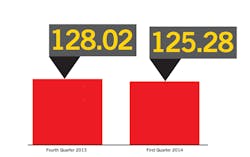

At the start of 2014, economical and legislative uncertainty still had operators concerned about the industry’s outlook producing an overall operator confidence index (OCI) of 125.28 for the first quarter. In January, the OCI dropped to 124.04, down nearly 4 percentage points from December 2013. An operator with a national vending company stated, “Healthcare confusion and consumer concern about their long term job status is hurting everyone.” February continued promising challenges, with another drop in the OCI, -1.19 percent to 122.57. However, March showed a substantial gain, jumping 5.43 percentage points to 129.23 for that month. Signs point to continued upward growth for April 2014 as well.

From the panel of operators, there seems to be a dichotomy forming. Some operators report optimism and increased sales, while others report that locations continue to close, dropping revenues.

Operators who have shown growth report adapting to the new, no cash carrying and finicky consumer. A New York operator said, “I am very pleased with the direction of our industry. We have expanded into the micro markets, adapted to the growing needs for healthier options, and have expanded technology with use of credit card readers, touch screens and modern advances to look of our machines.” Even operators that practice caution when upgrading technology seem to be looking towards it in order to move forward. “[We need to] re-evaluate every account. Recoup losses by implementing price increases where necessary. Offer to upgrade if the potential for growth is there or move on to another opportunity. Continue to embrace technology upgrades and offerings,” said an Ohio operator.

On the flip side, many operators are still suffering from a struggling economy. “We depend on tourism for the bulk of our vending business. Tour companies booking for this year are down thirty percent or more. Accordingly, hotel bookings are off by the same, in our area,” said an operator in Utah. “Consumer confidence is at an all-time low. People in New Mexico just aren't spending in vending machines,” shared another operator.

Vending remains flat

Nearly all operators report vending sales to be flat or dropping. A national operator reports that “Vending is trending down mid-single digits.”

Operator confidence in vending for the quarter was 3.31, slightly higher than middle of the road (3.0). Still, despite worries about the vending business, it continues to be central to operators. A Colorado operator explained, “We have noticed that vending has not been net profitable, but provides considerable cash flow and a necessary service for most customers.” This operator plans to raise vending prices in 2014, a move he hasn’t made for two years.

One reason vending struggles is the limited number of products available to vend. There is more variety in most other retail formats, which is what end users are coming to expect. “Vending remains flat as we continue to adapt to new product mixes that consumers are looking to purchase, but are often unavailable in vending machines. Once we get that in place, the outlook for vending is very bright,” said an operator based in Florida.

OCS: strong grower

Coffee service is an area that has shown exceptional growth. Operators report it as having the strongest OCI number every month of the first quarter, averaging to be 3.66. While there are many reasons OCS has been doing well, even during the recession, there is still opportunity for growth. A coffee roaster commented: “OCS/Vending is stagnate as operators are very slow to think out of the box and embrace new exciting [coffee] brands unlike consumers and retail/grocery buyers.”

Micro markets still in minority

Many of the Board of Operators report not yet having micro markets, which implies they plan to add them in the future. Even coffee service companies are recognizing the potential. “We are seeing a lot of interest in the micro market concept. The conversion rate from traditional vending should gain a lot of traction this year,” said one Minnesota OCS operator.

Many operators who commented they did not yet have micro markets also rated the micro market outlook as very weak, which weighted down the micro market OCI number for the first quarter to 3.48.

Despite success stories, there is resistance to the micro market model. There are operators who consider micro markets threatening to their business. An Idaho operator summed it up when he said, “Micro markets are great, but they are death to vending as we know it.”

Business savvy wins

While there does seem to be a correlation between technology and a positive industry outlook, it is unclear whether that is because the technology is contributing to the bottom line or that operations that are growing, tend to invest in technology. The economy still plays a key role in whether vending operators see improvement in sales, but so does reevaluating the business to increase efficiencies, gain proper prices and achieve the best overall product mix, especially in the limited space of a vending machine.

Methodology

The OCI is based on a monthly survey sent to the VendingMarketWatch Board of Operators and is sponsored by Mondelez International. The Operator Confidence Index is the first of its kind that tracks the level of confidence in the vending, micro market and office coffee service (OCS) industry and it is only available from VendingMarketWatch and Automatic Merchandiser.

If you are interested in joining the Board of Operators, please contact the publication editor.

About the Author

Emily Refermat

Emily Refermat began covering the vending industry in 2006 and served as editor of Automatic Merchandiser from 2012 to 2019. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].