Business Strategies: Reposition the Benefits you Give the Customer

One development getting a lot of coverage in business news today has a definite impact on the refreshment services industry: U.S. companies are reducing the benefits they are offering to their employees. The focus is company pension plans. The federal government has rolled out new laws requiring companies to shore up the solvency of their plans. In other words, infuse cash into the pension plans.

The federal government wants to make sure the financial commitments that companies have made to their employees will be met. Although that sounds great to those who have pensions, there is a downside. Many companies don't want to use their cash to fortify their plans, but plan to use it in other areas of their business. IBM is a great example of this. Starting in 2008, IBM's pension benefits will be locked in place at the employee's current salary and length of service. New employees will not be able to participate in the pension plan at all.

By now you're probably asking yourself, what does this have to do with my vending, OCS or food operations? I would suggest that you can help ease the pain of your customer's difficult transition in having to lower their benefit offerings. This can be accomplished by sharing with your customers the benefit your products and services provide to their employees.

The beauty of your benefits is that it is a fraction of the cost of traditional benefits. I know some readers are saying, "this guy can't be suggesting that the candy bar and bottle of soda I sell to my customer will be a substitute for a pension plan." No, I'm not. But the reality of the future for virtually every American worker is that he/she will be providing for more of their future financial security than generations in the past.

The vending industry can help make the work environment more bearable as difficult decisions are being made on what to do with company cash and profits.

The following examples are ways to present cost-effective products and services to your customers. Consider them work environment enhancers.

CAFETERIA SUBSIDIZATION

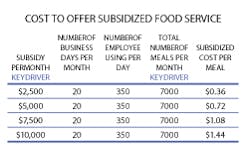

Let's initially look at the per employee cost of subsidizing a 1,000-person company that offers an inhouse cafeteria, or in vending vernacular, manual food. First, we need to make a few assumptions. Assume the cafeteria is open for breakfast and lunch every business day.

There are 20 business days a month and the utilization of the facility is good; 35 percent of the workforce uses the cafeteria for at least one meal per day. What is the per employee cost of operating the cafeteria?

The information in the graph demonstrates that the cost for a company to offer a subsidized food service is low. The key drivers in the chart are the amount of employees utilizing the facility and the cost effectiveness of the operations as reflected in the subsidy.

The best way to ensure that the drivers are moving in the right direction is to provide the customer with the kinds of quality foods and services they are looking for.

Looking at the cafeteria from a different perspective are areas that are beneficial but harder to quantify. They are things like improved morale, greater employee retention and increased productivity.

OTHER BENEFITS TO THE EMPLOYER

I spent several years of my career in corporate dining facilities. During our service periods, I was out in the "front-of-house" working a production station, tending the cash register, or taking care of customer service needs on the dining room floor.

I can remember many times when two company employees would meet in the cafeteria and say something like this: "Hey Joe, I have been meaning to call you about project X. I'm glad I met you here the cafeteria. Could we eat breakfast or lunch together to cover some of the details?" What is it worth to the company to have those meetings take place? What's it worth to the employee to have the ease of contact with his/her fellow employee? It's difficult to put a dollar figure to it, but the value does exist.

COFFEE SERVICE BENEFITS TO THE EMPLOYER

Let's next consider OCS. This service goes almost unnoticed as a benefit in most offices today. Employees of most companies I have been affiliated with will offer coffee, tea and hot chocolate to their employees. There is an expectation that this service will be provided. Try to take away an existing OCS program and see what kind of feedback is given by the employees.

The question that needs to be asked is, "What is the cost of the OCS program from a tax perspective?" The cost of an OCS program in most cases is a legitimate business expense that can be deducted on a company's taxes. IRS Publication 535, page 3, gives a good definition of a business expense/deduction.

One caveat: I would not recommend dispensing tax advice unless you know what you are talking about. The following example can be used to convey the tax cost of an OCS program.

Take a company that has $100.00 in revenue, a 35 percent tax rate, and buys its coffee at $25 per case. Using accrual accounting, which recognizes expenses when incurred and revenues when earned, we would get on an income statement $100 in revenue, $25 in expenses and an operating profit of $75.

A second perspective is to consider the company's tax return. Taxes are calculated not on an accrual basis, but on a modified cash basis. Essentially, the cash that is received or dispensed from the company is recorded either as an increase or decrease in tax liability.

What cash did the company receive? $100. If the company does not have any deductions, it is responsible to pay the IRS $35 for the money it received ($100 times 35 percent). The cost of the coffee, however, is a deduction and can reduce revenue by its cost.

The company now pays $26.25 on the tax return (($100 minus $25) times 35 percent) instead of the $35. The tax difference is $9.75.

Another way to look at the tax difference that is created by the cost of the case of coffee is to take the deductible expense and multiply it by 1 minus the company tax rate. For example, ($25 times (1 minus 35 percent)) equals $16.25. A difference of $9.75 ($25 minus $16.25).

Notice the difference in this calculation is the same as the tax difference calculated above.

Once you have gone through the calculations with your customers, there is potential to expand the program that you are offering to your customer. They will realize that after tax break, the cost of their OCS program is not as great as they once thought it was. Take a look at the Coffee Tax Deduction chart for an illustration of the example just provided.

OSHA MANDATES SOMETHING YOU PROVIDE: PROPER HYDRATION

For many operators, blue collar industrial is a substantial portion of their business. Many of these locations are warehouse facilities that expose employees to the elements. In the summer months, this can create a situation that is dangerous as employees are exposed to long durations of heat.

The government, in an OSHA fact sheet dated 01/01/95 — Protecting Workers in Hot Environments — recommends that one of the key ways to prevent heat distress conditions is to ensure that employees are properly hydrated. Here is where the vending operator can help contribute to the welfare of its customers' employees.

An opportunity exists during the summer months to establish a program where a customer's employees can maintain their hydration using the vending operator's equipment. Develop a program with your customer where they can make purchasing your beverage products easy.

A popular method is to sell coupons to your customer that work in your beverage machine like cash and have them distribute the coupons to their employees. The employees use the coupons to buy product in the machines.

Another method is to have the customer subsidize the beverage machine. The price of the beverage products is reduced to a price point that is inexpensive. Say, for instance, 50 cents for a 20-ounce product. At the end of the month, the customer is billed the difference between what you normally charge and what was collected at the machine.

REPOSITIONING CAN WORK

Can repositioning work? Absolutely. I had the privilege of working for Frito-Lay as part of their sales force. I took products that were similar in nature but differentiated enough to make them unique and sold them to vending distributors and operators who were in my territory. In turn, the operators sold the products to the ultimate consumer.

The end user knew that the latest version of Doritos, Fritos, Lay's, etc. was simply a flavor profile change, but they bought it because they viewed it as a different product. The consumer was happy, the operator was happy, and the manufacturer was happy.

The dynamics of the business environment are constantly in flux. The organizations that will be successful in the future are those that think creatively about what they can offer their customers. The positioning is not easy and takes time and energy, but the rewards are worth it.

ABOUT THE AUTHOR

Paul Humphrey is a veteran financial officer for vending and OCS companies based in Tulsa, Okla.