Consumers’ concern for safer commerce is giving locally owned SMBs as much of an opportunity to earn their business as larger retailers. According to a new study by Visa, since the start of COVID-19, a quarter (25%) of consumers have shopped the majority of the time at locally owned businesses and three in 10 (30%) have shopped at an equal mix of locally owned businesses and larger retailers.

The Visa Back to Business Study examined global small business trends and consumer insights powering recovery through digital and contactless payments amid COVID-19.

From their everyday shopping to big-ticket purchases, consumers want to be able to complete their transactions in the safest way possible, according to the study. The kinds of stores they would switch to include grocery stores (46%), gas stations or convenience stores (31%), clothing or apparel stores (31%) and electronics or appliance stores (26%).

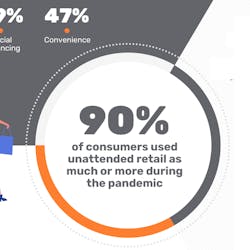

For many shoppers, a store that doesn’t have a contactless payment method is a store that doesn’t get their money, Visa said. Nearly half (48%) of consumers wouldn’t shop at a store that only offers payment methods that require contact with a cashier or shared machine like a card reader.

And it would appear that contactless options for payment is here to stay. More than half of Millennials (56%) are more likely to avoid shopping at a store that only offers payment methods that require contact, compared to Gen Xers (44%) and Boomers (38%).

Consumers expect that stores are doing everything possible to make their shopping experience a safe one. In fact, consumers feel disinfecting the checkout area after every customer (49%) and using contactless payment methods (46%) are among the most important safety measures for stores to follow.

A sign of hope amid crisis

In the United States, a large majority (82%) of SMBs are optimistic about the future of their business, more than the 75% reported globally. In addition, more than a quarter (28%) are “extremely optimistic,” compared wit just 14% globally.

SMBs in the U.S still estimate it will be about seven months before their businesses are back to full operation.

Three in five (60%, compared with 67% globally) of SMBs in the U.S. have pivoted to keep their business on track since the start of COVID-19. Nearly a quarter (23%) have targeted advertising on social media, 20% have offered alternative payment solutions and 18% applied for a business loan.

The Back to Business study is the latest in a series of Visa initiatives to provide SMBs with the tools and resources they need to rebuild, or newly build, stronger businesses.