The recession has forced operators to shift to a “survival” mode as worksite downsizing and a decline in consumer spending is hurting sales. In the interest of helping operators develop a business strategy, Automatic Merchandiser commissioned a consumer research firm, Chicago-based Leo J. Shapiro & Associates, to find out specifically how consumers view vending in light of the current economy. Vending operators might take some solace in learning that other retail foodservice channels are suffering the same fate.

The survey found that most vending purchasers establish a relationship with the vending machine that they patronize, indicating vending operators have an opportunity to build on their existing equity to improve sales. “If that could be tapped in a small way, you could improve frequency of use,” observed George Rosenbaum, who designed the Shapiro survey.

Operators will find that by building on an established equity — convenience — they can weather the current recession and improve profitability over the longer term, when the recession ends.

Many retail observers claim that consumer buying habits are changing, and the “trading down” that has occured will continue when the recession subsides.

In addition, while vending has gained some level of acceptance due to its perceived value in comparison to other retail channels, price resistance remains a major challenge.

RECESSION CHANGES CONSUMER BEHAVIOR

The Shapiro study is based on telephone interviews with 562 adults in 38 states.

Overall, the study found consumer satisfaction with vending reasonably good, even in the recession, but consumers remain resistant to paying higher prices.

The 22 percent of consumers who purchased from vending machines in a recent 24-hour period account for 60 percent of vending sales. The percent rises to 78 percent for everyone buying within the past seven days.

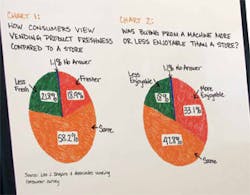

For most purchasers, the vending experience was equal to or superior to a store purchase. Only a minority felt compromised by using a vending machine rather than a store. One third (33 percent) said the vending purchase was more enjoyable than if it had been made in the store, and nearly half (49 percent) said it was the same as a store. Just 18 percent found it less enjoyable.

Relative satisfaction was slightly lower for freshness: 19 percent said that the vending product was fresher than the same purchase would have been from a store; 22 percent said it was less fresh. The balance (59 percent) said vending and store freshness were the same.

More than a third (36 percent) felt that the price for the vending purchase was unfair. This inequity was especially true for non-beverage purchases (55 percent).

Customers are making fewer vending purchases. Among active purchasers – those purchasing within the past seven days and accounting for 78 percent of vending dollars – 49 percent said they are buying fewer cold beverages than a year ago; 59 percent said fewer hot drinks; 42 percent said fewer snacks; 49 percent said fewer candy; and 48 percent said fewer sandwiches.

The number of customers who say they are buying more this year is relatively small; highest for snacks (37 percent); cold drinks (28 percent); and candy (26 percent); lowest for hot drinks (10 percent) and sandwiches (10 percent). On balance, those cutting back outnumber those buying more by a margin of about two to one or higher.

VENDING VERSUS OTHER RETAIL CHANNELS

The pressure on vending purchases reflects sales pressure generally for foodservice. Active vending purchasers (those who have purchased in the past seven days) have cut back more visits to fast feeders (61 percent), to coffee shops, also 61 percent, and tablecloth restaurants (51 percent) than to vending machines. Active vending purchasers cut back less on vending purchases, 50.5 percent, than in the other retail outlets.

Consumers overall are cutting back on vending just as much as the other outlets, but active vending users are cutting back more in competing retail outlets than in vending.

Among active vending users, 24.7 percent are increasing their vending purchases, compared to 17.8 percent who are buying more from fast food outlets and 13.3 percent buying more from coffee shops.

MORE PROMOTIONS WOULD HELP

The survey indicated that promotions would improve sales. The opportunity for creative promotion is signaled by the impact of various approaches in comparison to a price decrease. Among active vending purchasers, 62 percent said that a 10 percent price cut would have a great deal of influence on their purchasing.

Three alternative promotions came fairly close. Nearly half (49 percent) said that fresh dating would have a great deal of influence on their purchasing, i.e., “if the date when the machine was loaded with fresh product was posted on the machine.” An equal proportion (49 percent) said that a choice between popular and private label brands, with the latter priced 20 percent lower, would have a great deal of influence on their purchase, and 53 percent said one or two items on special each time that they used the machine would be of great influence. Of less influence (21 percent) was replacing an older machine with a new one.

VENDING OPERATORS MUST RECONSIDER STRATEGIES

Given the current state of the economy, most operators are focused on reducing costs, giving little thought to investing for long-term growth. Few operators are investing in new equipment and technology that will enable them to improve the value they provide customers, which most agree is necessary to succeed in the long term.

Many operators, if not most, are reducing service visits, considering layoffs, and limiting product variety to top sellers, buying product solely with the goal of qualifying for manufacturer rebates.

These actions, while understandable given the state of the economy, curb the operator’s chances for becoming more relevant to the consumer. Operators cannot be blamed for making changes necessary to survive, but they cannot expect to succeed in the long term by following a reactive operating mode.

The survey indicates that consumers have recognized the value of vending relative to other channels, but resistance to price indicates that the industry has failed to justify its need to charge a fair price for its service.

NEW TOOLS ADDRESS CHALLENGES

New tools have been introduced that will make vending more relevant to consumers. The capabilities of cashless transactions, remote machine monitoring and digital signage messaging will allow vending machines to interact with customers more actively.

No other retail channel can bring a rewarding buying experience to the consumer in so many locations as vending. And no other retail channel is positioned to communicate with consumers where they spend most of their waking hours: at work.

The future is as bright as the present is depressing. Can these two disparate scenarios really be bridged? The answer to this question depends on the individual operator. For the average operator, survival will be a struggle, but it can also be a learning experience that will create a prosperous future.

THE FUTURE CAN GUIDE THE PRESENT

The future, described in almost surreal terms, is not a fantasy. It will be a reality. And it holds relevance to the present in that it can serve as a guidepost.

The individual operator is limited in his or her ability to provide the benefits that modern technology can provide. But the traditional vending machine provides the location a potential benefit that is more important than ever.

Operators must realize that U.S. employers are better educated about the importance of motivating workers. Employers recognize that providing benefits is critical to their own success. An entire human resources industry has evolved because of this.

To better make the case for vending, operators must communicate their value to customers.

Many operators have been able to win approval for price increases by comparing the prices of vend products to similar packages in other outlets. An example from CL Swanson Corp., based in Madison, Wis., is shown above.

Point of sale communication is an area where technology offers major benefits, but traditional tools can work well in the meantime: customer newsletters, point-of-sale stickers, posters in the break room, not to mention the physical interaction of the customer service representative.

Several technical innovations in recent years are designed to improve customer value. While most operators can’t afford these at the present time, understanding what these technologies offer will instill a better sense of the service vending already offers.

As some industry experts have phrased it, the challenge is in becoming retailers and not simply service operations.

The SPIO Media Network system is a coupon dispenser that is installed in the machine. When a vend is made, a promotion is dispensed simultaneously. It can be an offer to receive a free item from a restaurant or $5 off a $25 purchase at a retail store. The company is working with consumer product manufacturers on vending promotions.

QuickStore24 is a pairing of a snack and beverage machine with interactive video touchscreens, multiple payment options, and on-site coupon dispensers.

More recently, a group of vending operators partnered with Cantaloupe Systems on a new company called Sprout that will deploy telemetry and cashless services, along with coupons and loyalty reward programs. The principals claim several major consumer product manufacturers have taken an interest in the program.

Such solutions have the capacity to change customer perception of vending, but before this can happen, these solutions will require critical mass.

This does not mean that these innovations have no purpose at the present time.

The vending operator’s first step is to recognize the value he brings to the location and the consumer. As simple as this sounds, current operator behavior does not indicate widespread recognition of this need. By focusing on purchase costs and accepting low prices and high customer commissions, it is difficult for operators to provide the value the customer seeks.

About the consumer survey

This past November, Leo J. Shapiro & Associates surveyed 562 adults in 38 sates, which it believes represents all geographic regions, on vending purchase behavior. The complete survey includes demographic data on vending users, such as age, gender, where they use vending, type of job, level of education, type of products purchased, attitudes about vending and other retail outlets, frequency of purchase, and how purchasing compares to a year ago. The survey allows readers to track demographic factors to purchasing habits and attitudes.

The survey is available for $249.00. For information, contact Gary Thom at 800-547-7377 ext. 1333.

TALKING POINTS

- The recession has made consumers more value conscious; experts believe the change is long term.

- A core of active vending users make most purchases.

- Vendors can raise sales by improving value, through price promotions, freshness posting and other means.

- Consumer price resistance remains a major challenge.

?

About the Author

Elliot Maras

Elliot Maras served as the editor of Automatic Merchandiser magazine from 1993 to 2012. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].