Editor's Note: Click here to download the State of the Vending Industry Report as a PDF.

Fiscal 2010 brought some relief to the vending industry as the recession that decimated sales in the previous two years grew less severe. While vending operators continued to lose sales on an aggregate basis, the dip in 2010 was mild compared to 2008 and 2009.

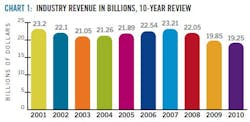

According to the Automatic Merchandiser State of the Vending Industry Report, aggregate vending sales fell 3 percentage points in 2010, taking the industry to $19.25 billion, the lowest level since 1994, which was $19.24 billion. The 3-point drop, however, was small compared to the aggregate 15-point fall from the prior two years.

The 18-point revenue loss in the last three years reflected the nation’s overall employment loss, which affected every sector of the U.S. economy. The nation’s unemployment rate since the recession began in late 2007 reached a high point of 10 percent in the fourth quarter of 2009 before falling to 8.8 percent in the fourth quarter of 2010.

While employment improved in 2010, it remained at a historically low level. The employment gain in 2010 did not significantly reverse the downward trend of the prior two years.

High joblessness not only reduced the number of vending customers. It also hurt the willingness of consumers to spend money.

On the upside, many vending operators noted high unemployment delivered a more dedicated work force to their companies.

Operators also noticed fewer operators in the business. But they were reluctant to cite this as a benefit since the level of competition remained high. Many operators believed the increasing level of investment required for vending reduced the number of players, but the existing players became more formidable.

The State of the Vending Industry Report tracked a decline in the number of medium size operators ($1 million to $4.9 million in annual sales) in recent years. This trend continued in 2010. In 2010, the number of large operators ($5 million to $9.9 million) also declined while the number of small operators (under $1 million) increased. The number of extra large operators remained the same in 2010, but their share of industry sales increased.

Vending operators enacted profit saving measures in response to lower sales to minimize the recession’s impact on their bottom lines. While the State of the Vending Industry Report does not measure profitability, the National Automatic Merchandising Association (NAMA) profit report indicated operator profits improved during the recession.

The NAMA profit report found that the pre-tax profit margin for a “typical” firm doing more than $2 million in sales improved for the third straight year in 2010. Pre-tax profit was 2.4 percent in 2010 compared to 1.5 percent in 2009 and 0.5 percent in 2008.

Operators continue profit protection

The State of the Vending Industry Report found operators continued many of the profit protection measures they enacted in 2008 and 2009, indicated in chart 6.

Operators enacted fewer layoffs in 2010 than in either of the previous two years.

More operators reported raising prices in 2010 than in either of the previous two years, also indicated in chart 6. The recession spurred more frequent price increases than any time sinceAutomatic Merchandiser began tracking vend prices.

Operators interviewed at random agreed that competition among operators limited their ability to raise prices.

Operators agreed that higher prices in other retail outlets made it easier to raise their own prices. However, the price increases did not fully compensate for higher operating costs.

Reflecting operators’ limitations in managing higher costs, more operators simply absorbed extra costs in 2010 than either of the prior two years, indicated in chart 6. Absorbing extra costs has been cited as the second most common strategy for handling higher costs in each of the last three years.

Reducing service frequency and rearranging delivery routes were the next most common cost management measures in 2010.

Lowering commissions jumped from the eighth most common cost handling strategy in 2009 to number six in 2010.

Cost increases continued in health insurance, vehicle expenses, taxes, payroll and workers compensation.

Regulatory challenges increase

Additional challenges emerged on the regulatory front in 2010, the most significant being mandatory calorie disclosure. The federal health care reform act signed by President Obama requires vending operators with 20 or more machines to post calorie counts at the point of sale. The law is not scheduled to take effect until 2012, and the U.S. Food and Drug Administration is not expected to release specific requirements until later in 2011.

In the meantime, more states, schools and local governments continued to propose nutrition restrictions on vend products in 2010. Many proposals only applied to government accounts, although some were directed at the private sector as well.

Support grows for ‘healthy’ items

Government initiatives notwithstanding, vending operators observed growing interest among account decision makers in “better for you” products. While operators have long observed that meeting these requests results in lower sales, the performance of products associated with health and wellness posted a better showing than in the past, indicated in chart 14B.

Improved sales for healthy products was most evident in the candy/snack segment, which has the largest product variety.

Other government mandates made headlines in 2010.

The U.S. Justice Department announced lower reach requirements for vending machines accessible to the public. The requirements are scheduled to take effect in 2012. They call for different accessibility standards than are found in most existing machines. At the present time, NAMA is trying to get the federal government to change the requirements for vending operators.

Oil rig disaster impacts gulf coast

The Deepwater Horizon rig that exploded in the Gulf of Mexico in April of 2010 disrupted Gulf Coast tourism. The economic fallout from this disaster mainly affected Gulf Coast businesses. The rescue effort compensated for some of the loss.

One factor benefiting overall U.S. employment in 2010 was the automotive sector, which reversed the downward spiral of the prior four years. After falling 44.7 percentage points from 2006 through 2009, North American auto production rose 39.6 points in 2010, according to the Detroit, Mich.-based Automotive Information Center. Besides adding more workers to the automotive factories, the increase benefited sales for automotive suppliers and dealers.

The auto industry’s improvement was not enough to offset the continued decline of manufacturing as a share of vending locations, indicated in chart 3.

For the first time in the vending industry’s history, in 2010, office accounts represented the largest single customer segment of vending locations, indicated in chart 3, ending the historic dominance of manufacturing accounts. This quantifies the vending industry’s need to upgrade its offerings to serve a customer that has more meal and refreshment options.

Investment in technology grows

Investment in new technology increased in 2010, continuing a trend that became evident in 2008, indicated in chart 10. Whether the recession has hampered or hastened this investment is a matter of debate.

Those interested in investing in technology were helped by low borrowing rates as the Federal Reserve Bank tried to keep inflation in check.

Operators who invested in technology noted that the introduction of cashless readers and bill recyclers facilitated sales of higher priced products. Hence, some operators reported these technologies made higher prices more acceptable to customers.

Some operators also noted that the introduction of new technology minimized the importance of product price in the machine to the customer. Hence, technology supported the vending industry’s efforts to “de-commoditize” itself.

NAMA introduced a cashless program in 2010 designed to encourage more operators to invest in cashless technology.

In addition to cashless transactions, wireless reporting hardware and bill recyclers, technologies that gained visibility in 2010 included “pick to light” warehouse picking systems that support pre-kitting routes in the warehouse.

Vending lags retail again

Vending operators once again were forced to compete against retail channels that faced less bottom line pressure in 2010.

Vending sales underperformed foodservice in general. Where vending lost 3 percentage points in 2010, foodservice in general lost only 0.2 percent of sales in inflation adjusted terms, according to the National Restaurant Association.

The foodservice industry’s minor sales loss in 2010 followed its worst year ever in 2009, when it fell 2.9 points.

Business and industry (B&I) foodservice sales, however, underperformed vending in 2010. Technomic, a research firm which tracks foodservice industry sales, reported that B&I foodservice suffered a 4.6 percentage point sales loss in 2010. This loss was less than half the 10-point loss reported for this segment in 2009.

Convenience stores, which many vending operators view as their biggest competitors, posted a 4.4 point sales gain in 2010, according to the National Association of Convenience Stores.

The AM State of the Vending Industry Report is based on returned email questionnaires sent to more than 9,000 operators in the magazine’s subscription list, which generated a 15 percent response.

Following is a summary of the main product segments.

Cold beverages regain ground

In 2010, the cold beverage vending segment recovered some of the volume lost in the prior two years, driven by a mild resurgence the category experienced in all retail outlets.

Cold beverages was one of three vend product segments to gain revenue in 2010, the other two being OCS and ice cream, indicated in chart 12b.

The Beverage Marketing Corp. (BMC), which tracks beverage sales in retail outlets, reported the U.S. refreshment beverage market grew by 1.2 percent in 2010, reversing the declines of the previous two years. BMC noted that non-carbonated beverages played a big role in the comeback.

Beverages such as ready-to-drink (RTD) tea and coffee, sports beverages and energy drinks displayed particular vibrancy during 2010, while larger, more established segments such as carbonated soft drinks and fruit beverages failed to grow, BMC reported.

RTD tea led all beverage segments in 2010 with a 12.5 percent volume gain, followed by sports drinks (9.4 percent), ready-to-drink coffee (8.1 percent), energy drinks (5.4 percent) bottled water (3.5 percent), value-added water (0.2 percent), fruit beverages (-2 percent), and carbonated beverages (-0.8 percent), according to BMC.

The 1.58-point gain reported for cold drink vending sales in the AM State of the Vending Industry Report in 2010 hardly compensated for the losses suffered in 2008 and 2009. In addition to the loss caused by the first two years of the recession, vending operators were forced to remove soda, their top selling beverage, from many schools and government accounts due to health concerns.

Vending operators attempted to compensate for this setback by raising prices, indicated in chart 13C. Extra large operators were especially involved driving up the average prices in this category.

Cold drink machines rebound

The cold beverage revenue gain in 2010 was also due to the fact that operators placed more cold beverage machines in 2010, reversing a 5-year trend. Bottlers and vendors began pulling machines in 2006 and continued doing so through the recession beginning in late 2007. The decline in machines of the previous five years appears to have bottomed out in 2010.

Also contributing to the 1.58-point cold drink revenue gain in 2010 was the fact that glassfront machines continued to expand.

While the rate of glassfront expansion slowed during the recession, and more so in 2010 than in the prior two years, these machines enabled operators to boost individual location sales by 30 percent on average.

Glassfront machines allowed vending operators to offer a greater variety of products, giving them the means to serve the more diverse customer demand that characterizes modern consumption habits.

A successful cold beverage strategy in many vending locations was to have a closed front machine for the high volume sellers (such as soda) along with a glassfront machine for the secondary ones.

Energy drinks command highest prices

Energy drinks were the highest priced cold beverages in vending, with price points typically above $2. While these were not high volume sellers, vending operators found that having such a high price in the machine helped condition customers to accept higher prices for other products.

Vending operators noted energy drinks carried a high level of brand loyalty. Customers who preferred one brand were not likely to buy an alternative.

Operators found product level management software particularly helpful managing a large variety of beverages.

Hence, technologically savvy operators were able to utilize glassfront machines more effectively than less technologically sophisticated operators.

Cans continue to gain on bottles

Cans continued to gain at the expense of PET bottles in 2010, continuing a trend from the previous years, indicated in chart 13B. Many operators noted that as customers became more price conscious during the recession, more opted to buy the lower price cans.

Some operators noted that container deposit fees did not apply to cans as much as bottles.

Beverage Digest, a beverage industry newsletter, reported that aluminum cans posted a 0.2 percent shipment gain in 2010, the first growth in can shipments since 2006. Can shipments had been declining since 1994, the newsletter reported.

At the same time, vending operators noted that beverage manufacturers continued to market 20-ounce bottles aggressively, and most operators did not expect cans to make a significant comeback.

Vending operators also noted that bottles delivered a higher monetary profit than cans, even if the profit percentage on cans was sometimes higher.

Candy, snacks and confections fall

The candy, snack and confection segment continued to lose volume in 2010, despite continued price increases in the top 20 selling items, indicated in chart 14E. The decline in the number of candy, snack and confection machines leveled off in 2010, indicated in chart 14A.

Management Science Associates (MSA), which tracks line item revenue and unit sales in this vending segment, indicated unit sales posted a bigger decline than dollar sales in 2010. This explains why the segment continued to lose volume despite price increases and no change in machine placements.

This marked the second consecutive year vending operators raised prices in the candy, snack and confection segment. Most product manufacturers did not raise prices in this segment in 2010, making it the second year operators were able to make up for the manufacturer price increases in the previous three years.

Operators did not raise prices as much on their top 20 selling candy, snack and confection products in 2010 as 2009. Chart 14E indicates the 2010 price increases were less on a percentage basis for all but two of the top selling 20 items.

Candy lost market share to snacks in 2010, continuing a trend from the previous four years. However, in each of the last two years, the loss was less on a percentage basis. This indicates the decline in candy could be bottoming out.

Candy products continued to lag snacks among the products gaining the most distribution in 2010, indicated in chart 14F. However, candy items improved their performance in this area for the second straight year.

While none of the top 15 products that gained placement were candy products in 2008, two candy products made the list in 2009 and four made it in 2010.

The most notable change in 2010 was the increase in nutrition snacks, which include breakfast bars, cereal, fruit snacks, functional bars, nutritional pretzels, granola bars, rice cakes and trail mix, indicated in chart 14C. This continued a trend from 2009, but in 2010 the gain was much larger (7.7 points in revenue sales and 4.4 points in unit sales). Nutrition snacks was also the only snack category other than food snacks to post a volume gain in 2010.

The increase in nutrition snacks was driven by a 17.6 point gain in the number of these items stocked in 2010, indicated in chart 14C. Nutrition snacks posted the largest number of items added in 2010 and was one of only two categories to register an increase, the other being salted snacks, which posted a 0.7 point gain.

Hot beverages fall again

Hot beverage vending continued to decline in 2010 despite a vibrant retail coffee market. Hot beverage vending has been unable to participate in the general growth of coffee consumption due to unfavorable economics (fewer locations are large enough to support the investment in hot drink machines) and the inability of vending operators to change the public’s negative view of vended coffee.

Hot beverage machines were historically concentrated in industrial, blue collar work sites. As the industrial manufacturing customer base declined in recent years, vending operators began removing hot beverage machines. This continued in 2010, indicated in chart 15A.

Another reason for the decline of hot beverage vending was the growth in OCS.

Vending operators expanded into OCS in recent years in response to a customer base favoring white collar accounts. OCS surpassed hot beverage vending in 2007 as a percent of total vending industry sales.

OCS posted the largest 1-year sales gain among all segments in 2010, indicated in chart 12.

The unfavorable economics of hot drink vending became more challenging in 2010 as coffee roasters increased prices due to rising commodity prices. Vending operators failed to raise hot beverage prices in 2010, indicated in chart 15D, despite price increases announced by competing retail channels. Hot drink prices remained flat, the exceptions being fresh-brew specialty/flavored coffee and hot chocolate, which were small categories.

Vending operators active in OCS raised OCS prices more frequently than hot beverage vending prices in 2010, indicated in chart 7.

The failure of vending operators to raise prices in a segment that witnessed price increases in other retail outlets reflected its low value perception.

Vending operators observed that customer perception of hot beverage vending remained poor due to low quality product compared to coffee available in other retail outlets.

In 2010, Starbucks Corp. partnered with Crane Merchandising Systems to introduce a Seattle’s Best Coffee branded machine designed to change this perception, marking a commitment by a specialty coffee roaster to the vending channel.

The recession has created an opportunity for hot beverage vending in some accounts seeking to eliminate OCS as a cost saving measure. But due to the high investment needed to place and service a hot beverage machine, the opportunity was limited to accounts large enough to support the investment.

Food remains challenged

While the loss in vend food sales was not as severe in 2010 as 2009, it nonetheless suffered the largest segment decline besides cigarettes, a negligible business, indicated in chart 12.

Vend food, like hot beverage vending, has been severely hurt by the decline in the nation’s blue collar manufacturing segment.

Operators did not raise prices in this segment in 2010 as much as in 2009. This negatively impacted the segment’s profitability in light of the jump in wholesale food prices in 2010. The National Restaurant Association reported wholesale food prices rose 5 points in 2010, which more than offset a 3.8-point drop in 2009.

The most positive development for food vending in 2010 was that a decline in frozen food machines, first reported in 2008, reversed. Frozen food machine placements declined in both 2008 and 2009.

Frozen food machines, which allow vending operators to provide food to customers more economically than refrigerated food machines, increased consistently since they were introduced in the mid 1990s up until 2008.

Frozen food machines required less frequent service than the more common refrigerated machines and have nearly zero product waste.

The reversal of the 2-year decline in frozen food machines in 2010 indicated that account downsizing, which Automatic Merchandiser cited as the cause of fewer frozen machines in 2008 and 2009, leveled off in 2010.

Refrigerated food machines, which have a larger market presence than frozen machines, continued to decline in 2010.

In response to the decline of refrigerated and frozen food machines since 2008, more operators began offering food in ambient machines, indicated in chart 16A. Operators were able to utilize ambient machines for food due to the introduction of shelf stable lunch kits.

Operators used more shelf stable food in 2010, indicated in chart 16B.

There was also a slight gain in the amount of non-food offerings in food machines, reflecting the need to reduce costs and waste.

Integrated food systems, while never a big market, suffered a hefty loss in placements in 2010 due to the liquidation of a major operator of these systems. Integrated food systems are machines that heat and serve pre-cooked meals.

Milk keeps falling

Milk sales fell for the third straight year in 2010, largely due to the continued decline in refrigerated food machines, which carried most vended milk. The loss was also driven by a continuous reduction in dedicated milk machines, indicated in chart 17B.

Refrigerated food machines and dedicated milk machines were historically placed in industrial accounts which have diminished steadily in recent years.

Aggressive marketing by dairy organizations in the mid 1990s did not sustain milk sales.

Some state and regional milk initiatives continued in 2010, but the nationwide initiative subsided in 2009.

Total retail milk sales suffered in 2010, reversing gains in the previous two years.

Annual estimated total fluid milk sales declined by 1.4 percent in 2010, according to the U.S. Department of Agriculture’s Agricultural Marketing Service (AMS). This was the worst annual decline since AMS began publishing the monthly data in 2000. Previously, the largest annual decline in fluid milk sales reported by AMS was a 1.01 percent decline in 2004.

Some vending operators reported success offering milk in schools since many school districts removed soda and other beverages. However, acceptance by schools was not uniform since school foodservice directors remained divided over milk’s nutritional benefits, especially flavored milk.

Milk nonetheless remained a staple in many cold food machines. Many vending operators found milk a good substitute product where they wanted to reduce cold food offerings due to declining food sales.

Ice cream revives

Ice cream sales posted one of its best showings in 2010, building on a trend that began in 2009. Ice cream posted the largest segment gain of any category other than OCS in 2010. The gains in the last two years nearly returned the segment to its 2007 level, indicated in chart 18B.

The gain in 2010 was driven in large measure by operators moving more of the offerings in frozen machines from frozen food to ice cream. In 2010, the number of frozen machines increased, as noted in the discussion on frozen food sales.

2011: Outlook mixed

Vending operators reported stronger sales in the fourth quarter of 2010 continuing into 2011. Economists claimed the nation was recovering from the recession, but signs were mixed.

Consumer confidence, which reflects consumer willingness to spend money, steadily increased from the fourth quarter of 2010 through April of 2011, according to the Conference Board, an organization that tracks consumer spending.

Food and fuel prices began rising at a rapid pace in the first quarter of 2011, threatening to undermine any gains in consumer confidence.

Vending operators continue to invest in new technologies in order to improve their operating efficiencies. The new technologies also give operators a better understanding of product costs, which have become a bigger challenge.