From September 2013, the overall operator outlook for the U.S. vending, micro market and office coffee service (OCS) industry slipped a few digits. It showed improvement in the final month of 2013, compared to the two previous and operators finished off the year with more optimism.

Bad weather drove up location sales as did better trained staff. However, legislation continues to hamper the industry’s immediate growth.

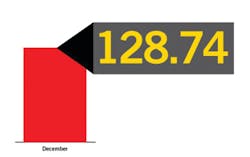

Index rebounds

The latest 2013 Operator Confidence Index (OCI) bounced back after a two month decline. Reaching 128.74 in December, the average index for the quarter was 128.02. This represents a -2 percent change from the first OCI of 130.6 reported in September of last year.

Healthcare regulations were cited by many operators as contributing to both their own uncertainty about the future as well as the resistance from customers to do more purchasing from vending machines and micro markets. A Georgia operator stated, “The ACA [Affordable Care Act] is the biggest concern now. With increased insurance costs consumers will probably cut back on spending.”

It is not just insurance costs looming over the industry, but also the calorie disclosure law and new restrictions on vending in schools. Amid operators' own concerns on the cost and necessity of implementing calorie disclosure on vending machines, news media across the country has been contacting industry members for statements on potential effects of the law. Yet, the FDA still has not published a final rule, therefore there is no enforcement and the effects are unknown.

Additionally, in July 2014 food sold in schools, including vended food, will have to abide by new USDA regulations. This will have a negative effect on sales for operators with large school accounts. A Tennessee operator who caters to high schools cited the “competitive food act” as his major concern for the coming months. “This is unknown territory at this point. We may be out of business,” he said.

December sales boost

In some areas of the country, winter weather has been partially responsible for increased sales. One operator commented: “The early winter weather in the Northeast this year is keeping customers on location to make purchases from our micro markets and vending machines rather than braving the cold and the snow to go out to lunch. This increase in volume will help offset the typical decrease in sales we see during the holiday season due to client shutdowns.”

Operators have also increased the training of staff. An operator based in New York claims customers seek out better service more now than they did before. “A ‘street-level’ service and attention to detail are keys to success,” he said.

An operator in Georgia added, “Our sales team and support staff are the best we have ever had. We have currently booked over $600,000 in new business for next year already. Technology and teamwork are our greatest assets moving into 2014.”

An office coffee service provider in Kentucky says his sales have rebounded completely from the recession. “Gross profit has improved and net profit has exceeded the previous three years,” he said. “Much of this was achieved through increased training for everyone in the company.

Micro Markets

Micro markets continue to be a strong segment in the industry. Over the fourth quarter 2013, the outlook for micro markets only dropped slightly before reaching 3.44 in December, three tenths higher than vending.

Micro markets continue to do well because the sales gain is significant. Markets appeal to a larger population within a workplace as well as allow for a higher price point. “I feel micro markets will continue to grow due to the fact it is the only way an operator can get the prices he needs and deserves - that he can't get out of traditional vending,“ explained a Kentucky operator.

Despite the positive outlook of micro markets, the percentage of markets across the industry is small when compared to vending machines. Not every location is large enough or secure enough for a market.

OCS

OCS continues to be the strongest industry performer. In December, the OCS outlook reached 3.78, above the 3.73 reported in September. OCS has been called recession proof and many operators report it is their best seller. “OCS sales are driving the bus,” explained an Illinois operator.

Vending

Vending is the only segment that has not shown any recovery over the quarter. Operators report the outlook to be 3.17, a 10 percent drop from September. The market is saturated with vending operators and machines aren’t bringing in new customers. “The last quarter of 2013 we are seeing our vending going flat,” said a Connecticut full-line operator.

Overall, how regulations affect the industry will be the item to watch in 2014. While some areas of the country are recovering more swiftly than others, vending remains flat. Micro markets and OCS show the most growth potential.

Methodology

The OCI is based on a monthly survey sent to the VendingMarketWatch Board of Operators and is sponsored by Mondelez International. The Operator Confidence Index is the first of its kind that tracks the level of confidence in the vending, micro market and office coffee service (OCS) industry and it is only available from VendingMarketWatch and Automatic Merchandiser.

If you are interested in joining the Board of Operators, please contact the publication editor.