Crane Co.'s 2021 third-quarter sales rise 21%, Payments & Merchandising sales jumps 32%

Crane Co. (NYSE: CR), a diversified manufacturer of highly engineered industrial products including vending machines and currency payment systems, today reported third-quarter 2021 financial results and updated its full-year 2021 outlook. Third-quarter 2021 sales were $834 million, an increase of 21%, compared with the third quarter of 2020. The sales increase was comprised of a $134 million, or 20%, increase in core sales, and a $13 million, or 2%, benefit from favorable foreign exchange.

Crane's third-quarter 2021 operating profit was $138 million, compared with $76 million in the third quarter of 2020. Operating profit margin was 16.6%, compared with 11.1% last year, with the improvement driven primarily by higher volumes.

KEY POINTS

- GAAP earnings from continuing operations per diluted share (EPS) of $1.87 compared with $0.84 in the third quarter of 2020.

- Excluding special items, record EPS from continuing operations ("adjusted EPS") of $1.89 increased 103% compared wit $0.93 in the third quarter of 2020.

- Core year-over-year sales growth of 20% and core year-over-year order growth of 31%.

- Raising and narrowing GAAP EPS from continuing operations guidance to $6.50-$6.60, from $6.05-$6.25.

- Raising and narrowing EPS from continuing operations guidance, excluding Special Items, to $6.35-$6.45, from $5.95-$6.15.

- Announced new $300 million share repurchase authorization.

“We delivered extremely strong results in the third quarter with record EPS. Performance was outstanding across all of our businesses, and we were able to achieve 20% core year-over-year sales growth and high-teens adjusted operating margins even in the face of continued inflationary pressures and ongoing supply chain challenges," said Crane Co. president and chief executive Max Mitchell.

"Looking ahead, we see further broad-based strengthening across our primary end markets which is reflected in our 31% core year-over-year order growth and 13% core year-over-year backlog growth," Mitchell continued. "Considering our strong performance in the third quarter and our outlook for the balance of the year, we are raising the midpoint of our adjusted EPS guidance by $0.35 to a range of $6.35-$6.45 reflecting an approximate 80% year-over-year increase. The midpoint of our guidance range is also now well above our prior-peak 2019 total adjusted EPS of $6.02 despite Engineered Materials' current classification as discontinued operations, and with many of our end markets still in the very early stages of recovery. In addition to our outstanding performance and near-term outlook, I continue to be very excited about the momentum we have with our ongoing investments in technology and our strategic growth initiatives, all of which are positioning Crane for long-term sustainable above-market growth."

PAYMENTS & MERCHANDISING

Crane has four business segments: Aerospace & Electronics, Process Flow Technologies, Engineered Materials and Payment & Merchandising Technologies. On May 24, 2021, the company announced that it had signed an agreement to divest its Engineered Materials segment.

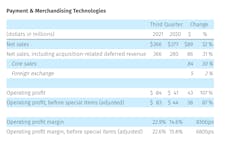

In the current third quarter, sales in Crane's Payments & Merchandising business, which includes Crane Payment Innovations, were $366 million, an increase of $89 million, or 32%, compared with the same quarter last year.

Payments & Merchandising improvement was driven by an $84 million, or 30%, increase in core sales, and a $5 million, or 2%, benefit from favorable foreign exchange. The divisions operating profit margin increased to 22.9%, from 14.6% last year, primarily reflecting higher volumes. Excluding special items, operating profit margin increased to 22.6%, from 15.8% last year.

See Crane Co.'s full report and financial tables at Business Wire.