hit of all product segments outside of manual feeding in 2009.

For the second consecutive year, frozen food machines, which grew steadily since their introduction in the early 1990s, declined. The fallout in frozen machines, which allow operators to offer food without incurring the waste involved with refrigerated machines, underscored the sorry state of food vending in 2009.

Ever since the introduction of frozen machines, the expansion of this segment more than offset the decline in refrigerated machines, which has been continuous for the past decade.

Frozen machines, for their part, are not fully used for food; most are used for ice cream.

Operators were more aggressive raising food prices in 2009 than any segment besides cold drinks and snacks. But the price hikes did little to offset the decline in machine placements and the consumer’s unwillingness to patronize the food machine.

While vend food offered some of the best single-serve food values available to consumers, negative perception of vend food remained a major obstacle. Even at a time when consumers were more value conscious, negative perception of vend food prevented them from choosing the vending machine over the fast food restaurant or the convenience store.

Some operators found that advertising the superior value they offer compared to food in other retail venues helped win food sales.

Frozen-prepared versus fresh

What role the continuing decline in freshly-prepared food plays compared to frozen-prepared food remains a matter of debate. Some operators maintain that fresh food is important to win the food sale, while others say that frozen-prepared food has improved significantly, rendering the fresh-versus-frozen debate unimportant.

Food-borne illnesses increased in 2009, which contributed to consumer reluctance to buy packaged food.

While refrigerated and frozen machines declined in 2009, more operators began using ambient machines to offer canned food, as indicated in chart 16A. More lunch kits, usable in ambient machines, were introduced in 2008 and 2009.

Milk falls again

For the second straight year, milk sales fell in 2009, largely due to the decline of all types of machines that vend milk. Most vended milk is sold in refrigerated food machines as opposed to dedicated milk or cold drink machines, as indicated in chart 17A.

Milk sales declined despite the fact that vending operators continued to raise prices in this segment in 2009, as indicated in chart 17D.

The vending industry has not been able to share in the overall growth of milk in recent years, which has been driven in large measure by the milk industry’s aggressive advertising. Milk continued to grow at retail in both 2008 and 2009, according to the BMC, which tracks beverage trends.

The number of dedicated milk machines declined for the second straight year in 2009. This was partially due to the dairy industry’s diminishing support of vending.

In the mid 1990s, national, state and regional dairy organizations provided marketing support to milk vending, primarily targeting schools. Many associations subsidized milk machines.

Chart 17A indicates that milk sales in refrigerated food machines did not decline, unlike dedicated beverage machines and dedicated milk machines. This continues a trend from 2008, when milk sold in refrigerated machines increased despite the drop in the number of these venders. Vending operators likely increased the use of milk in refrigerated machines to reduce the amount of food in them.

Ice cream grows slightly

Ice cream and frozen desserts were the only segment other than cigarettes to post a gain in 2009. The 2.2-percentage-point gain was not significant, and it did little to compensate for the decline reported in 2008.

The decline in frozen machines continued in 2009, but operators using frozen machines allocated more of their facings to ice cream than frozen food in order to reduce expenditures.

The number of dedicated ice cream machines fell for the second straight year in 2009. The number of old style dedicated 3- and 4-select machines took a big hit, indicating they are being phased out.

Much of the reduction in frozen food machines was driven by schools that banned ice cream due to nutrition rules.

2010: Gradual improvement expected

Vending operators agreed that the losses that began in the last quarter of 2007 began to level off in the third and fourth quarters of 2009. There was no significant change in the first quarter of 2010, indicating conditions were stable but not showing major signs of recovery.

Operators overall felt that a gradual recovery was under way but that business was not going to return to 2006 levels any time in the current year.

The Conference Board, a Washington, D.C.-based organization that tracks economic trends, reported that the nation’s economic activity has been improving slightly but consistently since mid 2009 through the first quarter of 2010.

The National Restaurant Association predicts that onsite foodservice, which took a huge hit in 2009, will grow by 4 percentage points in 2010, which translates into 1.3 points when adjusted for inflation.

Vending operators have used the “down time” imposed on them by the recession to review their financial reports, make changes to improve profitability and in some cases, invest in technology that will further improve their profitability.

About the Author

Elliot Maras

Elliot Maras served as the editor of Automatic Merchandiser magazine from 1993 to 2012. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].