Self checkout markets raise the bar: Key things for operators to consider

The 2012 National Automatic Merchandising Association (NAMA) OneShow marks the second year self checkout micro market companies will be on the exhibit floor. The growth and importance of the micro market channel is further confirmed by the presence on the NAMA OneShow program of a panel, “Customers Love Self Checkout – How to Capitalize on This New Trend,” to be chaired by Terry Touchton, vice president of sales and marketing at Vistar Corp. Panel participants will include the four exhibiting micro market companies – 365 Retail Markets, Avanti Markets, Breakroom Provisions, and Microtronic US – and operators who have installed their micro markets.

With an estimated 2,000 micro markets now on location, major questions remain about the model that will make the micro markets profitable for operator. Given that virtually all the current micro market operators are vending operators, the initial response is to follow the vending business model, whereby product manufacturers subsidize the micro market equipment (similar to beverage companies providing vending machines) and provide rebates based on products purchased.

In my opinion, the vending model, when applied to micro markets, is severely limited because it does not address the major opportunity afforded by the micro markets: the ability to identify and then satisfy individual consumer tastes and demands for food and beverages to increase sales.

Why data analysis?

Instead, product manufacturers, micro market companies, and micro market operators should concentrate their resources on consumer data analysis to develop product promotions to increase micro market sales and profits. They can do this by:

- Encouraging non-users at the location to become micro market consumers;

- Increasing the units and dollars per transaction and frequency of the transaction by the current micro market consumers; and

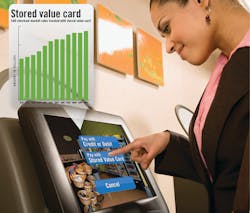

- Converting debit/debit card consumers to use the micro market stored value account card to make purchases.

In a previous article, I noted that vending operators need to act more like traditional retailers to optimize micro market benefits. One example is the use of social media. Micro market operators will have to use social media – Facebook and Twitter – and mobile marketing to engage the consumer on an individual basis.

To engage the consumer in a meaningful way, micro market operators need data about the consumer’s buying habits. Fortunately, the equipment manufacturers have software that gathers this data. The question is to what extent they will share it with operators to allow operators to maximize sales.

The data file, “Market Report” shown on this page should be familiar to all micro market operators. Any micro market operator not familiar with it needs to get up to speed on it as soon as possible. The market report has the basic information needed to analyze the micro market consumer, specifically:

- Consumer ID from the stored value card;

- Product purchased and category;

- Price; and

- Date and time purchased.

From this data, one can observe that Consumer 11036737 (ignoring the first four digits) purchased two items, Seagram’s 20-ounce Seltzer and Pyramid Humus with Pita Chips totaling $3.84 on July 11, 2011 at 2:21 p.m. On July 14 at 11 a.m., the consumer purchased only the Seagram’s.

Basic questions can be asked about the consumer. Why were there no purchases on July 12 and 13 and why was no snack or food products purchased on July 14? Analyzing this data over a longer period, the objective would be to increase both the consumer’s frequency of sales and the number of items purchased at each transaction.

Each consumer is unique. Look at consumer’s 11039462 purchases of Toggi Chocolate Wafers on July 12 and 13. Should a “reward” program, once a month, be offered to consumers who purchase the same products on a regular basis, such as a “buy two and get one free” offered by many CVS pharmacies?

Convert to stored value card

Most importantly, the market report shows, starting with the blank fields under “consumer,” the purchases made by credit/debit cards. The micro market operator has a dual incentive to convert these purchases to be made by the stored value account card: 1) to eliminate the credit/debit card fees, and 2) to identify specific promotions to these consumers.

Finally, the micro market operator should work with the product manufacturers to coordinate micro market promotions with the product manufacturers’ national and regional advertising and promotions.

For example, Coca-Cola and Kraft had a joint Super Bowl promotion advertised in the New York metropolitan area. New York area micro market operators could have taken advantage of this advertising as a tool to convert non-users to consumers. These product manufacturers’ programs and advertising are already calendared for at least the next six to nine months. Micro market operators should know these programs, have the ability to implement them to attract new consumers, and analyze the effectiveness of these programs.

The ability to analyze the impact of the product manufacturer’s programs on individual consumers places the micro market operator in the forefront of the second decade of the 21st century. If the micro market operator cannot analyze sales by consumer and stock keeping unit (SKU), micro markets will just be a stagnant, back-water retail channel compared to the dynamic developments in other retail channels.

Since almost all the micro market operators are vending operators, the micro market channel may suffer the same fate as the vending industry, as argued by Elliot Maras, the editor of Automatic Merchandiser in his March 6, 2012 blog. He noted that the vending operators’ reluctance to recognize the world is changing undermines the industry’s progress.

Will kiosk suppliers be supportive?

Micro market operators need support in analyzing this data. But given the current contracts with micro market companies, the question arises: who owns the data? Microtronic US and Breakroom Provisions agree that the data is the property of the micro market operator.

In its contract, Microtronic US affirmatively states that “Client (micro market operator) shall own exclusive rights (including all intellectual property rights) to any information hosted by the database pertaining to client’s account only, and shall be entitled to the unrestricted use of any information for any purpose, commercial or otherwise.”

Breakroom Provision advertises that the micro market operators own their own data. Breakroom Provisions currently offers a variety of combination deals to customers. The company claims its combination offerings are versatile.

In contrast, some other micro market companies have a different view. Some apparently believe the operator does not need to own the data to reap the benefits of market data based promotions.

In its contract, Company Kitchen has the right to mandate product promotions and loyalty programs to its micro market operators and to approve product promotional programs initiated by the micro market operators.

Currently, Company Kitchen offers promotions to micro market consumers. The company claims it utilizes merchandising analytics to target promotional activity. One advertised Company Kitchen promotion offered: “20% Off for Any Sandwich & Any Frito-Lay Chip & Any 20 oz Pepsi Product.”

Avanti Markets recently released a customer rewards program. The company claims to have the ability to offer meal deals and bundling deals.

Avanti Markets has language in its contract that commercial advertising revenue must be shared between Avanti Markets and the micro market operator.

Retail 365 offers its clients a comprehensive and strategic analysis of its sales data as well as access to its proprietary product optimization algorithm. The company claims the combination of these items help its micro market operators optimize profits.

Operators must understand data needs

The micro market operator must have a clear, unequivocal understanding from its equipment provider as to the ownership of the data. Operators who wish to rely on the kiosk provider for promotions will have to be willing to work with a company that owns the data. Operators who think they might wish to develop their own promotions with the product manufacturers, however, will need to own their own data.

Either way, the micro market operator should be associated with an organization that can provide independent consumer analysis. In retail channels like grocery and convenience stores, such organizations exist and work with the product manufacturers to provide such data. Perhaps the product manufacturers can provide similar guidance to the micro market operators.

Vending operators for the most part just track and report vending purchases, not consumer sales. This is a 20th Century approach, increasingly not viable in the 21st Century.

Currently, my firm, Vending Consultants Co. is conducting a micro market test to analyze the micro market data with a micro market operator and product manufacturer to increase the monthly micro market sales by 20 percent. To achieve this objective, products and promotions beyond those normally associated with vending will be tested. In addition, new advertising technology will be placed at the micro market location.

To achieve success and profitability, micro market operators should partner with product manufacturers who have and are willing to dedicate the resources and provide analysis similar to that of retail marketing analytics. Such analysis will allow the micro market operator to provide products and promotions directed at each individual micro market consumer.

With this analysis, the micro market operator and product manufacturer then can take the next step to develop a complete social media program appropriate for the second decade of the 21st Century.

How to choose a micro market provider

Following are some considerations for a prospective micro market operator in evaluating micro market company contracts.

In additions to the considerations listed below, the contract should include provisions integrating the inventory component of the operator’s vending management system and its electronic “picking” technology.

Equipment

- Cost and financing

- Warranties

Branding Restrictions On Kiosk

- Restricted to micro market company trademark

- Option for customized design for the micro market operator

Stored Value Account Card

- Restricted to the micro market company trademark

- Option for customized design for the micro market operator

- Control of prepaid funds: micro market company or micro market operator

- Ability to use the card at both micro market and vending machines

Monthly Fee Options

- Percent of micro market sales

- Fixed monthly fee

- Conditions under which such fees can be increased

Software Support Fees

- Fees for software updates

- Conditions by which micro market operator can continue using software if equipment provider goes out of business

Ownership Of Consumer Data

- Equipment provider owns all data

- Equipment provider and operator have joint ownership of data

- Operator owns all data

About the Author

Allen Weintraub is president of Vending Consultants Co., 333 Mamaroneck Ave., #239, White Plains, NY 10605; office: 914-287-0095; mobile: 914-882-3074; email: [email protected].

Consumer data analys: some retailers know more about us than immediate family members

All retail channels are concentrating on consumer data analysis. A recent New York Times article described the consumer data collected by Target Corp. through its "GuestID" program. Target not only collects data on everything the consumer buys at Target. The company also buys data about the consumers’ ethnicity, job history, home ownership, reading habits, education level, charitable giving, political leanings, and automobile ownership. The article states: “All that information is meaningless, however without someone to analyze and make sense of it. That’s where Andre Pole and the dozens of other members of Target’s guest marketing analytics department come in.”

Pole was given the task of figuring out if a customer is pregnant even if she did not want Target to know. The reason for the question is that pregnancy, a major life changing event, affects consumer purchasing. While Target had data after the birth of the child, identifying and marketing to pregnant women before she gave birth would be more advantageous to Target. After the birth, the mother had no time to consider the deluge of promotions.

The article then describes Pole’s “pregnancy prediction model.” The success of the model is striking. A father walked into a Target complaining to the manager that his high school daughter was receiving Target coupons for baby clothes and cribs. The manager apologized and a few days later called the father again to apologize. The father, however, interrupted the manager and said: “I had a talk with my daughter. It turns our there’s been some activities in my house I haven’t been completely aware of. She’s due in August. I owe you an apology.”

About the Author

Allen Weintraub

Allen Weintraub operates Vending Consultants Co. providing research and consulting services for product manufacturers, technology companies, and individual vending operators. He can be reached at: 333 Mamaroneck Avenue #239, White Plains, NY 10605, phone: 914-287-0095; email: [email protected].