OCS Survey: Customer Survey Notes Progress and Challenges for OCS

American consumers are largely aware that OCS provides them a convenience, but many do not know that it enhances productivity, and many believe they would purchase more from OCS providers if there were more specialty coffees available. In addition, most believe the quality of OCS coffee to be only average compared to coffee available from other sources.

These findings indicate that the OCS industry has made American consumers aware to a degree of the benefits it provides. But they also indicate that OCS operators could sell more coffee if consumers could be convinced they are receiving better quality coffee and more specialty options.

These are the results of the most comprehensive OCS consumer survey ever conducted. The survey was conducted by HarrisInteractive on behalf of the National Automatic Merchandising Association. The main objectives of the study were to understand the coffee drinking environment, to ascertain awareness and perceptions of OCS, to understand the OCS consumer, and to identify OCS growth opportunities.

The research was conducted in three phases, beginning with the employees who consume the beverages provided by their employer in the workplace. Consumers were asked why they use the office service, what keeps them there and what they'd like to see offered in the future.

The project also identified where consumers purchase similar products and services.

Besides OCS users, interviews were also conducted among the general population and account decision makers. A total of 3,232 U.S. adults 18 years of age or older were interviewed with a subset of 534 OCS users. The interviews were conducted from Sept. 6 to Sept. 13 in 2005.

Key findings of the survey

The key findings of the survey were as follows:

- A significant portion of office coffee drinkers do not know how they get the product.

- The OCS market is driven by perceptions of"convenience" and "price."

- Coffee purchased outside the office benefits from perceptions of "taste" and "quality."

- Almost half of OCS consumers never bring coffee to work.

- Consumers report that getting coffee from outside the office takes three times longer than from OCS.

- Most OCS consumers have not changed their coffee consumption habits due to caffeine concerns.

This survey marked the first attempt to quantify the savings that OCS provides over leaving the office to bring coffee back. The survey found consumers spend more than three times as much time away from the office if they leave the office for coffee, indicated in chart 7.

Key selling point remains worker productivity

This indicates that the time savings offered by OCS increases in proportion to the number of coffee drinkers in the office. For offices interested in maximizing employee productivity, this figure provides a strong selling point.

This finding is consistent with other parts of the survey confirming the key benefit that OCS provides: convenience.

When asked to describe the benefits that OCS provides, more consumers mentioned convenience factors than any other type of factors, as indicated in chart 17.

In recent years, however, OCS operators have faced rising competition from consumers who seek coffee more on the basis of product quality than on price or convenience.

OCS Still has a big selling job to do

While the findings indicate that the OCS industry has done a reasonable job educating consumers about the convenience it offers, the survey also found that the general public does not fully recognize the fact that OCS improves worker productivity.

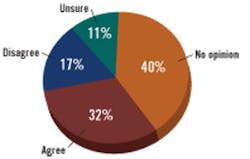

Forty percent of consumers have no opinion on whether or not coffee supplied in the workplace has any bearing on productivity, as shown in chart 1. While more than twice as many people agree (32 percent) than disagree (17 percent) that coffee enhances productivity.

OCS consumers, for their part, fully understand the benefit OCS has on their productivity, as indicated in chart 12. Close to 80 percent of OCS consumers believe the service improves their productivity, and as many said it affects their view of their employer's commitment to employees. This represents a significant selling point to potential OCS decision makers.

Retail competitors market quality

The OCS industry still has a strong selling job ahead of it in communicating the quality of the products it sells. While the industry has done a good job in recent years of marketing higher pack weights and charging more for better quality products, as measured by the Automatic Merchandiser State of the Coffee Service Report, the NAMA survey indicated that only 14 percent of OCS consumers drink the coffee because of quality. The leading reason for drinking OCS coffee, far and away, is convenience.

This is an important challenge, given the fact that the OCS industry's competitors are marketing high-quality coffee more aggressively.

Specialty coffee chains such as Starbucks began luring coffee drinkers with high-priced coffee several years ago. Since then, convenience stores, gas stations, delis, fast food restaurants and even membership warehouse clubs have jumped on the specialty coffee bandwagon.

The survey indicated that more than half of all coffee is consumed at home. While the OCS industry holds a leading position in the 48 percent of the market that is consumed outside the home (OCS accounts for 37 percent of this market), several competing channels are not far behind.

Convenience stores and gas stations combined account for the same percent as OCS operators, as indicated in chart 5.

Survey indicates an opportunity to win more sales

The leading reason people bring coffee in from outside the office, cited by 34 percent of respondents, is they want coffee before they get to work, as indicated in chart 6. The second leading reason, cited by 26 percent of the consumers, is that they seek different types of coffee that are not available at the office.

This indicates an opportunity for OCS operators to capture a bigger share of the at-work coffee market. In addition, 12 percent said they prefer the taste of products not available at the office.

These results are consistent with the 2005 National Coffee Drinking Trends survey from the New York City-based National Coffee Association, another consumer survey. The NCA survey, based on telephone interviews with consumers nationwide, found an 11 percent jump in out-of-home coffee consumption from 2003 to 2004. The NCA survey noted that while there was a gain in out-of-home sales, more people were getting their coffee outside the office.

Automatic Merchandiser noted in its 2005 State of the Coffee Service Industry Report that based on the NCA study, OCS operators were not responding to the demand for high-quality coffee as fast as their retail competitors.

OCS Still has opportunity in specialty coffee

The NAMA/HarrisInteractive survey indicated that only a quarter of OCS consumers have specialty coffee available at their workplace, indicated in chart 8A. Hence, despite the fact that single-cup brewing systems have increased significantly in recent years, most OCS consumers still do not have access to them. This finding represents a major growth opportunity for the OCS industry.

While 56 percent of consumers said the availability of specialty coffee would not increase their OCS consumption, the balance would nevertheless result in a revenue gain for OCS operators.

As indicated in chart 9, most OCS consumers believe that additional features would increase OCS use; 53 percent said greater variety of flavors and blends would make a difference; 46 percent said the same for specialty equipment for espresso and cappuccino; and 21 percent said the same for single-cup systems.

Among those consumers with access to specialty coffee products, the majority use these features, as indicated in chart 10.

OCS Consumers like specialty coffee

Satisfaction levels with existing specialty equipment was overall high among OCS consumers, as indicated in chart 11. This reflects the increasing capability of much of the single-cup equipment in recent years. Single-cup manufacturers have offered new and improved models capable of offering an increasing variety of product.

Opportunities for selling more specialty coffee will vary by individual market. White collar accounts tend to be more receptive to specialty coffee than blue collar ones, although blue collar consumers are also consuming more specialty coffee.

OCS operators in markets where specialty retail stores are more established will also find a stronger response to specialty coffee options.

The most significant finding of all, perhaps, is the comparative perception of OCS coffee quality versus the quality of coffee available elsewhere, as indicated in charts 14, 15 and 16.

Consumers were almost evenly split on whether they agreed that OCS quality is the same as the quality of other coffee. The overwhelming majority, about 70 percent, ranked OCS quality as average.

If more consumers ranked OCS quality as above average, there is a strong possibility that they would patronize OCS more than its competing providers.

The survey indicates that the OCS industry has done a good selling job communicating its initial consumer benefit: convenience. While many industry observers recognize there are new challenges to address in today's changing coffee market, OCS operators also need to realize that a significant portion of U.S. workers (20 percent) remain unaware of the fact that OCS provides an important convenience, as indicated in chart 3.

Also important is the fact that a larger portion (57 percent) either don't know or don't believe that OCS improves worker productivity. OCS operators need to continue to communicate both of these benefits — the advantages of convenience and improved worker productivity — to improve their overall sales.

OCS Operators can use the survey as a marketing tool

The survey also indicates a need to convince consumers that OCS offers coffee that is high in quality compared to other outlets. A key strategy is to introduce more advanced coffee dispensing systems that can provide higher quality product and more variety.

The NAMA/HarrisInteractive survey itself offers a selling tool for OCS operators to use to convince account decision makers of the benefits they provide. The survey quantifies higher levels of worker productivity for locations that have OCS, and higher levels of satisfaction among consumers who have access to state-of-the-art coffee systems.

OCS operators also need to consider the demands of their specific customer base. As already noted, the importance of specialty coffee will be stronger in markets where specialty coffee stores are commonplace.

OCS must communicate emotional awards better

OCS operators also need to move perceptions of OCS beyond the rational benefits to also include more emotional rewards. This requires marketing all of the benefits that the account receives to the account decision makers. OCS marketing efforts need to be more professional in order to accomplish this.

To receive the complete survey, contact NAMA at 312-346-0370.

Chart 7: How long it takes to get coffee at work versus outside of work

At work 4.6 minutes

Outside work 14.9 minutes

Chart 9: additional features would increase ocs use

Variety of flavors and blends of coffee 53%

Specialty equipment for espresso and cappuccino 46%

Single-cup brewing system 21%

Chart 12: How OCS affects perception of performance and employer

OCS enhances productivity 79%

OCS indicates employer cares 79%

OCS indicates a succesful employee 57%

Chart 17: How consumers view OCS coffee's key benefits

No benefits in particular 41%

Convenience 38%

Price 25%

Coffee description 12%

Convenience factors (net 38%)

Easy/convenient 21%

Fast/quick 6%

No chance to leave building 4%

Availability 4%

Saves time 4%

Good taste or flavor 4%

Easy access 3%

Price factors (Net 25%)

Free 19%

Reasonable price 5%

Coffee description factors (Net 12%)

Fresh 5%

Hot 3%