The vending industry is in decline. The Automatic Merchandiser State of the Industry Report for the 2011 calendar year concluded that “aggregate vending [dollar] sales fell to $18.96 billion, taking the volume to a level comparable to the early 1990s". The 2011 dollar vending sales declined almost 22 percent from 2006, the highest volume reported by Automatic Merchandiser. The 2011 SKU unit sales decline is even more dramatic when increases in vend prices are incorporated. For example, five years ago a vend operator had to sell four beverage cases, 96 units, each week to average $100 for a service collection; now only three beverage cases, 72 units, have to be sold for a $100 collection. Profits are down -- higher vend prices barely cover the accompanying increases in commissions and sales taxes, not to mention the product manufacturers’ cost of goods (COG) increases.

The bright light in the vending industry, however, is the development and growth in the placement of micro markets. Last May an estimated 2,000 micro markets were on location. Currently this figure has at least tripled. In the next several years, how many micro markets will be placed at the current 130,000 locations replacing the unprofitable refrigerated food vending machines?

Micro markets are part retail evolution

Support for this micro market growth is found in the 2012 white paper, Digital Malls: The Next Generation of Self-Service Shopping, researched and prepared by the Internet Business Solutions Group of Cisco Systems, Inc.

The Cisco white paper describes the current retailing world as suffering from high vacancy rates, declining sales, high labor costs and diminishing customer satisfaction. To meet these challenges, the Cisco white paper suggests developing and combing innovative vending machines, micro markets and virtual stores to “create a completely new retail business model -- interactive, low-labor, destination ’digital malls’ in densely populated venues such as airports, universities, stadiums, resorts, large work places or residences”. The Cisco white paper projects self-service digital malls to be a $7 billion retail channel.

The National Automatic Merchandiser Association (NAMA) has recognized this significant opportunity to grow the industry. At the NAMA OneShow a day-long micro market seminar entitled, “Where We Are, Where We’re Going, and How to Get There,” chaired by Brad Bachtelle of Bachtelle Associates, will be held on Tuesday, April 23. In addition, a micro market super session will be led by Bachtelle on April 24, from 10:00 a.m. to 11:30 a.m. followed by a breakout session moderated by Emily Refermat, the editor of Automatic Merchandiser from 11:45 a.m. to 12:45 p.m.

How to use marketing to increase sales

Specifically, this article will concentrate on how both the micro market operators and product manufactures can partner with marketing programs and implement social media applications to identify and engage micro market consumers to increase sales.

First of all, the micro market operators and product manufacturers must look outside the ”vending box”-- a box traditionally designed just to service impulse sales without engaging the consumer. The micro market data bases have the information to identify consumers and their purchasing habits to engage the micro market consumers in a wide range of social media applications designed to increase micro market sales.

Recently I attended the two day show, “Customer Engagement Technology World,” at theJavitsCenterinNew York City. In attendance and making presentations were representatives from high-end clothing manufactures like Ralph Lauren, restaurant chains such as Dave & Busters and vending/micro market product manufacturers such as Hershey and Kraft. Every educational session (I attended eight in two days.) centered on using consumer data through social media to engage the consumer to increase sales, such as: “Bring Self-Service Solutions to the People: Empowering Consumers with What They Want-When, Where and How!” and “Social Media, Kiosks & Mobile: Omni-Channel Convergence to Maximize Customer Engagement.” The message succinctly was use the data to engage customers and increase sales.

For the micro market operator coming from a vending mentality such a message requires a change in business culture. The micro market operator must seek out partners who will support and provide the applications to engage the consumer through the social media. Micro market operators should work with product manufacturers like Hershey and Kraft who presented at the Customer Engagement Technology World Show and have applications being used in other retail channels to apply them to the micro markets. For example, in the grocery channel Kraft has tested near-field communication (NFC) and quick response (QR) codes carrying advertisements for Kraft products to engage the consumer. By using Kraft “shelf-edge” advertisements, mobile consumer engagement was twelve times higher, according to a Kraft News America Marketing (NAM) and Thinaire Report in a October NFC World article.

Just recently, Bonin Bough, vice president of global media and consumer engagement at Mondelez International announced pilot projects for “mobile at retail,” “social TV” and “SoLoMo” (defined as the intersection of social, location aware tech and mobile to connect brands with consumers and drive impulse sales.) Mondelez should reach out to micro market operators to test and involve them in such projects.

General Mills has recently introduced its “categoryfirst consultants” which may be a helpful tool in this regard. The product manufacturers who continue to offer the standard vending rebate program are useless to improve the sales and profitability of micro markets. The rebate programs do not engage consumers. The rebate programs merely cannibalize sales from one product manufacturer to another with minimum benefit to the micro market operator.

Sales growth programs

In testing several programs to increase micro market sales, Vending Consultants has concluded that while the product manufacturer should provide the marketing program, the micro market operator must assume the responsibility to develop different pricing.

Manufacturers have developed integrated sales data and the social media marketing programs for other channels. This can be used by micro market operators to increase sales. As for the micro market operator, a sales growth program requires changes in pricing. Vending Consultants is involved in testing a sales growth program described as Buy Ten, Get One Free, combining fresh food, a beverage and a snack for the consumer to purchase within a specific time period in order to increase sales. The micro market operator who will test this program is committed to doubling the monthly fresh food sales by properly pricing the “Buy Ten" products to afford the “Get One Free.”

The product manufacturer should work with the micro market operator to engage the consumer with the objective to increase monthly micro market sales by 20 percent.

Look at other retail suppliers

Micro market operators should also look outside the regular vend product distributor to product wholesalers who service a more diverse range of retail channels. In my discussions with these product distributors, they bring a different perspective as to the product selection and, more importantly, how to market, promote and rotate products to keep the consumer engaged. In contrast the vending model has no marketing component. Vend operators rarely pro-actively change products and do not seek to engage their customers.

Most importantly, the micro market operators must develop a partnership with a fresh food provider. Every survey has concluded that the benchmark for micro market success is providing high quality/high value fresh food. Look at what is happening at other foodservice channels. The 7-Eleven chain has turned to fresh food to increase same store sales. According to a December 2012 New York Times article, 7-Eleven is aiming by 2015 to have 20 percent of the store sales in fresh food, up from the current 10 percent.

Such a fresh food partnership should help the micro market operators replace cafeterias at locations.

Micro market operators must develop an on-going marketing partnership with the right product manufacturers to integrate consumer data, product development and the social media to engage the micro market consumers to increase sales. With this foundation, the micro markets operators then can take the next step into digital malls and reverse the decline in sales in the vending industry.

Micro market future: personalized ordering

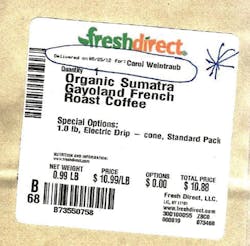

Technology will soon enable micro market operators to electronically communicate, and special order fresh food personalized for a specific customers. Already, today, my wife orders groceries from Fresh Direct and for special orders, in this case a specific coffee mixture she requested, Fresh Direct labels the coffee to confirm her special order with her name. How soon will it be before micro market operators will be able to do this, and perhaps encourage the removal of cafeterias by offering a smartphone app so that the consumer can both order and pay for their fresh food for next day delivery to their desk properly labeled?

Sales growth programs versus loyalty programs

A sales growth program differs greatly from a loyalty program. A loyalty program usually has points and doesn't have an expiration date. For example, using a specific airline gives a person points toward free flights on that airline. The points don't expire, they simply accumulate. It doesn't encourage the customer to fly more often, just not to fly with another airline. On the contrary, by definition, sales growth programs encourage a consumer to purchase more. It's a special offer paired with an expiration date. It might be a coupon only good for today or a reward for a free item after purchasing other items. Unlike loyalty programs, sales growth will drive up revenue.

About the Author

Allen Weintraub

Allen Weintraub operates Vending Consultants Co. providing research and consulting services for product manufacturers, technology companies, and individual vending operators. He can be reached at: 333 Mamaroneck Avenue #239, White Plains, NY 10605, phone: 914-287-0095; email: [email protected].