2017 State Of The Industry: Operators Close 2016 With 7-Year High of $21.6 Billion

Download the 2017 State of the Vending Industry as a PDF to reference the charts.

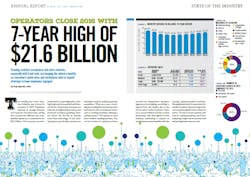

The vending and micro markets industry saw a boost in revenues in 2016. Operators reported an average increase of 3.2 percent. Revenue totals, taking into account the different size independent operators, is calculated to be $21.6 Billion. This nears pre-recession levels and is a 7-year high point. Driving the growth are external and internal forces. Externally, increases are from the strengthening economy and increased consumer spending. Internal drivers for the rise in revenue come from technology. In the vending segment specifically, operators are making in-roads in cashless payment acceptance. What once was a crawling pace in adoption has become more mainstream with an estimated 31 percent of vending machines offering a cashless reader. This equates to more than a million vending machines. The overall number of vending machines serviced by independent operators appears to be dropping, according to reports from our sample, due to the rise in micro market locations. There are a record number of micro market placements with that segment of the industry continuing to expand as workplaces are more familiar with the concept, employees prefer it and flexible equipment make it economical for smaller locations. Operators report the micro market segment will continue to thrive. Thanks to micro markets, but even in vending machines, fresh food is playing a larger role in revenues and enhancing break areas as well.

Strong workforce propels industry

The Bureau of Labor Statistics summarizes that after a high of 5 percent in April 2016, unemployment rates have decreased. By December 2016, the unemployment level was 4.7 percent, the lowest on average in nearly 10 years. The unemployment rate and consumer spending habits have always played a crucial roles in the growth of the vending and micro market industry. Employees must first have secure jobs and disposable income before deciding to shop at convenience channels. In 2016, consumers were back at work and employers were willing to spend money on retention and engagement of those employees, especially in technology companies. This is indicated, in part, by the more than half of operators surveyed who said the number of locations they service increased in 2016 (see chart 3B). In comparing the number of locations served in 2016 versus 2015, there is a substantial jump in the number of location, an average of 100 locations. It is important to note here that operators reported new locations, but not always new vending machines. They continue to purchase new vending machines for these locations, but also redistribute vending machines displaced by micro markets.

For vending machines, the type of locations serviced showed some variation. Manufacturing locations account for the largest increase jumping from 18.4 percent to 24.4 percent. Offices and retail sites also gained where military bases, correctional facilities and restaurants decreased. This makes sense with the increased requirements on vending machines in federal facilities. These locations are also commonly operated by Blind Enterprise participants (BEP) that operate under a slightly different business model. The decrease in restaurants is not surprising given the slow down in that sector. Even the convenience store industry has suffered losses, with CSP Magazine reporting a decline of 3.8 percent for 2016. It appears that off-site refreshment is struggling, while on-site refreshment appears to be enjoying more business.

In fact, workplace locations are substantially shifting their mentality about on-site break rooms. Many realize offering refreshments is a must for employees, especially with the latest studies showing the positive effects of free food and beverages. A 2016 study by Fractl reported that 10 percent of employees gave free snacks "heavy consideration" when deciding between a high paying job and low paying job. According to Peapod 2015 research, those free snacks and coffee are the difference between unhappy workers and happy ones.

Consolidation continues

While locations struggle to stand out to possible employees, operators struggle to stay relevant in a saturated industry leading to the continuation of consolidation. The percentage of acquisitions has been in the double digits since 2010. In 2016, 17.6 percent reporting acquiring part or all of another business, up from 12 percent in 2015 (see chart 6). The number of medium-sized companies shrank by 5.6 percentage points from 2015 due to mergers and acquisitions, while large companies remained largely unchanged (see chart 2). More than half of the industry is still emerging operators who report making under $1 million in annual revenues. This segment represents $1.9 billion in sales, however. The largest segment, by revenue, are those operators making over $10 million annually, who gained a greater percentage of the industry revenue share, increasing from 39 percent in 2015 to 43.7 percent in 2016.

With the consolidation of businesses, comes some staffing changes. Of the companies that added or reduced employees, more were hired in 2016 than were laid off (see chart 4). Delivery and warehouse personnel were the areas employees were added or reduced most often, which is a slight change from the year before. In 2015, more staff reductions were made in administrative personnel than warehouse personnel. Despite the consolidation, most companies made no staffing changes.

Rising costs means raising prices

As products, equipment and services get more expensive, operators continue to raise prices, although fewer did so in 2016 (see chart 5). Raising prices, absorbing costs and eliminating unprofitable accounts remain the top three strategies used by vending and micro market operators. Running a close fourth in 2016 was reducing service schedule. This can be done using a vending management system and telemetry. It also ties into making the existing routes more profitable and the increased use of technology, which is driving the industry's growth.

In fact, there has been a noticeable shift in how the industry looks at technology. Last year, LED lights were ranked the second most favored technology investment for operators, followed by vending management systems (VMS) and then prekitting. In 2016 however, that has shifted, with prekitting considered a valuable technology investment by almost 19 percent of operators (see chart 9A). VMS ranked a fairly close third with remote monitor coming in fourth. Cashless was the leading technology favored in both 2015 and 2016, and has been reported by many operators as one of the most important changes they made in the last year.

According to the responses, the number of vending machines in the U.S., operated by independent operators, that offer a credit and debit card machine is the highest ever, at 30 percent of the existing market. That is 1,050,000 machines with the latest market estimate (3.5 million vending machines, a number that has been shrinking due to the rise in micro markets).

The acceptance of two-tier pricing by consumers, where there is a 10- to 25-cent discount given for using cash, has convinced most of the vending operators who were holding out on cashless to now offer it. The most innovative are pushing the envelope, ensuring their card readers are accepting mobile payments, which many believe are the future, especially as the college-age students who use mobile wallets start entering the workforce. Raising the capital to invest in card readers and connecting them to the internet remain obstacles in some cases, but the industry has turned a corner in payment technology and it is advancing faster than ever before.

Another area of technology that is evolving quickly is VMS and telemetry. The number of vending machines connected to the internet has increased, according to the suppliers of these technologies. The information helps vending and micro market operators create more efficient operations. In fact, nearly 70 percent of operators are using some form of technology, from telemeters to handhelds to iPads, in order to gather sales data from their vending machines (see chart 9B). That data can then be used by a VMS to save time servicing machines, eliminate unprofitable routes, prekit and increase other money saving processes, not to mention delivering better cash accountability and sales analysis. The percentage of operators using a VMS increased to 65.3 percent in 2016 compared to 54 percent a year before.

Change in services (micro markets)

In the vending and micro market industry, we can't talk about the increasing adoption of technology without including micro markets. These systems gave consumers more of what they wanted in convenience services than vending ever could —more choices, including fresh and healthy products, the chance to touch and feel items before purchasing, an open concept with a café-style feel and convenience being right on-site. The share of sales revenue attributed to micro markets grew in 2016 to 12.9 percent, 2.7 percentage points over 2015 and representing $2.8 billion (see chart 11B). The average number of micro markets per operation spiked to 45, up from 13 the year before (see micro market chart section).

Micro markets have even shifted products in vending, raising up vending food due to the enhanced quality of food being introduced to meet the micro market need. Many operators are adding this food to vending and finding it more successful than previous food offerings. Food vending will likely never overtake micro markets, as consumers still do not like shopping for food items behind glass, but vended food sales have increased due to the greater variety and quality of the SKUs. Food is ranked as the third most important product category for micro markets, following beverages and candy/snack.

Product categories

Product categories are altering due to better insight at the item level. In vending machines DEX data combined with VMS helps operators identify what is selling and what isn't. Micro markets have this type of reporting built in. It is becoming more common place to rely on these systems to identify the items operators should include in locations than on gut instinct or the route driver. Route drivers continue to play a critical role however, especially in micro markets. The role has shifted to one of a sales and merchandising, with operators starting to focus more on those elements during driver training.

Cold beverages

When operators raised prices, cold beverages and snacks were the two categories affected most often (see chart 7). Operators reported expanding beverages based on consumer requests and demand. The number of SKUs dedicated to sparkling water, ready-to-drink teas and coffees, juice, energy drinks, and in some cases milk expanded. The core cold beverages, classic sodas, were reduced in many cases, however, they did not disappear. In vending especially carbonated drinks still remain a strong contender. The Beverage Marketing Corp. reports that although carbonated soft drinks slipped into second place among liquid refreshment categories, they continued to account for four of the five top beverage brands by volume. It was bottled water that had a truly significant year in 2016, surpassing carbonated soft drinks to become the number-one beverage by volume. This fits into the latest preferences of consumers, which is a high demand for healthy and organic products. A huge majority of vending and micro market operators, 84.7 percent, were asked to offer healthier items in 2016.

Candy/snack

The shifting focus on health and wellness is changing the snack segment, but not always in expected ways. Candy overall has seen an increase in revenue with chocolate options and the gum and mint offerings gaining the most (see chart 14). Cookies and crackers also saw a huge increase in sales in 2016 over 2015. The popularity of these types of items is often confusing as it runs counter to the better-for-you trend, but many consumers still have a sweet tooth and still want an indulgent product. Also, many gum and mint options are seen as healthier since they are low in calories and freshen breath.

Treats were not the only increases in 2016, however. Perhaps more expected was the increase in nuts and seeds and food snacks, which fit into the healthier snacking trend. Interestingly, the broad "nutritious" category saw a decrease in sales, likely do to the snacks in this category being redesignated into other categories such as chips, food snacks, etc. One of the biggest challenges for operators is getting a steady supply of these "healthier" options especially as consumers want an ever expanding selection for their micro markets. Many operators reported that suppliers, many of whom are smaller businesses, have a hard time keeping up with demand for healthy and nutritious grab and go convenience items.

Ice cream had low performance in 2016, with operators reporting decreasing sales revenues.

Hot beverage and OCS

Coffee prices, both in hot beverage vending machines and in OCS, were raised more often in 2016 than in 2015. Hot beverage machines suffered in 2016, with fewer being placed. This is due to the perception many consumers still have of vended coffee, which has seen a lower percentage of sales for a while. OCS appears to have declined as well, but this is due more to the increase in micro markets than actually decrease in the OCS segment. Operators continue to report OCS as a strong business, with many companies expanding it, some to food and beverage products beyond coffee, also called pantry service or the micro kitchen. This could also lead to operators reporting the revenue in food and beverage despite the location requesting it as part of their OCS solution. Coffee sales are also heavily affected by warm weather in some areas, which leads to decreased sales.

Food

Most of the food in vending machines is frozen/refrigerated food, 33.5 percent compared to 14.5 percent being fresh, because of the longer shelf life. While this year's survey did not ask about the specific food makeup for micro markets, it did ask what percentage of revenue was food. Operators with micro markets reported that 25 percent was from food sales, quite a bit higher than traditional vending. And operators have expanded fresh food product offerings to keep up with the growth of their micro market divisions and consumer requests for items beyond snacks. In micro markets specially, sundries and food do very well. Operators report that locally made sandwiches and fresh food do ideal in micro markets, as they appeal to the desire for local, freshly prepared items.

With more SKUs in the warehouse to satisfy the micro market food demands, operators began adding the proven micro market items to combination refrigerated snack and food machines. This has done well, driving up vended food sales. Operators are also keeping a close eye on food sales, since spoilage is higher. The micro market kiosk reporting as well as VMS are both important tools operators used in 2016 to decrease expired product that needed to be thrown away and increase the variety on a location-specific basis. Managing products in the warehouse continues to be a challenge for operators as does maximizing rebates when ordering products.

Convenience, snacking, a push for employers to provide enhanced benefits to lure and retain top employees — there are a number of trends happening right now that benefit the vending and micro market industry. Micro markets have elevated the status of operators so they are again being considered the break room experts — a professional image that had been lost with vending. Next on the horizon for many operators is enhanced foodservice with combination micro markets and made-to-order cafes, as well as enhanced pantry services. The location might be staffed during certain hours, but then turned into a self-checkout micro market all other hours or full of freely provided snacks covered by the employer. Break room design is becoming more important as well with well-lit, flexible spaces that are equally appealing for lunch or an informal meeting among staff. With locations willing to finance improvements and engage employees, operators must continue to push the envelope on new services to ensure they are in the right positive to benefit. As long as the economy continues to strengthen, we can expect a good year for the industry, especially micro markets.

Methodology

The Automatic Merchandiser State of the Vending Industry Report is compiled from a survey sent to vending operators in Spring as well as operator insights. The 2017 report is based on more than a 3 percent response rate, and includes small, medium, large and extra-large full service operations as well as snack and soda operators.

About the Author

Emily Refermat

Emily Refermat began covering the vending industry in 2006 and served as editor of Automatic Merchandiser from 2012 to 2019. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].