View the full article

complete with charts in PDF format

Automatic merchandising has often been described as a bellwether industry for the U.S. economy. When the economy is strong, vending and coffee service thrive as employers rely on refreshment service providers to sustain employee productivity. When the economy suffers, so does demand for refreshments in the work place.

The recession that began in 2007 and got progressively worse through 2008 has been described by many as a depression, with unemployment rising to unusual highs, consumer confidence hitting record lows and, as of August 2009, little sign of improvement.

Automatic merchandising, which never fully recovered from the “dotcom” implosion of the late 1990s, suffered heftier doses of work site downsizing, rising costs, consumer resistance to higher prices, and limited growth opportunities. The “mortgage meltdown” that struck in September of 2008 chipped the financial foundations of hundreds of thousands of businesses, spurring layoffs in almost all industries.

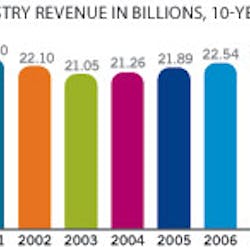

Automatic merchandising revenues slid 5 percentage points in 2008, ending a 4-year growth trend and returning to the 2003 level of $22.05 billion, according to the 2009 Automatic Merchandiser State of the Vending Industry Report, which is based on an online survey. The biggest losses came in the second half of 2008, as the unemployment gradually rose, hitting 7.2 percent in December.

By November of 2008, more than 1.9 million jobs had been lost and consumer confidence fell to record lows. The 7.2 percent unemployment in December of 2008 marked a significant 1-year change in national employment. Job losses were broad-based, with the manufacturing, construction, retail, financial service and business service sectors posting substantial declines. Only the health care and government sectors added jobs.

Vending losses were largely due to work site downsizing, which vending operators themselves were forced to do in their own operations to protect their profitability.

VENDING FACES ONGOING CHALLENGES

The rising unemployment and fallout in consumer confidence which gripped many industries in 2008 contributed to some larger challenges that the vending industry has struggled with for decades. Namely, the shifting of the nation’s work force from blue collar industrial jobs to white collar and “pink collar” service jobs.

Some observers claim negative consumer perception of vending prevented operators from capitalizing on a “trading down” trend that convenience stores and, to a lesser extent, fast food restaurants were able to do in 2008.

Consumers, in order to reduce expenditures, bought more food and refreshments at convenience stores and fast food restaurants rather than full-serve restaurants to save money. Data from food industry associations confirms that convenience stores and fast feeders outperformed the overall foodservice industry, which had one of its weakest years in 2008 with a 3.3 percentage point revenue growth, according to the National Restaurant Association (NRA).

Fast food restaurants, a competitive channel for vending and onsite foodservice, posted a 4.4 percent sales gain in 2008, outpacing the overall foodservice industry. The NRA noted that on an inflation-adjusted bases, fast food sales were flat, posting their weakest performance since 2002.

Convenience stores outperformed all other foodservice sectors in 2008, boosting sales by 8.1 percentage points, according to the National Association of Convenience Stores (NACS).

While many vending operators believe their industry’s long-term challenges are more serious than the current recession, a widespread consumer reluctance to spend money in all retail outlets certainly contributed to vending sales declines in 2008.

OPERATORS RESPOND IN VARIOUS WAYS

Vending operators responded to the challenge with a variety of actions, as indicated in chart 6, the most frequent being raising prices. Fiscal 2008 witnessed the second consecutive year of aggressive price increases. In 2008, operators raised prices in all product segments, as indicated in the charts in this report.

Operators noted that raising prices in 2008 was less difficult than in prior years since customers recognized food prices were rising in other retail channels. Wholesale food prices rose 8 percent in 2008 following a 7.6 percent rise in 2007, according to the NRA, marking the largest 1-year gain in three decades.

Many operators found it helped to provide customers notices of price increases from product manufacturers. In the case of coffee price increases, operators could provide copies of newspaper reports about these increases.

While operators found it easier to convince account decision makers to let them raise prices in 2008 than in previous years, consumers — the end users — were not as accepting of the increases, even when similar products were priced higher in other retail channels. Most operators noticed that higher prices usually resulted in lower sales for several weeks and longer.

In addition, the price increases were far from enough to make up for the decline in population counts. Operators were limited by competition and consumer “buying angst” from raising prices to the levels at other retail channels.

Aside from raising prices, the second most frequent profit protective measure for vending operators in 2008 was to absorb the higher costs, as indicated in chart 6. This hurt profitability. The impact of higher operating expenses on profitability in 2008 was measured in the National Automatic Merchandising Association (NAMA) Operating Ratio Report. (See page 6).

The pressure on profitability once again compromised operators’ efforts to invest in technology that theoretically will improve profitability. The survey once again reported few operators invested in cashless readers, remote machine monitoring (RMM) and bill recyclers, although there was an increase over 2007 in some areas, as indicated

in chart 9.

Among the new payment technologies available, more operators reported installing bill recyclers than RMM or card readers. Bill recyclers represent a much less costly investment than the other options. But the level of activity in this area, 25 percent, was slightly less than in the previous year, indicating reluctance to invest in technology.

Investment in RMM increased in 2008. This was most likely due to the fact that RMM is a technology that supports both pre-kitting and dynamic routing. Pre-kitting and dynamic routing result in more efficient servicing, which took on greater importance to many operators in 2008.

MORE STAFF CHANGES

More than half of all operators either added or reduced staff in 2008, shown in chart 4A, with more reducing (39.7 percent) than adding (23.5 percent). Consistent with the routing changes noted above, the most common area of staff reduction was in deliveries, cited by 63.5 percent who reduced staff, followed by office staff reductions cited by 21.1 percent.

OPERATORS SEEK DIVERSIFICATION

More than a fifth of the respondents (21 percent) expanded into new services in 2008, and the results indicate that much of this activity was outside of the refreshment services area. When asked which areas they expanded into, 44 percent cited “other” areas versus businesses within refreshment services, as shown in chart 8B. The most common refreshment service field mentioned was OCS, cited by 24 percent of the respondents.

Health and wellness continued to be an important consumer issue in 2008, but consumer research indicated that the recession dampened its importance due to heightened concerns about saving money. Schools and government agencies continued to enact nutrition restrictions, and while these do not represent major amounts

of business for most operators, the restrictions continued to hurt sales.

In August of 2008, California became the first state to mandate nutrition rules for school vending machines.

The only product with a strong “better for you” association that drove sales in 2008 was bottled water, which has been growing for years. In 2008, state and local governments began considering taxes on bottled water to reduce landfill wastes and protect water resources.

Following is a summary of the main product segments.

COLD DRINKS: CANS COME BACK

Vending operators unanimously agreed they faced a price barrier with 20-ounce bottles in 2008 and were unable to match the price points being charged by competing retail outlets. While chart 11C indicates that operators did make progress raising bottle prices, many complained that the increase did not match the higher costs that suppliers were charging.

The most notable change in the cold beverage segment in 2008 was the gain in cans’ share of sales, despite the fact that can prices remained flat. This marked the first market share gain for cans and the first decline for bottles in four years. The return to cans was more common among smaller vending operators who have less buying clout with product suppliers.

Most operators interviewed said that suppliers did not raise prices on cans as much as bottles. More importantly, they said cans gave them the opportunity to offer a lower priced product at a time when customers want to save money. Some operators said consumers realized a better value buying two 12-ounce cans than one 20-ounce bottle.

Some further noted that government agencies levied deposit fees on 20-ounce bottles that did not apply to cans.

The majority of operators did not make the switch to cans, however. Many noted that while the profit margin was better with cans on a percentage basis, the dollar margin was lower.

The survey indicated that cold beverage prices rose more than any product segment in 2008 except for candy and snacks. Cold beverages, being the largest single vend product segment next to manual foodservice, affected the overall revenue change more than any product segment in 2008.

COLD DRINK MACHINES DECLINE

For the first time ever, the total number of cold drink machines declined in 2008, reflecting operators’ efforts to protect profitability by eliminating unprofitable accounts. The decline in the number of machines, while not radical, contributed to the category’s negative growth in 2008.

One positive sign was that while total beverage machine counts fell, glassfront beverage machines increased in 2008, continuing a trend since these merchandisers were introduced in the mid 1990s. Glassfront machines allow operators to showcase more variety and thereby capitalize on the more diverse tastes that have driven the nation’s cold drink business in recent years.

While glassfront machines increase sales, some operators argue that on a per-machine basis, they are less profitable due to the higher level of servicing and product warehousing required. Many also note that only the latest glassfront models are mechanically reliable.

Another factor contributing to the decline in cold drink sales was the segment’s negative performance across all retail channels.

Beverage Digest, a beverage industry newsletter, reported that the total liquid refreshment business decreased in 2008 for the first time. The decline was 2.2 percentage points. Carbonated drinks, long the dominant segment, have fallen for several years, while growth in non-carbonated beverages prior to 2008 offset soda performance and generated overall growth for beverages in recent years.

Beverage Digest noted that the recession, along with other factors, caused consumers to reduce consumption of all liquid refreshments and switch to tap water. Other observers noted that the perceived environmental impact of single-serve bottled water contributed to this trend.

BOTTLED WATER SALES SLOW DOWN

Growth slowed in the once fast-growing single-serve bottled water business in 2008, accounting for 19.7 percent of liquid refreshment volume, compared to 19.3 percent in 2007, according to Beverage Digest.

Teas, juice drinks, sports drinks and shelf-stable dairy drinks were essentially flat over 2007, rising a collective 0.1 percentage point.

Even energy drinks, a small category that posted a 54.1 percentage point growth in 2007, rose only 4 points in 2008. Energy drinks are among the highest priced beverages that vending operators offer, commanding price points in excess of $2.00. The high price point is believed to have contributed to its slowdown in the current recession.

While some question the health benefits of diet soda, sports drinks and energy drinks, most of the health concerns have been directed at high calories and high-fructose corn syrup and artificial sweeteners, which are commonly associated with soda.

CANDY, SNACK AND CONFECTION PRICES RISE

The candy, snack and confection segment posted the biggest price increases among all vend product segments in 2008, driven by manufacturer price hikes. This segment nonetheless fared little better than vending as a whole in revenue performance, due to account downsizing, elimination of accounts and a move by many operators to replace certain items with lower priced products.

Candy in particular experienced some of the steepest manufacturer price increases for the third straight year in 2008. The government announced it was investigating some big chocolate manufacturers for price fixing early in the year. This did not stop some of these companies from raising prices again later in the year.

Many operators have long observed consumers resist candy price increases in vending machines due to the heavy price promotions in other retail outlets.

In 2008, many operators responded to the candy price increases by reducing candy facings and replacing them with snacks. In recent years, snack manufacturers have introduced more products that fit in candy spirals.

Fourteen of the top 15 placement gainers in 2008 were salty snacks and one was a cookie, as indicated in chart 12G.

CANDY SALES FALL FURTHER

This marked the third straight year that candy sales declined at the expense of snacks, as indicated in chart 12B, which is based on data provided by Management Science Associates Inc. (MSA). Candy sales declined 8.78 points in 2008, following a 1.39-point drop in 2007 and a 0.09-point drop in 2006.

In 2008, baked goods gained by double digits after losing volume in 2007. One reason the segment rose was that operators stocked more of these items in machines, indicated in chart 12C. This segment also benefitted from vending operators’ efforts to replace candy with less expensive offerings.

MSA reported that the number of candy items stocked in machines declined by 6.8 percentage points in 2008 while snacks and baked goods increased.

Some industry observers claimed that the move to reduce candy facings resulted in lower sales since candy products generate faster turns than many snacks.

Product manufacturers noted that the decline in candy facings was more common among smaller operators. Some claimed that product manufacturers were more flexible in their terms with larger operators.

Operators continued to increase placements of large size candy and snack packages in 2008 in order to raise prices in the machines, as indicated in chart 12D. Operators interviewed noted that large size snacks accounted for most of these premium size offerings, as opposed to large size confections.

Large size snacks could still be offered for less than $1.00 in many accounts, whereas large size confections could not. Many operators, facing a cost conscious consumer, did not feel confident about offering confections priced over $1.00. In addition, many operators were not convinced that a large consumer demand exists for large size confections.

“Nutrition snacks” declined in 2008, marking a reverse from the prior year, despite the finding that operators increased placements of these products, as indicated in chart 12C. This supports the finding that when the recession struck, consumers became less concerned about nutrition in favor of better pricing. Products that market nutrition typically carry a premium price point.

However, nuts and seeds, which were not categorized as “nutrition snacks” by MSA but nonetheless carry nutrition connotation, posted a slight market share gain, despite the fact operators stocked fewer of these items.

HOT BEVERAGES FALL AGAIN

Hot beverages posted one of the biggest declines in 2008, continuing a long-term trend that reflects the fallout of large industrial locations that have always been the mainstay of hot drink vending machines. Vending operators included this segment in their pricing increases — operators were especially confident about raising coffee prices due to the well publicized retail price increases of the major consumer brand coffees — but the downsizing in large industrial work sites impacted this segment’s sales more than any other factor in 2008.

The reduction in large work sites that are needed to support hot beverage machines, which are among the most expensive machines for operators to buy and maintain, has made it difficult for operators to invest in the newest hot beverage equipment with more attractive designs and, in some cases, more product variety than the older machines.

VEND FOOD STRUGGLES ON

Vend food sales suffered one of the biggest hits in 2008, continuing a long-term trend that, like hot beverage machines, has been driven by the decline in large work sites.

Vending operators posted some of their biggest price increases in the food segment, largely because the price points in this category are among the highest to begin with. But the price increases did not come close to compensating for the volume drop caused by lower work site populations and the elimination of machines.

Fiscal 2008 marked the first decrease in the number of frozen food machines. Since frozen machines were introduced in the mid 1990s, they have increased every year until 2008. These machines, which are oftentimes used as ice cream machines, eliminate food waste. Hence, they allow operators to provide food to locations that are not big enough to justify the service that refrigerated food requires.

The reduction in frozen food machines in 2008 reflects the impact of location downsizing.

Another factor was the removal of many of these machines from schools that no longer allowed ice cream due to nutrition restrictions.

Refrigerated machines continued to decline in 2008, sustaining a decades-long trend.

Frozen-prepared and shelf-stable food both gained slightly at the expense of freshly-prepared food in 2008, reflecting the reduction in in-house food preparation.

While commissaries have declined for several years due to the unfavorable economics of food vending, many of the larger operators continued to operate commissaries and still claim they are an important customer pleaser. Operators who can profitably manage commissaries claim they provide good quality food more economically than relying on frozen-prepared and shelf-stable food.

Commissaries also give operators the ability to meet customer requests faster.

COMPETING CHANNELS AFFECT FOOD SALES

Another factor contributing to the loss in food sales was the increasing competition from fast food restaurants and c-stores for meal purchases. Both fast feeders and c-stores aggressively promoted breakfast and lunch meals and invested in better quality and more variety and improved their value offerings.

C-stores have been driven by declines in tobacco and cigarette sales to capture more food and beverage sales and have succeeded in doing so, according to the National Association of Convenience Stores. C-store foodservice sales rose 7.7 points in 2008 while sales of prepared food rose 9.1 percent on a per-store basis.

Food manufacturers have noticed that c-store chains work more closely with them in point-of-sale marketing than vending operators.

MILK SALES TAKE A HIT

For the first time in several years, milk sales fell in 2008, largely due to the erosion of all types of machines that vend milk. Most vended milk is sold in refrigerated food machines as opposed to dedicated milk machines and cold drink machines, as indicated in chart 15A.

The number of dedicated milk machines declined in 2008. Most of these machines are in schools, amusement locations and industrial sites. The population fallout in many industrial sites made dedicated milk machines unprofitable.

Population drops in industrial sites also forced vending operators to remove many of the cold food machines that sold milk in these locations.

The percentage of milk sold in cold drink venders and dedicated milk machines both declined in 2008.

Vending operators included milk in their overall price increases in 2008, as indicated in chart 15C.

Up until 2008, vend milk sales rode the category’s overall growth which was driven in large measure by the milk industry’s aggressive advertising, which highlighted milk’s health benefits. The category overall continued to grow in 2008, according to the Beverage Marketing Corp. (BMC), which tracks beverage trends. BMC reported that milk volume in all retail outlets was essentially flat in 2008 and dollar sales rose by about 4 percentage points.

Milk has in recent years created a new business opportunity for vending operators in many school accounts since milk is not included in most school beverage vending contracts. However, milk is not as profitable as most other beverages and students are price sensitive, restricting the prices operators can charge.

The Milk Processor Education Program, an industry group that tracks milk vending in schools, reported a dip in milk availability in vending machines in secondary schools, from 24 percent in 2007 to 16 percent in 2008.

ICE CREAM SUFFERS

Ice cream, one of the smallest product segments in terms of sales volume, took the biggest hit of all categories measured in 2008. It was the only segment to post a double digit sales drop. The loss was largely driven by the reduction in frozen food machines, the first year this occurred since frozen food machines were introduced in the mid 1990s.

Much of the reduction in frozen food machines was driven by schools that banned ice cream due to nutrition rules.

Market research organizations have reported that the recession did not adversely affect overall ice cream consumption since it is considered a “comfort” food.

According to the International Dairy Foods Association Ice Cream Market Research Report, retail dollars sales of ice cream were flat in 2008, as compared to 2007, but were up for the other three categories of frozen desserts: frozen novelties, frozen yogurt and sherbet/sorbet/water ice. Frozen yogurt, which analysts have claimed has benefited from its health association, has not been available in vending distribution.

2009 CHALLENGES THE INDUSTRY MORE

While 2008 was one of the weaker years for automatic merchandising, 2009 does not promise any improvement, given the continuing increase in account downsizing and decrease in consumer confidence. National unemployment reached 9.5 percent in July of 2009, the highest rate since the 1980s. The employment situation is not expected to improve significantly in the near future.