Beyond Recession: Leaders Position for Growth

Cautious optimism” best describes vending operators’ expectations about the economy in 2010. Most believe the decline that hit them in 2008 and 2009 has bottomed out, and that sales will begin to recover, however gradually, in 2010. But that doesn’t mean a lot aren’t hopeful for a good year.

A recent operator survey revealed many operators expect 2010 to be a good year. The more optimistic among them are not relying on customers to rehire a lot of employees, or for employees to begin spending a lot of money in the break rooms. These optimists believe that the changes they have been making during the downturn have enabled them to improve their bottom lines.

More importantly, they believe the changes will position them for growth when employers begin rehiring in a big way, which economists claim is destined to happen at some point.

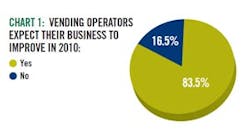

A recent Automatic Merchandiser online survey sent to a random sampling of vending and OCS operators nationwide revealed 83 percent believe their businesses will improve in 2010.

While reader surveys do not accurately reflect the views of all operators, the survey does confirm there is a group of operators who are optimistic about the future.

Surveys designed to measure investment plans typically result in forecasts that are more optimistic than the industry norm. This is because the more optimistic operators are more likely to complete a survey than the less optimistic ones.

Automatic Merchandiser also conducted random phone interviews with operators nationwide and confirmed that many operators have evaluated their operations in response to the current recession and believe they have positioned themselves for success.

A similar 80 percent majority say they have made some strategic changes in their companies, as indicated in chart 3 on page 30. The largest single change reported was expanding into a new geographic area, cited by 19 percent, followed closely by acquiring another vending or OCS business, cited by 18 percent.

The majority of respondents do not plan to add new services in 2010, as indicated in chart 2c. Among the 42 percent planning to add a new service, most plan to add OCS.

About 80 percent also said they are investing in new technology, indicated in chart 2d. This marks one of the most positive forecasts for technology in recent years. More operators recognize they need to invest in new technology to succeed, and many are doing so despite the unfavorable business climate.

Technology providers have long noted that vending operators have been slow to adopt new tools to enhance the customer’s vending experience and to make managing a vending operation more efficient. When the recession hit, operators looked to reduce costs, not add them.

The economy’s impact on operator willingness to invest in technology is hard to determine. While operators have been slow to invest in technology in recent years, investment has gradually increased, surveys have consistently indicated. The most likely explanation is that investment has grown as operators have become more knowledgeable about the technology.

Another reason is that over the years, a group of recognized technology providers has emerged.

Operators interviewed about technology said they realize that benefits of remote machine monitoring and cashless transaction capability, the two leading areas of investment, will allow them to operate more profitably.

The two technologies are closely related, since the hardware required for remote machine monitoring oftentimes supports cashless transactions, and vice versa.

Remote machine monitoring (RMM) in particular has been recognized as a technology needed to support pre-kitting routes. Many operators have been able to improve route productivity by pre-kitting routes in the warehouse.

Cashless vending was cited as the most common technology operators are adding.

The survey did not distinguish between “open” and “closed” cashless systems. Industry observers have long noted that “open” cashless systems will give the vending industry the ability to charge higher prices and be more competitive with other retail outlets.

While “open” cashless installations have increased in recent years, the “closed” systems, which allow the location to reward employees with purchase money, have also increased.

Many operators introducing “open” cashless systems note that it takes time for customers to use the cashless, but the cashless purchasing does increase with time.

Operators who have introduced new technology note that while it allows them to reduce route labor, they need to spend more time reviewing financial results to get the full benefit.

Hence, while technology can reduce labor, it can also require more management time. Operators who have used RMM note that the systems allow them to ascertain if the account is being serviced properly, to determine what consumers are buying, and it alerts them to service issues in a more timely manner.

Several operators interviewed noted that because RMM allows them to analyze location profitability on a more timely basis, they have found it worth their trouble to analyze location profitability regularly.

By reviewing individual location reports, operators can decide what changes need to be made to improve location profitability, such as service frequency, number of machines installed and line-item product performance.

Operators using new technology frequently find that technology influences their decisions to acquire other vending operations.

For instance, an operator who has machines with full DEX reporting capability will consider whether another operation’s machines have comparable DEX capability before deciding how much to pay for the company. The need to upgrade machine DEX represents an additional investment.

At the same time, an operator utilizing RMM could find that he can incorporate more routes at lower cost and will therefore be more interested in buying additional routes.

A 53 percent majority said they expect to add more employees in 2010, indicated in chart 2b. The most common job responsibility operators plan to add is in sales, cited by 18 percent. An additional 6 percent of operators indicated they will add customer relations personnel.

Interviews with operators confirmed that many recognize the importance of dedicated sales and customer relations functions.

About 80 percent of operators also indicated they plan to buy new vending machines in 2010, indicated in chart 2a. Operators have postponed equipment purchases since the economy went into recession.

However, many operators have noted that some new machines have more capacity and are more aesthetically pleasing, which can improve sales.

Operators agreed that the economy will improve slightly in 2010. The more determined operators believe they are positioning themselves for growth in the meantime and well into the future.