Fastenal Company Reports 2019 Second Quarter Earnings

WINONA, Minn. --(BUSINESS WIRE)-- Fastenal Company (Nasdaq:FAST), a leader in the wholesale distribution of industrial and construction supplies, today announced its financial results for the quarter ended June 30, 2019. Except for share and per share information, or as otherwise noted below, dollar amounts are stated in millions. Share and per share information in this release, and in the financial statements attached to this release, has been adjusted to reflect the two-for-one stock split effective at the close of business on May 22, 2019 . Throughout this document, percentage and dollar calculations, which are based on non-rounded dollar values, may not be able to be recalculated using the dollar values included in this document due to the rounding of those dollar values.

Quarterly Results of Operations

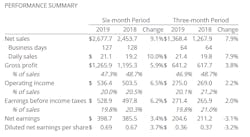

Net sales increased $100.5 , or 7.9%, in the second quarter of 2019 when compared to the second quarter of 2018. This increase was driven by higher unit sales related primarily to our growth drivers, most notably contribution from industrial vending, Onsite locations, and construction, as well as higher underlying market demand compared to the second quarter of 2018. While general economic activity remained positive, we did see slowing in the second quarter of 2019 relative to activity levels experienced in the first quarter of 2019. A lesser contributor to our sales growth in the second quarter of 2019 was higher product pricing as a result of increases implemented in late 2018 and early 2019 to mitigate the impacts of general and tariff-related inflation in the marketplace. Sales of our fastener products grew 5.5% on a daily basis over the second quarter of 2018 and represented 34.5% of sales in the second quarter of 2019. Sales of our non-fastener products grew 9.5% on a daily basis over the second quarter of 2018 and represented 65.5% of sales in the second quarter of 2019.

Our gross profit, as a percentage of net sales, declined 180 basis points to 46.9% in the second quarter of 2019 from 48.7% in the second quarter of 2018. The most significant factors behind the decline in our gross profit percentage in the period were the impacts of customer and product mix and net inflation on product margins, the latter of which had a larger negative impact on our margin than in the first quarter of 2019. While we successfully raised prices as one element of our strategy to offset tariffs placed to date on products sourced from China , those increases were not sufficient to also counter general inflation in the marketplace. We have taken additional actions in the third quarter of 2019 to counter the broader pressures we are experiencing on our costs as well as the additional tariffs that were levied on China -sourced products in May 2019 .

Our operating income, as a percentage of net sales, declined to 20.1% in the second quarter of 2019 from 21.2% in the second quarter of 2018. The decline was due to the lower gross margin, which more than offset our ability to leverage our operating expenses. Our operating and administrative expenses (including the gain on sales of property and equipment), as a percentage of net sales, improved to 26.8% in the second quarter of 2019 compared to 27.5% in the second quarter of 2018. The primary reason for this improvement was our ability to leverage occupancy-related and general corporate expenses.

Employee-related expenses, which represent 65% to 70% of total operating and administrative expenses, increased 6.8% in the second quarter of 2019 when compared to the second quarter of 2018. The increase in employee-related expenses was mainly related to an increase of 6.6% in our full-time equivalent ('FTE') headcount. Occupancy-related expenses, which represent 15% to 20% of total operating and administrative expenses, increased 2.5%. This primarily reflected an increase of 7.6% in expenses related to industrial vending equipment as total expenses related to branch and non-branch facility costs were mostly unchanged. All other operating and administrative expenses, which represent 15% to 20% of total operating and administrative expenses, decreased 0.6%.

Our net interest expense was $3.6 in the second quarter of 2019 compared to $3.1 in the second quarter of 2018. This increase was mainly caused by a higher average debt balance during the period and higher average interest rates.

We recorded income tax expense of $66.8 in the second quarter of 2019, or 24.6% of earnings before income taxes. Income tax expense was $54.7 in the second quarter of 2018, or 20.6% of earnings before income taxes, which included the impact of a one-time benefit of approximately $9.7 related to accelerating depreciation for certain physical assets. This one-time benefit reduced our tax rate during the period by 3.7 percentage points. We continue to believe our ongoing tax rate, absent any discrete tax items, will be in the 24.5% to 25.0% range.

Our net earnings during the second quarter of 2019 were $204.6 , a decrease of 3.1% when compared to the second quarter of 2018. Our diluted net earnings per share were $0.36 during the second quarter of 2019 compared to $0.37 during the second quarter of 2018, a decrease of 3.2%. Adjusting for the one-time tax item that benefited net earnings during the second quarter of 2018, our net earnings and diluted net earnings per share in the second quarter of 2019 each would have grown 1.5% over the prior year period.