Keurig Dr Pepper reports strong second-quarter 2021 results; sales up nearly 10%

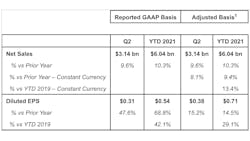

Keurig Dr Pepper Inc. (Nasdaq: KDP) today reported strong and balanced financial results for the second quarter, ended Jun. 30, with sales rising almost 10%. The company also raised its 2021 guidance for constant currency net sales growth to a range of 6% to 7%, from the previous 4% to 6%, and reaffirmed its guidance for adjusted diluted EPS growth in the range of 13% to 15%.

"KDP delivered another strong quarter, as we successfully navigated a challenging macro environment marked by inflation, supply chain disruptions and a tight labor market, said chairman and chief executive Bob Gamgort. "For the first six months of 2021, we delivered 9% revenue growth and nearly 15% adjusted diluted EPS growth."

CONSOLIDATED RESULTS

Keurig Dr Pepper's net sales for the second quarter of 2021 increased 9.6% to $3.14 billion, compared with $2.86 billion in the year-ago period, driven by growth in each business segment, with beverage concentrates and Latin America beverages posting strong double-digit growth. On a constant currency basis, net sales advanced 8.1% in the quarter, reflecting higher volume/mix of 6.1% and favorable net price realization of 2%. For the first six months of 2021, constant currency net sales advanced 13.4% versus the first six months of 2019.

COFFEE SYSTEMS

Net sales for the second quarter of 2021 advanced 5.6% to $1.10 billion, compared to $1.04 billion in the year-ago period. On a constant currency basis, net sales advanced 3.9%, reflecting higher volume/mix of 3.5% and favorable net price realization of 0.4%.

PACKAGED BEVERAGES

Net sales for the second quarter of 2021 increased 7.6% to $1.50 billion, compared with $1.39 billion in the year-ago period. On a constant currency basis, net sales increased 7.3%, reflecting favorable volume/mix of 6.2% and higher net price realization of 1.1%. Leading the strong net sales performance were CSDs, particularly Canada Dry, Sunkist, Dr Pepper, 7UP, A&W and Squirt, as well as growth in Core Hydration, Evian, Snapple, Polar, Bai, and Motts, partially offset by a decline in Hawaiian Punch.

BEVERAGE CONCENTRATES

Net sales for the second quarter of 2021 increased 21.4% to $375 million, compared with $309 million in the year-ago period. On a constant currency basis, net sales advanced 20.7%, reflecting higher volume/mix of 10.3% and favorable net price realization of 10.4%. The volume/mix performance largely reflected improving trends versus year-ago in the fountain foodservice business, driven by higher levels of consumer mobility in the restaurant and hospitality channels, and the benefit of significantly higher marketing investment.

LATIN AMERICAN BEVERAGES

Net sales for the second quarter of 2021 increased 38.3% to $166 million, compared to $120 million in the year-ago period and, on a constant currency basis, net sales increased 20.8%. This performance was driven by strong volume/mix growth of 16.6%, reflecting the benefit of significantly higher marketing investment and favorable net price realization of 4.2%. Leading the strong net sales performance in the quarter were Peñafiel and Clamato.

2021 OUTLOOK

KDP raised its guidance for constant currency net sales growth to the range of 6% to 7%, from the previous range of 4% to 6%, and it reaffirmed its outlook for Adjusted diluted EPS growth in the range of 13% to 15%, with any over-delivery reinvested back into the business. KDP continues to expect its management leverage ratio to be at or below 3.0x at year-end.