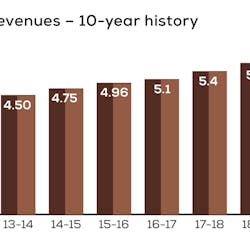

As more employees return to the office, the office coffee service (OCS) industry continues to recover from the COVID-19 pandemic slowdown – with revenue increasing 20% from 2021 to $2.49 billion in 2022.

In this year’s State of the Office Coffee Service Industry Report, 64% of respondents reported an increase in sales in 2022, and 20% reported no change in revenue.

For the number of locations served in 2022, more than half of respondents (62%) reported an increase in locations – compared with 42% in 2021. The rise in locations was accompanied by a reported increase in OCS staff as well with 57% of respondents reporting that they added staff in 2022.

The 2022 Automatic Merchandiser State of the Office Coffee Service Industry Report is featured in the 2023 September/October issue.

Click here to download the report.

Strategies to combat high costs

While green coffee prices somewhat stabilized by the end of 2022 after reaching a 10-year high in late 2021, OCS operators continued to face challenges of inflation, transportation costs, product costs and labor costs.

To handle rising costs, half of the respondents said they relied on a combination of raising prices and absorbing costs, and 45% said they adjusted their product mix. Others began selling additional services (37%), and 9% divested.

It has been the ability of OCS operators to adapt to an ever-changing environment, and 2022 was no different – with 34% of operators reported that they added pantry service, 24% said they added micro markets, while 31% added water service.

Bean-to-cup is now a dominant choice

In 2022, whole-bean varieties increased again from the previous year, becoming the dominate coffee product sold, making up 39% of OCS sales over frac packs (29.5% of OCS sales), followed by single cup (17%) and K-cup at 14%.

To meet the demands by clients to offer high-end coffee service as a reward for returning to the office, most operators provided high-quality coffee, with local coffee brands familiar to clients (25%) as the top-selling OCS product, then whole bean (22%), nationally branded coffee (17%), private-label products (7%), and single cup at 6%.

For OCS product categories, pantry service as well as water filtration service and ice machines all showed a notable jump in 2022 sales due to customer demand.

An increase in respondents (81%) said they offered online ordering of coffee or related products in 2022. And, 75% said they are using industry-specific software to manage OCS business; 9% are using the same software for vending.

Sustainability and coffee trends

In 2022, a higher number of OCS operators reported that they offered more water filtration devices to reduce bottled water (29.5%), as well as an increase in coffee with sustainability features, such as organic or fair trade (26.3%), and about 35% said they offered recycled products (cups, filters, pods, utensils). Only 9% said they do not offer any products to address environmental concerns.

Consumer demand also was reflected in the percentage of OCS operators reporting they offered cold brew options in 2022 – 83% compared with 66% in the previous year. Among those, 13% offered on-draft kegs, 30% offered single-serve bottles, and 34% said in packages the location can brew.

About 90% of operators offered iced coffee options. Also, a higher number of operators reported an increase in espresso in their OCS sales by supplier type – 10% in 2022, up from 5.5% in 2021.

Single-cup brewers also showed an increase in 2022 – at 41% compared with 39% in the previous year.

Locations and population size

In 2022, the typical location population of coffee service accounts from respondents had 20-29 employees (27%), followed by 30-49 employees (17%), and then 15-19 employees (16%).

There was an increase in both white-collar workplace populations (40%) and in blue-collar locations (19.3%). A continued increase was reported by operators in schools and colleges (12%), as well as other locations such as healthcare/hospitals, hotels and auto dealerships (12.8%).

Operator snapshot

For the operator respondent profile, 26.8% reported revenue of $1 million to $2.5 million, followed by 25% with revenue of $0.5 million to $1 million, then 21.4% with revenue of $2.5 million to $5 million, 14.3% with revenue less than $0.5 million, 8.5% with revenue of $5 million to $10 million, and 4% with revenue over $10 million.

A bright outlook

Many operators reported that business is improving even more in 2023. They cite further upturns in office populations, their ability to meet increasing client demands, and employers’ willingness to pay more for higher levels of convenience services as incentives for workers returning to the office. The OCS sector’s ability to restructure operations, adapt to hybrid work models and add services all point to a steeper comeback trajectory from the disastrous pandemic year. This collective momentum marks a strong recovery from the setbacks of 2020 and underscores the resilient resurgence of the OCS industry as a whole. ■