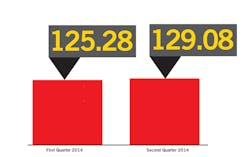

Confidence in the vending, micro market and office coffee service (OCS) industry continued to rise in the second quarter of 2014. The operator confidence index (OCI) reached 129.08 for the quarter, a 3 percent increase from the start of the year. April showed the strongest outlook, with the OCI index being 130. The index fell slightly in May and June of 2014 to 128.67 and 128.58 respectively, although all three months were above last quarter’s average of 125.28.

Operators report more same-store sales for the second quarter as the strengthening economy in some U.S. areas allowed locations to hire more employees and the current employees felt more secure in their positions. This produced a stronger outlook in the second quarter for all three industry segments (vending, micro market and OCS), although OCS was the strongest performer.

The increasing cost of products and pressure on pricing as well as requirements surrounding healthy vending snacks have the greatest negative impact of the industry’s outlook for the future.

Vending remains core business

The outlook for vending remains steady, even slightly up among operators nationwide. Growth in the segment can been seen where locations are adding employees. This has increased the amount spent at vending machines.

“We are reaping the benefits of our local economy improving and businesses continuing to hire,” said a Minnesota vending operator. Other operators echoed this sentiment mentioning that different business and industry segments were returning to their previous volumes and adding employees and work shifts. “Our sales are strong across the spectrum. Have not seen numbers like these since 2006,” commented an operator in Utah.

Vending remains the core of many businesses despite the segment being the lowest OCI number. In all three months of the second quarter, the vending OCI number held steady at 3.41 out of a possible 5, compared to the other segments, which averaged over 3.5. Operators predict that future growth in the segment will likely come from cashless payments, , whether in the form of credit cards or mobile wallets. “We believe mobile payments will be the main source of payment with the upcoming generation of customers,” said an Ohio operator. “We are looking forward to the PayRange launch in July. We plan on equipping our top 100 machines.”

Troubled economies see no relief

While the majority of operators are feeling the economic recovery, there are many areas still suffering as businesses close or refuse to contract services. In these areas, uncertainly also limits the user’s spending at machines. “We are seeing some recovery in a few accounts but then we see layoffs in others. No consistent pattern,” said a national vending operator.

Micro markets considered light on horizon

For the second quarter 2014, the outlook of micro markets is positive, with many operators looking to the segment for growth and additional sales. “Micro market growth opportunities are the true long term bright spot in the vending sector,” said a Minnesota operator. Many operators agreed with comments like this California vendor, “Micro markets are leading the way for stronger sales.”

The micro market OCI number has risen to 3.54 for Q2 2014, an increase over last quarter’s 3.48, despite some operators struggling with the new model.

“While we have targeted micro markets as a sales objective for this year, we are not seeing the ROI that we expected on the markets in place,” observed a Wisconsin operator. “We are investigating whether we have the right locations and/or if the product mix is at issue in these locations. Some of the locations have had traditional vending which has been removed and replaced with micro markets. Since this concept is in its infancy, we don't have enough experience to make a proper decision. Besides, there are other considerations in placing some of the micro markets.”

There also continues to be operators who don’t believe the micro market business model will work in their area. For example a Missouri operator indicated, “We are still not in the micro market business and still don’t see the value.”

OCS proves strong performer

Coffee continues to be a strong growth area for operators, reaching an OCI number of 3.60, just shy of last quarter’s 3.66. Since December 2013, OCS has nearly always performed the best in terms of segment confidence. OCS operators are noticing an increase in bean to cup systems as well as locations making a switch to local coffees. The biggest worry for operators providing coffee is the future cost of beans. “Coffee price fluctuations are too volatile to project too far into the future,” said one Louisiana OCS operator. “And the current glut of new coffee offerings is driving interest away.”

Nod to technology

Technology is helping operators feel more optimistic about the future. There will be more payment options to increase purchases, more engaging displays to grab consumer attention and even better telemetry systems to increase operating efficiencies. “The vending industry is experiencing a renaissance,” said a New York vending operator. “Technology upgrades with credit card readers, telemetry, LED lighting, interactive machines, micro markets, bright graphics along with a wide array of trendy new products that are healthy, organic or gourmet has created the revitalization. It is leading to increased participation from consumers who have a new perception on the vending industry. It's no longer just about the sale. It's about the experience.”

“Vending and ocs sales should be strong as well especially if your company is 100 percent committed to technology from prekitting to credit cards,” said one Tennessee operator.

Sales up, margins not

There are some hurdles to profitability felt across the industry. One is the increasing costs of goods. “We’re in an up-turn because of new accounts and an increase at a couple of large locations,” said a Georgia operator. “I think new technology is a plus. My biggest concern right now it price increases.” Many operators talked about sales being up from the prior year, but actually taking in less profit due to their margins. Many are trying to raise prices to get the gross profit dollars back to positive levels. “We need to increase our margins,” said a North Carolina operator. “We need to get the price increases we need and deserve and be the same pricing as convenience stores.”

Healthy snacks create another obstacle

The U.S. Department of Agriculture’s ruling for reformulated snacks to be vended in school was another top concern for operators. Some operators were worried about being able to meet the requirements while others felt there was an adequate number of available products.

An operator in Connecticut commented: “We are in several schools and are concerned with the rollout of the smart snacks. First of all the rules for snacks are very tough and most of my inventory is considered healthy but not according to the USDA rules.

A different operator serving parts of Ohio has a more positive view of what’s available. “I was concerned with what was going to take place with our school vending accounts with the new USDA standards that go into effect July 1,” said the operator. ”I am very pleased with the wide array of products that became available and that were reformulated. The public school channel of our company will continue to prosper. And in non-school accounts vending users still enjoy foods that don’t meet these healthy guidelines.”

Overall, the industry outlook has been improving since the low of 122.57 in February 2014. OCS, micro markets, an improving economy in most areas and technology are giving operators tools to remain profitable. The cost of goods, especially with the unpredictable coffee prices due to environmental concerns needs to be watched and managed. Being able to meet the demand of healthy vending will need attention and work, but there is hope with

About the Author

Emily Refermat

Emily Refermat began covering the vending industry in 2006 and served as editor of Automatic Merchandiser from 2012 to 2019. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].