2016 Vending Quarterly Micro Market Pulse, First Quarter

The majority of micro market operators participating in the Operator Confidence Index reported “strong” or “very strong” micro market sales in the last quarter of 2015 and uplifted confidence in the first weeks of 2016.

In the last quarter of 2015, TX-based Mcliff Coffee + Vending saw substantial growth, said Ray Leydecker, vice president of operations. “We are very optimistic about micro markets and their overall impact for our company,” he said. “Where we were once presenting the concept, they have become more familiar to the public and are clearly becoming the refreshment option larger companies are seeking.” He predicts that the segment will continue to rapidly grow in the upcoming year.

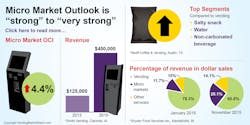

Rod Nester, president of IA-based Smith Vending, is also positive about the future of micro markets within his company. Micro market sales for Smith Vending increased from around $125,000 in 2013 to nearly $450,000 in 2015. Although Nester predicts market growth in 2016, he sees shrinkage and theft as an issue. “We have rolled out three new tools to help ‘keep honest people honest,’ but the burden is still there to deal with a small percent of people who still abuse the market,” he said.

Although many operators cited ‘shrinkage’ as an issue, Jeff Snyder, CEO of IN-based Snyder Foodservices Inc., is concerned more with the problem of commissions in markets in 2016. “We are already hearing of competitors starting to offer commission dollars for new sales businesses in the markets,” Snyder told VendingMarketWatch.com. “If that trend continues, markets will soon become just like vending, where we bust our humps all day long and make little or no monies.”

Despite this concern, Snyder’s view of micro markets is positive. “We were slow to the [micro market] game, only due to the fact that our early sales return on markets in 2014 was not encouraging,” he said. The following year, 2015, proved to be much different for Snyder Foodservices Inc. Revenue in vending and markets shifted from a ratio of 78.3% / 11.7% in January 2015 to 60.8% / 25.1% of total dollar sales for November 2015, respectively, for the company, with other services making up the remainder of revenue.

Strength in categories

Fresh food is big seller for many in micro markets. “Without a doubt the largest gain is in fresh foods, primarily due to the fact people can touch the containers and then are able to make a value for cost determination,” said Snyder.

Leydecker reports that for Mcliff Coffee + Vending, overall market sales are around 45 percent beverages, 25 percent fresh food items and 30 percent snacks or dry goods. “Chocolate sells less [in micro markets] than in traditional vending,” said Leydecker. “Salty snacks, water and still beverages (non-CSDs) do really well compared to vending.”

Operator sentiment regarding the micro market segment is generally upbeat from 2015 into early 2016. “With the holidays behind us now we are expecting to see some rebound to more normal levels in all of our markets,” said Dennis Dionne, CFO of WI-based BE’S Coffee & Vending Service, Inc.“We just put in several more Avenue C micro markets in the last quarter.” The company has several proposals out for new markets at new and existing customers. However, at the time of press it did not have any firm commitments for first quarter 2016.

Micro markets are proving to be a source of growth for many, regardless of region or operation size.

About the Author

Adrienne Klein

Contributing Editor

Adrienne Zimmer Klein is a freelance writer with a background in the vending, micro market and office coffee service industry. She worked as an associate editor and managing editor at Automatic Merchandiser and VendingMarketWatch.com from 2013 until 2017. She is a regular contributing writer at Automatic Merchandiser.