Consumer Spending Remains 23 Percent Higher Than Levels Pre-COVID While The American Households' Grocery Basket Returns Mostly To Its Previous Mix

NCSolutions Finds Shoppers Prioritize Veggies, Salty Snacks, and Cheese in their Grocery Baskets as Americans Evolve from a Pattern of Extreme Buying to Home-Confined Buying

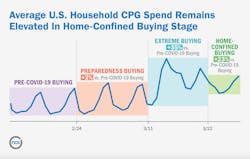

NEW YORK, April 9, 2020 /PRNewswire/ -- NCSolutions (NCS), the leading company for improving advertising effectiveness for the consumer packaged goods (CPG) ecosystem, today released new data showing average household grocery spend has fallen since the COVID-19 Extreme Buying peak but still remains elevated at 23% higher than pre-pandemic levels. This marked shift—coupled with a return to a grocery basket mix reminiscent of pre-COVID-19 shopping patterns—indicates consumers have entered a new purchasing stage: Home-Confined Buying.

In this new stage, which began on March 22, U.S consumers are adding more food and drinks to their carts but fewer paper products and household cleaning products due to supply issues. Vegetables, salty snacks and cheese are back on top for the week ending March 28. Indulgent comforts are also making their way back into baskets: beer and wine purchases are higher than usual, ranking at number 9 and 11 respectively, compared to number 12 and 14 the year prior. Chocolate, which fell to number 18 during the Extreme Buying stage, climbed to number 12 during the week ending March 28 (likely boosted by the anticipation of Easter), and ice cream and cookies joined the ranks, 14 and 5 spots higher than two weeks prior respectively.

"This pandemic is altering consumer purchasing behavior, although it's too early to tell if the change will be permanent," said Linda Dupree, CEO of NCS. "We see grocery shoppers cycling through five discrete buying stages as their lifestyles are upended. This evolution will inevitably raise important questions for advertisers around brand loyalty, especially when we eventually enter a 'new normal.'"

According to NCS data, consumers entered the Preparedness Buying stage on February 24. March 10 marked the shift to Extreme Buying, with American household grocery spend rising to 35% more than pre-COVID levels.

During the Extreme Buying stage from March 11 to March 21, consumers stocked up on paper goods and household cleaning products. For the first time, items such as toilet paper and shelf-stable soap were ranked among the top 20 purchased items in the week ending March 14, 2020.

"In this new stage of Home-Confined Buying, shoppers continue to hunt grocery store aisles for essential supplies. In some cases, they're finding their favorite brands out of stock and are sampling other brands," said Dupree. "We expect Americans will adjust to a wider variety of the consumer products they're used to buying—not only of brands, but also of types, flavors and styles. They may try cavatelli pasta or cherry-flavored yogurt for the first time because their usual is out of stock and end up discovering a new favorite."

"Now that the entire household is home all day, every day, Americans are consuming more items at home due to new daily routines," said Lance Brothers, chief revenue officer, NCSolutions. "What we're hearing from our advertiser clients is that they're pivoting quickly to adapt. They want to ensure their advertising reaches the right audiences and has the right message for the current environment. To make the right adjustments, they need to understand exactly how the grocery basket is evolving through each stage."

Currently, in this Home-Confined Buying stage, shoppers are filling their grocery baskets with higher quantities of frozen meals, cheese and lunchmeat than they did last year. Sales of frozen meals, for example, were uncharacteristically high between March 8 and March 28, compared to the same period last year, as consumers stocked their freezers with reserves.

Cheese reached number 4 in the week ending March 21, up from number 6 during the same period last year, and continued to climb, after many U.S. schools shifted to remote learning programs and parents were left to fend for themselves for lunch sandwiches. At the same time, lunchmeat jumped to number 32—up from number 42 during the same period last year, and bread climbed from number 7 to number 5 between March 8 and 28.

"As the pandemic alters consumer behavior, advertisers have a choice to build new consumer connections," said Dupree. "The question is: In the face of these changing purchase patterns, what should both 'dominant' and 'standard' brands do now to maintain or build brand equity?"

NCS has defined five stages of consumer buying, related to the COVID-19 pandemic:

- Pre-COVID-19 Buying (prior to February 24): "Business-as-usual" non-seasonal grocery and OTC buying prior to February 24.

- Preparedness Buying (February 24 - March 10): As news about the novel coronavirus appears, there is a noticeable uptick in CPG purchasing at the end of February—a 2% increase in average household spending. Hand sanitizer and household cleaner purchases start to take off the last week of February, peaking on February 29, when toilet paper sales start to build.

- Extreme Buying (March 11 - 21): March 11 becomes the inflection point as consumers spend heavily to stock their pantries: average household spend increased 35% compared to pre-COVID buying levels. During this stage, consumers clear out shelves and CPG retailers experience shortages of some items.

- Home-Confined Buying (March 22 and onward): "Social distancing" mandates limited visits to stores and average household spend dips 9% the week of March 22 compared to Extreme Buying, but consumers continue to shop and buy at levels 23% higher than pre-COVID levels.

- New Normal Buying: Yet to be seen in the U.S., the period after the pandemic, when "shelter-in-place" and other emergency measures are lifted and consumers feel more comfortable returning to physical stores.

For the latest trends in pandemic-driven consumer purchasing behavior, visit NCS's COVID-19 Resources and Updates page.

About NCS

NCSolutions (NCS) makes advertising work better. Our unrivaled data resources powered by leading providers combine with scientific rigor and leading-edge technology to empower the CPG ecosystem to create and deliver more effective advertising. With NCS's proven approach, brands are achieving continuous optimization everywhere ads appear, through purchase-based audience targeting and sales measurement solutions that have impacted over $25 billion in media spend for our customers. NCS has offices in NYC, Chicago, Tampa and Cincinnati. Visit us at ncsolutions.com to learn more.