ICO: coffee prices reached new highs in August, supply and freight anxieties grow

Coffee prices rose for the 10th consecutive month, according to the International Coffee Organization’s recent August report. Adding fuel to coffee market concerns are supply chain disruptions, adverse climate conditions in major producing countries, rising freight costs and ongoing COVID-19 restrictions upsetting trade in Asia, especially in Vietnam, the world’s second-largest coffee producer.

In August, the monthly average on the ICO composite indicator increased by 5.2% to 160.14¢ a pound from 152.24¢ per pound in July. The level reached in August represented an increase of 51.3% since the start of the current coffee year, according to the ICO data.

Prices of arabica coffee have logged substantial increases while robusta coffee recorded a moderate upturn. Concerns over the size of the next Brazilian crop, exacerbated by the recent frost, have led to record high volatility of the spot and futures prices.

In terms of market fundamentals, shipments of all forms of coffee by all exporting countries to all destinations totaled 10.7 million 60kg. bags in July 2021, an increase of 1.7%, compared with 10.5 million bags in July 2020. The level of total exports in July 2021 is 4.4% below the volume of 11.9 million bags recorded in July 2019, before the pandemic.

KEY AUGUST 2021 POINTS

The monthly average of the ICO composite indicator rose by 5.2%, from 152.24¢/lb. in July 2021 to 160.14¢/lb. in August 2021. The level reached in August 2021 represents a 51.3% increase, compared with 105.85¢/lb. recorded in October 2020.

Prices for all group indicators increased in August and achieved their highest levels in several years. The highest price increase was recorded by the Brazilian naturals indicator, which reached 174.89¢/lb. in August 2021, an 8.9% increase compared with 160.62¢/lb. in July 2021.

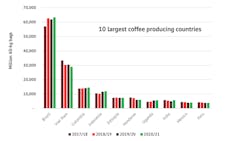

Estimates of total production for coffee year 2020/21 increased slightly by 0.4% to 169.6 million 60-kg bags, compared with 169 million bags during the previous coffee year. While arabica production is expected to increase by 2.3% to 99.3 million bags, a 2.1% reduction is expected in the production of robusta coffee to 70.4 million bags.

Click here to see ICO's full August 2021 market report.