PHILADELPHIA--(BUSINESS WIRE)--Aramark (NYSE: ARMK) today reported first quarter fiscal 2019 results.

“2019 is off to a good start, with broad-based momentum across the portfolio, driven by strong base business performance and progress in our integration of Avendra and AmerPride. We continue to elevate the consumer experience by enhancing our product offerings, obsessing on service excellence, and innovating with new technologies,” said Eric J. Foss, Chairman, President and CEO. “We now expect our full-year Adjusted EPS outlook to be $2.30 to $2.40.”

Foss added: “Aramark benefits from an advantaged business model and excellent financial flexibility. As we look ahead to the full year, we expect to deliver solid financial performance that will drive sustainable shareholder value."

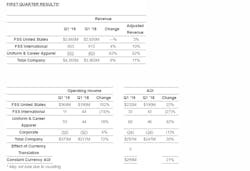

Consolidated revenue was $4.3 billion in the quarter, an increase of 11% on a constant-currency basis over the prior-year period, composed of a 4.5% increase in revenue related to the Avendra and AmeriPride acquisitions, 2.5% increase in revenue related to an accounting rule change, and 4% of growth in the legacy business. The year over year decrease due to the divestiture of the Healthcare Technologies business has been excluded from the calculation of legacy business.

The Company continues to deliver broad-based productivity improvements while reinvesting in the business. The FSS United States segment income benefited from the inclusion of Avendra results and synergies, as well as a client payment. In the FSS International segment, these improvements were offset by start-up costs associated with onboarding several new business wins across multiple geographies, and an increase in personnel costs. Uniform income benefited from the inclusion of AmeriPride results and synergies.

FIRST QUARTER SUMMARY

On a GAAP basis, revenue was $4.3 billion, operating income was $373 million, net income attributable to Aramark stockholders was $251 million, which includes a net gain on sale of the Healthcare Technologies business of approximately $140 million, and diluted earnings per share were $0.99. This compares to the first quarter of 2018 where, on a GAAP basis, revenue was $4.0 billion, operating income was $217 million, net income attributable to Aramark stockholders was $292 million and diluted earnings per share were $1.16. First quarter GAAP diluted earnings per share decreased (15)% year-over-year, primarily due to a decrease in the net benefit to the income tax provision related to tax reform, partially offset by increased operating income. Adjusted net income was $160 million or $0.63 per share, versus adjusted net income of $139 million or $0.55 per share in the first quarter of 2018. A stronger U.S. dollar decreased revenue by approximately $59 million, and had a negative impact of approximately $3 million on operating income as well as a one-cent negative impact on adjusted earnings per share.

CAPITAL STRUCTURE & LIQUIDITY

Total trailing 12-month net debt to covenant adjusted EBITDA was 4.2x at the end of the quarter, a 30 basis point improvement versus the end of the first quarter of 2018.

During the quarter, the Company received $293 million of proceeds from the sale of the Healthcare Technologies business, the majority of which were used for debt reduction. At quarter-end the company had approximately $1.2 billion in cash and availability on its revolving credit facility.

SHARE REPURCHASE

During the quarter, the company repurchased 1.6 million shares of Aramark common stock for an aggregate amount of $50 million.

2019 OUTLOOK

The Company provides its expectations for full-year adjusted EPS and full-year free cash flow on a non-GAAP basis, and does not provide a reconciliation of such forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for the impact of the change in fair value related to certain gasoline and diesel agreements, severance and other charges and the effect of currency translation.

The Company is increasing its 2019 adjusted EPS outlook to $2.30 to $2.40 per share, which now reflects the full impact of the Healthcare Technologies divestiture, principally due to the use of proceeds to pay down debt. It also includes 4 cents of currency headwinds. The Company is affirming its full-year free cash flow outlook of $500 million. This outlook includes approximately $50 million in cash outlay related to the divestiture of the Healthcare Technologies business, and approximately $50 million in spending on the integrations of Avendra and AmeriPride. The Company expects its leverage ratio to be at 3.8x by the end of the fiscal year.

CONFERENCE CALL SCHEDULED

The Company has scheduled a conference call at 10 a.m. ET today to discuss its earnings and outlook. This call and related materials can be heard and reviewed, either live or on a delayed basis, on the Company's web site, www.aramark.com on the investor relations page.

About Aramark

Aramark (NYSE: ARMK) proudly serves Fortune 500 companies, world champion sports teams, state-of-the-art healthcare providers, the world’s leading educational institutions, iconic destinations and cultural attractions, and numerous municipalities in 19 countries around the world. Our 270,000 team members deliver experiences that enrich and nourish millions of lives every day through innovative services in food, facilities management and uniforms. We work to put our sustainability goals into action by focusing on initiatives that engage our employees, empower healthy living, preserve our planet and build local communities. Aramark is recognized as one of the World’s Most Admired Companies by FORTUNE, as well as an employer of choice by the Human Rights Campaign and DiversityInc. Learn more at www.aramark.com or connect with us on Facebook and Twitter.

See more of the results here.