Recession squeezes sales and profits for second straight year

A stubborn recession keeps OCS sales depressed as U.S. employers remain reluctant to rehire. The nation’s jobless rate more than doubled from 4.5 percent in early 2007 to 10 percent in late 2009 and only slightly declined to 9.5 percent in the first half of 2010.

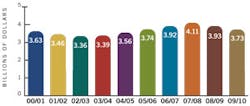

OCS revenues posted a 5 percent decline in the 12-month period ending in July of 2010, marking the second consecutive aggregate sales decline following a 5-year growth period, according to the Automatic Merchandiser State of the Coffee Service Industry Report. The second consecutive 5-point decline took aggregate OCS sales to $3.73 billion in 2009/2010.

Location managers remain in a cost cutting mode, forcing operators to reduce prices, offer less expensive products or less coffee variety.

Price concerns have caused customers to shop more aggressively since the recession began in 2007, making it harder for operators to raise or even sustain prices. This, combined with rising operating costs, has hurt operators’ profit margins.

The State of the Coffee Service Industry Report is based on the results of a questionnaire emailed to 600 dedicated OCS operators and 2,700 vending operators with OCS operations. The commentary in this report is based on interviews with operators, product suppliers, equipment suppliers and researchers.

The aggregate OCS revenue in this report includes OCS revenue in the State of the Vending Industry Report, released in June/July. The OCS revenue reported in the vending study includes OCS sold to accounts that are mainly vending accounts.

OCS operators noted revenue declined in the last 12 months due to falling or stagnant location population counts and requests by customers for lower prices.

Declining revenue naturally results in lower profits unless profit improvement measures are taken, such as reducing staff. The survey indicated operators reduced staff in both the last two 12-month periods. Slightly less staff reduction activity took place in 2009/2010 than the previous year, as indicated in chart 11.

Profits suffer

The State of the Coffee Service Industry Report does not measure operator profits. However, phone interviews with operators nationwide indicated that profitability declined in the last 12 months.

Lower profit margins make it harder for operators to invest in new equipment, salaries and employee training.

While customers wanted to cut expenditures, they did not want lower quality products or services. Hence, OCS operators have been pressured to sustain existing product offerings at lower prices.

Due to the variety of OCS products and equipment available, many operators were able to switch to lower cost products that did not necessarily reduce customer satisfaction. For instance, in a location with fewer employees, operators could exchange a 4-station brewer with a less expensive 2-station brewer.

For another example, the operator can switch from a name brand specialty coffee to a less expensive private label coffee which, while costing less, can deliver comparable quality.

The operator can also exchange a name brand creamer or sweetener with a generic version to save money.

While operators faced pressure to lower prices, customers still wanted high quality coffee. Customers wanted to spend less money, but they did not want to switch to lower quality coffee, giving OCS operators some leverage to maintain prices.

Even in a recession, location managers recognize that lower quality coffee in the office will cause employees to leave the office for coffee stores.

Consumer demand stays strong

The National Coffee Association (NCA) national coffee drinking trends survey found that in 2010, consumption of coffee in the past day remained essentially unchanged from 2009, with 56 percent of adults aged 18 and older partaking. Daily consumption in 2009 was also unchanged from 2008.

Coffee consumption within the past week also held stable versus previous years at 68 percent, according to the NCA survey. This stability indicates that the number of people consuming coffee has not been significantly affected by the economic environment.

Also unchanged from last year was the NCA finding that 84 percent of consumers claim that their coffee consumption did not vary in the past six months in response to the economic environment. This indicates that most consumers are consciously maintaining the coffee behaviors they had developed prior to the recession.

Locations scrutinize costs

Many location managers continue to recognize the importance of quality OCS, but the recession has made them scrutinize expenses more thoroughly. OCS customer companies under pressure from their own customers to trim costs felt no choice but to pass this pressure onto their own suppliers.

Employers that laid off employees naturally felt justified in cutting back on employee benefits.

In response, many OCS operators argued that if employees were being asked to do more work because there were fewer people, the employer should at least maintain benefits that enhance employee productivity, such as OCS.

Some employers accepted this argument, but others felt employees that still had jobs should be willing to accept fewer benefits.

Single-cup growth slows

The growth of single-cup brewers, which drove OCS growth prior to the recession, continued in the last two 12-month periods, but at a slower rate, as indicated in chart 7. If homeowner single-cup brewers used in offices are included, the number of single-cup placements in offices posted a major gain in 2009/2010. But since homeowner units are not typically used by OCS operators, these units should not be considered OCS brewers.

Hence, OCS single-cup brewer placements, not including homeowner units used in offices, slowed in the last two years.

Single-cup still accounts for less than 20 percent of all brewer installations nationwide, as shown in chart 6. This indicates operators still have major growth opportunities with single-cup brewers.

Single-cup helps grow sales

Because single-cup brewers continued to expand, single-cup minimized the aggregate OCS sales decline. Single-cup brewers typically more than double the sales of a traditional batch brewer.

OCS operators noted that even accounts that suffered population losses usually did not want to give up single-cup brewers once they experienced their benefits. Single-cup systems deliver a coffee house quality coffee in an easy-to-use manner with less mess than a traditional batch brewer.

Thermal and airport brewers also continued to increase at the expense of glass pot brewers, continuing a 10-year trend.

Fewer price increases

For the second straight 12-month period, the number of operators raising prices declined, as indicated in chart 3b. This reflected three things: 1) customer resistance to price increases, 2) the slowing in single-cup placements which typically raise sales, and 3) an increase in private label coffee, as indicated in chart 5. Private label coffee is usually less expensive than national brand coffee.

The percent of operators raising prices hit a long-time high in 2007/2008, despite the onset of the recession, but it declined in the last two years.

In 2009/2010, more operators lowered prices than any time in the last 10 years. In addition, 40 percent reported not changing prices, which was also more than in any year in the same 10-year period.

OCS operators felt pressure from customers to maintain or lower their prices despite the fact that many coffee retailers raised prices in 2009 and 2010. Retailers raised prices due to higher green coffee prices, as indicated in chart 2.

Operators struggle with rising costs

With fewer price increases, OCS operators were limited in finding ways to offset higher operating costs, which included increases in employee benefits, workers unemployment, and state and local taxes. As indicated in chart 10, many operators were forced to simply absorb higher costs in both of the last two years, which hurt profits.

One small sign of improvement in 2009/2010 was that OCS staff reductions were less common than the previous year, as indicated in chart 11.

More operators added staff in 2009/2010 than in the prior year, indicating some willingness to invest in future growth. Among operators who added staff, most hired new sales people.

Many operators noted the only way to offset the impact of lower sales was to add locations. To do this, it made sense to hire additional sales people.

Another effect of the recession was an increase in requests for brewer payment mechanisms. This marked the second consecutive year operators reported more requests for payment mechanisms, as indicated in chart 12. Operators traditionally discourage these requests since payment mechanisms add equipment cost, accounting cost and maintenance cost, and reduce consumption.

More Competition from other players

In addition to stiff competition from one another, OCS operators noticed more competition for office coffee from office supply companies, water service companies and membership warehouse clubs.

While these channels were not new to the OCS business, OCS operators noticed these players became more aggressive due to declining sales in their other merchandise categories.

OCS operators particularly noted more competition from office supply companies in 2009/2010. This competition was mainly confined to locations with fewer than 50 employees.

Another factor contributing to OCS competition was the evolution of homeowner single-cup brewers.

Single-cup brewers, which played a big role in driving OCS sales from 2002 to 2007, made big inroads in the consumer market in recent years, rising from $101.5 billion in sales in 2005 to $270 billion in 2009, according to Homeworld Business magazine, which covers the consumer housewares industry. Homeowner single-cup units have given new life to a long stagnant homeowner coffeemaker market.

Information from the NCA coffee drinking study confirmed the impact of improved homeowner coffeemakers.

The NCA study found that in 2010, 86 percent of past-day coffee drinkers prepared their coffee at home, compared to 82 percent in 2009. At the same time, fewer past-day coffee drinkers drank coffee that was prepared away from home, as evidenced by a drop to 26 percent from 2009’s 31 percent. This, according to NCA, likely reflects how consumers have managed to balance their appreciation for good coffee with a desire to control costs in response to the recession.

Private label grows

Against all of this pressure on profit margins, OCS operators found some solace in their historic standby offering: private label coffee.

Private label coffee as a percent of sales reached a long-time high in 2009/2010, as indicated in chart 5, continuing a trend that began in 2008/2009. Private label has always been a tool for operators to provide better quality coffee at less cost than national brands.

The 13 percent gain in private label coffee as a percent of sales in 2009/2010 came largely at the expense of national brand coffee. National brand coffee has declined steadily for the past seven years, but 2009/2010 marked the first double-digit drop in this segment.

For some, diversification helps

Diversification into foodservice customer locations helped some OCS operators in 2009/2010.

Some operators expanded into foodservice customer segments such as restaurants and convenience stores, as indicated in chart 8. While this year’s survey pointed to a slight gain in these types of accounts, this was not a major change over prior years. OCS operators have traditionally not expanded into these channels due to the higher service costs and lower profit margins compared to traditional work place accounts.

Requests for “cause” coffee — fair trade, organically grown and bird friendly coffee — did not increase in 2009/2010, largely due to the recession. Cause-related coffee usually carries a higher price tag.

OCS operators observed ongoing interest in environmentally sustainable products, such as plant-based cups and utensils, but many customers were not interested in paying the premium for these products. As indicated in chart 13a, more operators offered recycled products, but fewer offered water filtration devices to reduce bottled water, or sustainable coffee.

Allied products as a percent of sales declined slightly in 2009/2010 as indicated in chart 5. Many operators saw reducing allied sales as an easy way to meet customer demands for lower invoices. Sales declined for bottled and filtered water, creamers and sweeteners, and paper products.

More operators add fuel charges

Fuel charges have also increased during the recession, as indicated in chart 11. Operators began adding fuel charges in 2007/2008 when gasoline prices were rising.

Retail K-Cup sales affect pricing

Many operators cited competition from retailers and office supply companies for K-Cups, the most dominant single-cup product, as a major contributing factor to their eroding profit margins in the last two years. The Keurig K-Cup dominates both the OCS single-cup market and the consumer single-cup market.

Keurig is also the only single-cup system in which the consumer K-Cup can be used in its OCS brewers. Hence, the office customer has more options, including the Internet, for sourcing K-Cups than for other single-cup coffee.

In addition, small offices can use consumer Keurig brewers instead of brewers designed for OCS applications. Keurig estimated that more than half of its office brewers are homeowner units, as indicated in chart 7.

OCS operators have noted that Keurig’s dominance in both the home and at-work markets makes it difficult for operators to use other single-cup systems. By aggressively marketing to consumers, Keurig established a high level of consumer awareness for its system.

The success of Keurig in both the at-work and home markets has caused some concern among location managers about employees pilfering K-Cups.

However, veteran operators note that such concerns are not new in OCS. Customer location managers have always had to make sure employees don’t steal coffee from the work place, just as OCS operators have always had to make sure customers don’t buy product elsewhere.

Another concern to emerge in the single-cup market is the impact K-Cups and other portion-control coffee packs have on the environment.

Some OCS operators addressed this concern by collecting portion control packs from their customers.

Others answered this concern by offering alternative single-cup systems that don’t use plastic packaging. These alternatives include hopper-based systems, liquid coffee based systems, and brewers that use sustainable filter pods. Many OCS operators believe that environmental benefits will become even more important to customers when the economy improves.

Among these alternatives, pod systems require the lowest upfront investment. Like cartridge-based brewers, the pod brewers are portion control systems.

Pod-based, single-cup systems were initially introduced as an economic alternative to cartridge systems several years ago.

Pod brewers continue to increase, but they have been strongly outpaced by both cartridge and hopper-based single-cup systems.

Signs of recovery emerge

The recession has undermined OCS sales growth, but OCS sales have shown some signs of recovery in the second quarter of 2010.

In addition, green coffee prices have increased in recent months. While OCS operators are reluctant to raise prices, rising green coffee prices could ultimately help them raise their prices.

The best scenario would be an end to the recession. Once the nation’s employers begin rehiring, OCS sales are likely to resume their

pre-recession growth.

In the meantime, the OCS industry has learned that maintaining a high quality service retains customer loyalty.

Not only are consumers maintaining their coffee drinking habits, they are also demanding high quality coffee, even in the face of economic challenges, according to the NCA.

In the meantime, OCS operators have to continue to invest in employee training since the need to sell and deliver high quality service requires a well trained staff.