Trail blazers of the micro market solution had a challenge. They needed to fit a retail concept into a breakroom, often using the same footprint as the old vending machines. These forward thinkers went to retail furnishing resalers to find racks and shelves. They ordered grocery and convenience store display units from large catalogues. It wasn’t easy, and the results were mixed, depending on what was available and the design prowess of the operator. Since the first micro markets were installed nearly a decade ago, much has changed, including the landscape of what micro market displays look like and who is supplying the industry.

“As a premium fixture manufacturer, we are seeing the demand increase for better looking and longer lasting fixtures,” said Bear Wegener, president of Axis Designs. “I feel that it is due to market effects, like competition, improved operator image and account awareness to the industry,” he said. “My guess is that in the future operators who set up their micro market accounts by mounting grid wall to the location’s drywall will be forced to improve their fixture solution.”

1. Freestanding fixtures are a must

One point of difference between the original micro market fixtures and those common today is making the display freestanding. Nearly all the micro market display providers felt this was important when bringing a micro market to locations in today’s environment or updating an older style.

“First, there is a difference between fixtures and cabinetry,” said Troy Geis, CEO and co-founder of Fixturelite. “Fixtures are screwed to the wall, or affixed. They can be destructive to the customer environment as well as difficult or dangerous to install.”

Instead, Geis says today’s fixtures should be free standing —able to support themselves. Despite that definition, freestanding can still mean slightly different things, which complicates micro market display ordering.

“Some displays are 100 percent freestanding, meaning they can be placed anywhere. Each piece can stand by itself,” Geis said. “Other displays are like Legos, you need piece X to hold pieces Y & Z in order for the unit to be stable.” Geis also says that these types of units must be pushed up against a wall since only the front side is finished.

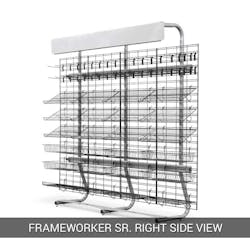

Freestanding displays will help the operator in the long run, says Kyle Reifert, president of Frameworks. “We realized we needed free-standing fixtures pretty early on,” he said. “We didn’t want the liability of drilling into a pipe or electrical wire.” Reifert also felt that offering a freestanding unit meant it would be able to be moved or even added to in case of corporate expansion.

2. Consider install requirements, movability and scalability

Operators looking at micro market displays should consider the time and effort in the initial install, but also the future.

“Our 8-foot rack takes two guys 12 minutes to put together,” said Reifert. “Merchandisers [Reifert’s word for micro market displays] should be relatively light, portable and easy to put together.”

Reifert created the racks he wished existed when he was first installing micro markets. “It was overwhelming the first time,” he said. “I was looking for super market and c-store shelving in industry equipment catalogs. You needed X many of these, with Y brackets, Z ends, etc. Just give me a simple rack, I thought to myself. That is what we try to do.”

Robert Liva, president of GTP, also markets his displays as light and easy to assemble. “Operators should look at the long-term costs of moving a fixture,” Liva said. “Operators will want to move it, pull it out to be cleaned, change out coolers, kiosks, ethernet cables, etc.” There is value in man hours, explains Liva, so it’s important that the unit is light weight as well as durable.

3. Count your pieces and your poundage

No matter what a fixture looks like, shipping it throughout the country can add up. Reifert suggests considering how many boxes the unit fits into and how fast the supplier can turn it around. Custom builds can also take longer to ship. “Think of my equipment catalog example,” he said. “That’s the way shelving business is for large retail. We think we’ve simplified it.”

Wegener says there is a common misconception about shipping. “In factoring shipping costs, it’s not just about weight or the package being flat,” he said, “It’s about density.” He uses the example of a micro market fixture being sent to the operator in a 4X8 foot box. “It’s light, but can’t have anything stacked on top of it, creating empty space above it in the truck,” said Wegener. The shipping company rates that higher making the cost higher. As a counterpoint he says that his displays ships fully assembled on a 4-foot pallet, taking up vertical space, which ensures it is rated lower. “There really isn’t much difference in the cost of shipping,” said Wegener. “In fact, in some cases, it could be the same or less to get a fabricated or fully assembled display.”

4. Quality material is money ahead

“The landscape is changing,” said Steve Orlando, co-founder of Fixturelite. “It used to be there was a standard based on the audience, 100 people got A, 150 got B, 200 for C and so on, as far as investment.” This is no longer the case, and it’s because customers want quality, Orlando adds. In his view, locations want micro markets that complement the mission of their business, which includes cabinetry, lighting and well-designed fixtures.

Orlando suggests looking for certification among micro market displays. “Our displays have the woodworking certification, which is an Architectural Woodwork Institute (AWI) industry standard. It signifies that the display material is designed and intended for the end use. “You are making an investment,” he said. “Don’t you want it to be the best.”

One advantage to creating a recognizable micro market brand using displays is that companies that have locations in multiple cities or states are likely to want the same look and feel in each location. It is also how operators will compete with power houses like Amazon for office business, explains Orlando. Level of craftsman ship should be considered, suggests Orlando. “Are the displays mill worked/fabricated using commercial grade equipment or design based on appearance?”

One advantage to a brand is that companies that have locations in multiple states will ask the micro market provider to service their other locations with the same micro market. It is also how operators will compete with power houses like Amazon for office business, explains Orlando. Level of craftsman ship should be considered, suggests Orlando. “Are the displays mill worked/fabricated using commercial grade equipment or deign based on appearance?”

Liva suggests operators look not just at the cost of a micro market installation, but how much it costs to find a new customer versus retain one. “You should start with better fixtures, in my opinion, for many reasons,” he said. “Number one is that they can be used again and again, easily modified and moved.” The ability to replace a single part of the display is also beneficial in case just a portion is damaged, says Liva.

“Number two is that it’s 11 times more costly to get a new customer. With that theory alone, you should always go in thinking a long-term solution. If you go in with a wire rack, are you not leaving yourself open for the competition to come in and show them something like we have? Of course,” he said.

Using quality material also means ensuring the right look and feel. Using bulky cabinetry can make some rooms look smaller and overpower the product, says Reifert. He prefers metal for its simple structure, minimal upkeep and long-lasting properties. “It emphasizes the product more than display racks, there’s no dusting, you can move it easily — it can be disassembled and reassembled without wear and tear to the market,” he said.

5. Merchandise, merchandise, merchandise

Another consideration brought up by Fixturelite’s Geis is when looking at micro market displays consider the alignment of the cabinetry and other pieces of equipment. Coolers, for example are come in a depth of 36 inches, whereas standard snack displays are 20 inches deep. The 16-inch difference can either be in the front or the back. “There are two philosophies,” he said. “Front aligned [flush in front] or rear aligned with some elements forward and some deeper in the market creating a jagged look.” Operators should consider which their customers will prefer.

When considering the return on investing in micro market displays, Orlando suggests also looking at the overall goal. “What’s the potential of the micro market — to pull people out of their cubes,” he said. “Provide the types of spaces that do that and they will spend more money.” Orlando can turn any conversation about the expense of fixtures into a conversation about investment in the space that will net an operator an overall environment. “If it weren’t necessary, national coffee shops would have card tables and folding chairs,” joked Orlando. “Instead it’s about creating an experience and contributing to the culture of a business.” He insists that by investing more in the space, an operator is more entrenched with the customer and that includes small elements that make a big design different. For example, fixtures should have lighting, but if it’s near the ground, it shines into the customer’s eyes. “You get out what you put into it,” said Orlando about displays.

Distinguishing between premium fixtures versus non premium fixtures can be likened to buying fine furniture versus buying something knocked down that requires assembly, says Axis Design’s Wegener. Operators are investing in quality fixtures to win accounts, improve retention and negotiate longer contracts. As the segment matures, and operators become more comfortable with the micro market concept, they realize they should invest in a more premium solution, he adds.

“In a bidding situation the competitive edge will be very related to what fixtures operators choose to put in the break room, and how the operator presents their micro market solution,” Wegener said. “Is it easy to assemble, is it made well, does it convey an image of quality? The trend is toward using quality fixtures that denote the value the operator places on the account.”

6. Take in the overall look and feel

There are two schools of thought for creating an overall micro market brand. Some micro market display providers suggest defining such a brand, extending it so every market is similar in look and feel. “Define your brand and what you want the customer experience to be,” said Geis.

Brands can appeal to certain clients as well, so that should also be a consideration. Is the micro market for an one-off company or a single location of a Fortune 500 Company? “Some locations are significantly more demanding versus one-off locations who are just happy to have a micro market,” said Geis.

On the other side are those that value personalizing a micro market to each location. “Customization is important,” said GTP’s Liva. He believes that each micro market should be unique to the space its placed. It should also look nice at all times, which is why Liva promotes what he calls “merchandisers” that push product forward as customers make purchases. “It keeps the market looking neat,” he said.

7. Go with an industry-specific provider

Operators should look for the micro market display provider that most closely aligns with their needs. Geis recommends looking for a supplier who has vision, fast turn around and reasonable prices. “We are more closely aligned with retail than vending,” said Geis about Fixturelite. “In retail, no matter the kind, the goal is to create an experience to drive the customer in....the better the experience the bigger the revenue is going to be for the operator.” He promotes a company whose core competency is micro markets.

Displays meant for residential use won’t last more than six months, warns Orlando. He adds that using a mashup of what’s available at the cheapest price possible doesn’t anchor an operator in a location, which is part of what a high-end micro market display will do. “You have to show you are the expert in your field,” he said. “Look for a provider that understands the niche businesses that we are in. Work with a partner that is an expert in their field.”

To properly assess micro market displays, operators must first consider various aspect of their operations. These include the customer looking for a micro market, if the operator values creating a brand and opting for a long-term solution. Quality should always be considered along with ensuring displays are free-standing to offer more flexibility.