Study: Consumers Seek Healthy Lifestyles, But Food Packaging Makes It Difficult

CHICAGO, March 28, 2017 /PRNewswire/ -- Today's consumers are more concerned than ever before about the foods they eat, yet they struggle to find the nutrition information needed to make informed purchasing decisions.

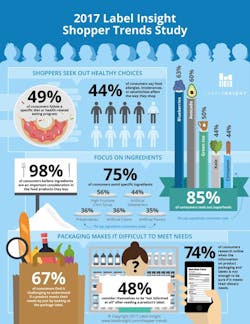

Label Insight's 2017 Shopper Trends Study reveals that nearly half of consumers (49%) adhere to a particular diet or nutrition plan, and 75% avoid specific ingredients when shopping for food products. But, 67% of consumers say it is challenging to determine whether a food product meets their needs simply by looking at the package label, and nearly half of consumers (48%) consider themselves "not informed at all" about a food product even after reading the label.

"Consumers vary in their definitions of healthy, and they want more detailed ingredient information. Today's product packaging is not meeting those needs," said Patrick Moorhead, Chief Marketing Officer at Label Insight. "Keeping pace with consumers' increasing demand for product transparency is one of the most challenging issues facing the food and beverage industry today."

The study, released today by Label Insight, the market leader for product transparency, examines dietary preferences and consumers' ability to find the nutritional information they need to make informed purchasing decisions. Key findings from the study include:

Shoppers Seek Out Healthy Choices:

- Health Conscious Consumers: Nearly half (49%) of consumers adhere to a particular diet or health-related eating program.

- Dietary Restrictions: Nearly half (44%) of consumers say food allergies, intolerances, or sensitivities affect the way they shop.

Focus on Ingredients:

- Ingredients Matter: 98% of consumers believe ingredients are an important consideration in the food products they buy, and 75% of consumers examine ingredients before they buy to ensure products meet their dietary needs.

- Ingredient Avoidance: 75% of consumers avoid specific ingredients when shopping for food products, including:

- High Fructose Corn Syrup - 56%

- Artificial Sweeteners - 44%

- Preservatives - 36%

- Artificial Colors - 36%

- Artificial Flavors - 35%

- Superfoods on the Rise: 85% of consumers seek out specific superfoods. The top superfoods consumers look for are:

- Blueberries - 63%

- Avocado - 60%

- Green tea - 50%

- Kale - 44%

- Cinnamon - 44%

Packaging Makes it Difficult to Meet Needs

- Challenges Meeting Dietary Needs: 67% of consumers find it challenging to determine whether a food product meets their needs by reviewing the package label.

- Lack of information: Half of consumers (48%) consider themselves to be "not informed at all about the product" after reading a product's label.

- Online Product Research: 83% of consumers take the time to look elsewhere for food information when food packaging and labels are insufficient, and 74% of consumers conduct online research for more information.

Consumers' focus on health and wellness has driven them to seek out more information about products than is typically included on product packaging. This shift continues to fuel the product transparency movement, and has motivated CPG brands and retailers to provide complete and accurate product information which can unlock value with consumers - from custom merchandising and dietary personalization at the retail level, to enhanced transparency initiatives like SmartLabel™ for CPG brands.

About Label Insight: Label Insight is the market leader for transparency, enabling access to complete and accurate product information for more than 350,000 products, representing 80% of the top purchased CPG products in the USA. The company's product transparency engine powers data driven solutions for brands, retailers, researchers, analytics providers, government agencies and consumer applications by capturing and enhancing data contained on the packaging and labeling of food, pet, and personal care products. Label Insight customers use this data to provide greater transparency to consumers; easily participate in industry and government initiatives, such as SmartLabel; create more connected omni-channel experiences; and maximize category growth potential. To learn more about Label Insight, visit www.labelinsight.com