Some of what do, and even things we don’t do, might cause them to decide NOT to buy. We know why they buy. Do we understand why they do not buy?

Clean, filled and working! Is that all we need to do? That is what we have all been told is the key to success in our business. For much of the past 50-60 years this rule has been the key driver to successfully drive sales and profit growth. It has worked in the past.

To start, let’s define merchandising as it applies to our channel. The classic definition is “making products available for sale through display, promotion and pricing to gain attention, stimulate interest and entice shoppers to make a purchase.” For today’s shoppers, especially those under 30 years of age, clean, filled and working is not good enough to win their loyalty.

There are four critical issues we must address now to prove that we are serious about merchandising in vending, OCS and onsite feeding. Specifically:

- How do we attract and interest shoppers to buy – and then buy again? We can’t survive unless we build repeat sales with the people who work at, or regularly visit, the locations we serve. Is there a better way to place our machines to drive sales increases?

- How should we arrange the products we display in our machines? Can we increase sales if we set our machines differently? Where do put specific items to maximize sales and profits?

- How do we minimize out-of-stocks? Research reports across retail stores indicate that shoppers will not come back to a store if they find that their favorite items are consistently out-of-stock. After the third time, a shopper will go elsewhere and not return. If we’re out of best sellers every week at locations, it won’t be long before we turn off and lose those shoppers who want their favorite candy, snack or beverage.

- How do we differentiate what we offer? If everyone sells the same products, then the lowest prices (and the highest commissions) will always win. We must rise above the “sameness” to make what we sell unique and different versus what everyone else offers.

Attracting and Interesting Shoppers To Buy - And Buy Again

How do we attract and interest shoppers – at 30’ – at 10’ – and when they are in front our machines? What is the most effective way to arrange our machines? Which machines should be closest to the entry point? Why? Which should be furthest from the entry point? Why?

This is a challenging subject. If you visit chain operations – fast food restaurants and convenience stores – you’ll see a fairly consistent design in each chain’s locations. It’s difficult for us, because every breakroom or lunchroom is different in size, format (rectangles, squares, whatever), color and fixtures – with tables and chairs varying from new to the 1950s. Our industry has always been creative and highly adaptive. Now we must step it up – in a big way.

We run different stores at every location. The machines placed vary based on how many people are being served. The products we stock change based on the site demographics – younger or older, white collar or blue collar or pink collar or grey collar, ethnic mix, etc.

Keep all of those factors in mind. Do you recall the advertising from Jack-in-the-Box when they got rid of their clown logo and remodeled their restaurants? In the ads, they blew up the store. It is time for us to blow up the store. Here are some radical new ideas:

- Get rid of the machine line-up. Space the machines farther apart. People don’t like to bump in to other people when they are shopping. Give them more room.

- Create landing areas. What is a landing area? Next time you’re in convenience store or a coffee shop, look at the spaces they provide for their shoppers to put down what they’ve purchased and deal with adding condiments, picking up utensils or napkins and simply getting organized. We don’t offer this. Have you ever watched a shopper at a vending site juggle a sandwich, snack and try to buy a soft drink? I have and I can tell that these folks are usually frustrated and annoyed. Go see for yourself.

- Cluster machines. This does not work at every site. But it will work at many locations and can be a game-changing enhancement to how shoppers interact with what we offer.

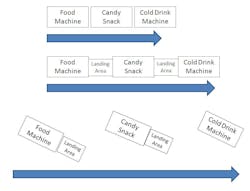

- Change the machine arrangement. The closest machine to entry point should be the least shopped machine. The machine at the most distant point should be the one most frequently shopped. We don’t usually do this in our business. But convenience stores do. They will walk you past candy and snacks and food to get to either the cold or hot beverages. Pay attention the next time you’re in a convenience store. Put the soft drink machine at the most distant point from the entry or room access. Put the food machine closest to the entry. Then snacks. Then coffee.

- Don’t use a machine line-up at all. This is my last and most controversial recommendation. Make the shopping process at each machine more like each is a separate department. Why? Make it easier for shoppers to check out a machine. This will give them more access to “window shop” and, hopefully be enticed to make an impulse purchase. If all of the machines are directly in line, it will be more difficult for shoppers to see what is being offered – especially if it is a busy lunch rush or break time. Pay attention the next time you’re in a convenience store. Watch how people move around to “hunt” among the departments – especially when it is crowded. Convenience stores have done a lot to make shopping easier. We can learn from what they’ve done and adapt it to vending and onsite foodservice locations. Check out the diagrams below.

And, this is something new that every company in our industry must do. When responding to an RFP, we must add two things we expect the client will be responsible for (in the contract):

- Providing the atmosphere and ambiance: If the breakroom is not an attractive and inviting environment, then we must ask (in the bid we submit), that the tables, chairs, etc. must be “upgraded.” We will have to sell this – because we are giving them productivity – by keeping their staff onsite. But if the lunchroom is “bad” – the staff will want to get away for breaks or lunch.

- Keep the breakroom clean: That includes tables, chairs, counters, sinks, and the floor. It also includes the microwave oven. A dirty breakroom will turn people away. They don’t come back and we lose sales. We’ve got to sell this too.

Arranging the Products We Display In Our Machines

We are in the immediate consumption business. What we sell is usually consumed within 15 minutes of being purchased. Some of those sales are planned. Some of those sales are made as impulse purchases – unplanned. Our merchandising must go beyond how the breakroom is laid out and how we place our machines.

Is the shopping process organized to make it easy for those are 30-feet away to realize what we are selling? If it is easy, they might come closer. If not, they won’t. It is the 30-feet decision point that makes me a big fan of branded machines. And that’s why I also like adding décor packages around the machines to get the attention of busy, distracted people – to help them notice what we offer. Did you ever wonder why the free-standing cold drink machines always feature big branded imagery? It’s simple – they want to attract your attention, stimulate your thirst buds and get you to walk up and buy a refreshing cold drink.

The front of the machine is the next stop in the merchandising game. My favorites are the interactive machines that Kraft, Coca-Cola and PepsiCo have featured at NAMA. The interactive screens help make sales by engaging the technology driven Gen X and Gen Y shoppers.

But most of our business is driven by glassfronts – especially so for candy/snack machines and carousel food machines. First, let me address food machines. I am not a fan of carousel food machines.

There are two studies I’ve seen from Europe over the last ten years. One says the middle rows radiating from the right to left generate the highest sales. The other study is more recent, about three years old, and indicates that a diamond format for the best sellers will drive higher sales.

And one more tool to merchandising efforts. Use social media – especially where the site population is younger and more tech savvy. PepsiCo has a new social media cold drink machine. You can buy a Pepsi for a friend and send then a message, with text or a photo or video. And Unilever has a new ice cream machine – when it senses that you’re smiling, you’re rewarded with a free ice cream and you can post your smiling face on Facebook.

Welcome to the world of social media. Imagine if you could put your plan-o-gram on a website, or Facebook, for each machine at each location. With telemetry, if you have the nerve, you could show what is (or is not) in stock up to the minute. We can do this – right now. Who will lead our channel in this direction?

No More Out-Of-Stocks

I’ve seen a lot of research about out-of-stocks. It is always the same. Most retail channels experience out-of-stock levels at 9 percent or more. These studies have been done in the U.S., Europe and Asia across a wide range retail channels. About 30 percent of shoppers decide not to make a purchase when their favorite item is out-of-stock. And roughly another 30 percent go elsewhere to find their favorite item. About 10 percent or more often decide not make a purchase at all. One study concluded that sales could be increased as much as 3 percent by eliminating out-of-stocks (in U.S. convenience stores). How would you like a 3 percent increase in sales – just by eliminating out-of-stocks?

We have an almost perfect toolkit – telemetry. We can, with remote monitoring, watch sales as they occur. We can be attentive to out-of-stocks before they occur. And do it with hot shot runs to refill a few spirals. How do we do that? Get rid of your slowest selling SKUs. Then double up and even triple up on best selling SKUs. What sells best will vary dramatically at our locations. So be smart and be flexible. Other vending channel research we’ve seen (from Europe) indicates that profit can increase dramatically when you do double up or triple up on the best selling SKUs.

Differentiating What We Offer

In vending, onsite feeding and OCS, we’ve heard about sales being down by 10 percent or more. Our tried and true practices are not delivering the same results we achieved in the past. We can blame the economy. But blame does not pay the bills. We can blame the competition. But their efforts to steal our sales will only continue to intensify in 2011.

If we follow the example set by fast food restaurants and convenience stores, we would use food – foodservice – to be our primary point of differentiation. That would be a challenging initiative for any company in our industry.

About the Author

Paul Schlossberg is the president of D/FW Consulting, which helps clients merchandise and market products in impulse intense selling envornments, such as vending, foodservice and convenience stores. He can be reached at [email protected] or 972-877-2972; www.DFWConsulting.net.

Editor's Note: For an extended version of this article, visit www.vendingmarketwatch.com.

About the Author

Paul Schlossberg

Contributing Editor

Paul Schlossberg is the president of D/FW Consulting, which helps clients merchandise and market products in impulse intense selling environments, such as vending, foodservice and convenience stores. He can be reached at [email protected] or 972-877-2972; www.DFWConsulting.net.

Most recently he has begun writing a bimonthly online column titled "Sell More Stuff" featured on VendingMarketWatch.com.