#1 U.S. Beverage Coffee Endures

Every year the National Coffee Association does a National Coffee Drinking Trends (NCDT) study. For the last three, there has been a notable increase in coffee consumption as it continues its position as the number one consumed drink. What consumers drink, where they’re drinking and when they’re drinking helps to define the increase in consumption.

Changes over the years

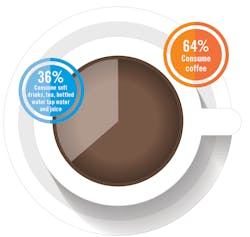

Penetration of coffee grew five percent from 2016 to 2017, and holds steady with an additional two percent gain in 2018, according to the NCA’s report. This long-term trend shows an increase, after a period of decreased consumption from 2012 to 2016. In 2012, coffee and soft drinks vied for the number one consumed beverage, according to the NCDT. This is significant because soft drinks have seen a sharp decline from 58 percent in 2012 to 35 percent in 2018. As soft drinks decline in consumption, coffee continues to rise.

Beverage penetration measures total coffee, soft drinks, tea, bottled water (unflavored), tap water and juice. Among these beverages in 2018, bottled water (unflavored), at 56 percent, comes in second behind coffee. Coffee remains the number one consumed beverage at 64 percent consumption in 2018. This year is an all-time high for coffee consumption not seen since 2012.

When, Where, What

Coffee drunk for breakfast remains dominant. In 2018, 82 percent of coffee consumed was during breakfast, a slight increase of 2 percent over 2017, according to the NCDT. Consumption over different dayparts is also growing. In 2012, 36 percent of coffee consumers drank coffee between breakfast and lunch, which increased to 41 percent in 2017 and 2018. While dinner and evening coffee consumption remained stable between 2012 and 2017, there was a slight drop of three percent in 2018. Overall, this shows an increase of consumption during different day parts.

Coffee continues to be most consumed at home, however this is slowly decreasing. The amount of coffee consumed at home has decreased from 84 percent in 2012 to 79 percent in 2018. Consumption of coffee prepared out of the home saw significant growth from 30 percent in 2012 to 40 percent in 2017. At the same time, there was a decrease this year in out-of-home coffee consumption from 40 percent in 2017 to 36 percent in 2018.

For the first time in NCDT history, 2017 saw more than half (59 percent) of coffee classified as gourmet; this is up from 46 percent in 2012. Gourmet coffee consumption remained relatively stable in 2018.

Part of gourmet coffee’s popularity comes as it continues to engage the younger crowd with a penetration of 37 percent of those aged 18-24, 48 percent of those aged 25-39, and 38 percent of consumers aged 60+, according to the NCDT. While gourmet coffee is increasing in popularity among younger consumers, coffee — not gourmet is increasing in popularity among an older generational group. In 2017, traditional coffee — not gourmet showed a strong penetration in consumers 60+ at 42 percent, compared with only 21 percent of consumers aged 18-24.

Penetration of espresso-based beverages grew from 18 percent in 2016 to 24 percent in 2017, the largest recorded one-year jump of espresso-based beverages in the history of NCDT. There has been a noticeable shift in the past few years from traditional coffee to espresso-based beverages. This segment has remained steady at 24 percent in 2017 and 2018, an increase over 2016 (18 percent).

The 2017 NCDT showed the addition of a new coffee segment, non-espresso-based beverages. This new addition represents the emergence of gourmet coffee beverages that aren’t necessarily espresso-based. Penetration of this segment was 10 percent in 2017, and 2018 saw a slight decrease at 7 percent.

Findings

Overall, there has been an increase in consumption of coffee beverages from 2016 to 2018. Soft drink consumption, which at one time was on par with coffee, has decreased significantly over the past few years. The emergence of new coffee segments in the NCDT shows how coffee is changing as consumers demand more options.

New wording has helped to create more descriptive terms, such as gourmet coffee beverages, to create a more accurate and succinct representation of consumption.