The options for adding cashless vending have increased, and the quickening rate of adoption among operators raises some important questions. A key question is how soon the “tipping point” will arrive, that time when the offering has become prevalent enough that operators must consider using it for competitive reasons.

Industry observers hold different views on how close the “tipping point” is, but most agree that the rate of investment has picked up significantly this past year, the recession notwithstanding.

Industry observers estimate the number of vending machines equipped with “open” cashless readers at about 100,000 in the U.S.

Against a total universe of 5.3 million machines in the U.S., based on the Automatic Merchandiser State of the Vending Industry Report, about 1.8 percent of machines have “open” cashless capability. (The 2010 State of the Vending Industry Report noted

2.3 percent of machines in 2009 have cashless readers, but this figure included stored value, closed loop readers.)

The percent of installations may seem low, but cashless system providers estimate the number has nearly doubled in the last year alone.

Factors to consider

This article will examine the factors that vending operators should consider about expanding into “open” cashless vending. “Open” cashless refers to the ability to use credit and debit cards issued by financial institutions in vending machines.

Vending operator surveys have indicated that most operators recognize the benefits “open” cashless will bring to the vending industry. Surveys have also confirmed most believe that cashless will at some point be prevalent.

“Open” cashless is an evolving development. As more cashless readers are installed, operators are learning more about the locations, price points and operational support systems that work best.

In addition, the market continues to change in ways that affect operator success. Product price points continue to rise, and consumers are becoming more inclined to use credit and debit cards for smaller transactions.

Most of these developments support the case for cashless. However, “open” cashless is not an easy business to understand for persons not familiar with the way credit and bank debit transactions work.

One contributing factor to the increasing rate of investment is the National Automatic Merchandising Association (NAMA) cashless program, introduced this year, which is designed to offer favorable processing rates for cashless transactions. The NAMA cashless program is a networked end-to-end solution that is hardware neutral and works with qualified communication suppliers and card associations for payment reconciliation and account management.

The NAMA initiative has received a lot of interest, based on the number of visits to their cashless solution section of the NAMA Website.

The Website includes several pages that provide a good overview for operators who want to understand the different components of “open cashless.”

The NAMA Website features a cashless calculator designed to help operators determine if a cashless solution makes sense. The calculator requires operators to estimate what percent of all transactions will be cashless, what percent of incremental sales increase (if any) they anticipate, and what percent of cashless sales are likely to be divided between credit cards and debit cards. The calculator incorporates special discounted Visa interchange rates available through select cashless payment gateways that are available to NAMA members.

Based on these estimates, the calculator helps determine annual net incremental operating profit per machine.

The NAMA program represents a partnership with Bank of America Merchant Services (BAMS), one of the nation’s largest processors providing both card processing services for cashless transactions as well as business-related applications. The NAMA cashless solution takes advantage of incentive-based fees and rates available through qualified gateways, noted Prof. Michael Kasavana, the NAMA endowed Michigan State University professor who helped develop the program.

Cost-plus versus fixed

The NAMA program is one of several options vending operators have for expanding into “open cashless.”

The NAMA program uses a “cost-plus” business model, one of two business models available to vending operators. The “cost-plus” model separates the processing charges from the credit/debit card issuer’s transaction charges. The transaction charges vary based on vend price. The cost-plus model has the advantage of transparency, as there are no hidden costs.

The “fixed” business model, offered by USA Technologies Inc. and InOne Technology LLC, combines the processing charges with the credit/debit card issuer’s transaction charges into one monthly fee. The “fixed” model has the advantage of simplicity.

While the “cost-plus” model allows the operator to see the transaction charges in greater detail, both methods may require additional administrative work to reconcile machine-to-machine sales activities.

Industry observers not affiliated with either of these business models say that the difference in total cost (within a small range of average vend prices) may not be significant. The most significant cost involved in “open cashless” often is the interchange fees set by the card issuer (Visa, MasterCard, American Express and Discover) that the processor charges for each transaction.

The interchange fees may be significantly different if charged on an individual transaction basis. Operators can utilize the comparative rate charts available at the NAMA Website to analyze competitive offerings.

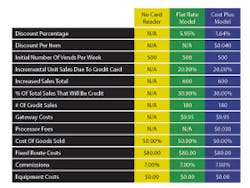

Brent Garson, president of Vendors Exchange International Inc., did a profit comparison using the fixed and cost-plus models. Garson, whose company does not market an “open” cashless product, considered all costs involved, as indicated in the illustration on page 14. Garson made certain assumptions regarding fixed route costs. He, like NAMA, assumes cashless will bring 20 percent incremental sales. Garson’s calculator, which is available at his company’s Website, allows the operator to do his own calculations by inputting his own cost and sales assumptions, similar to the NAMA calculator.

Garson calculated profit for 12 different vend prices using both the fixed and cost-plus models. He found that the fixed model indicates a slight profitable potential for price points under $1.50 than the cost-plus model. Thereafter, the cost-plus model is potentially more profitable.

Many operators may not regard the profit differentials between the two models in Garson’s analysis significant, depending upon the average vend price.

“The (interchange) rate is not the most important factor,” Garson said, regarding the profitability of a cashless vending transaction. “One percent here or there is not going to make or break this.”

More important to the operator’s profitability, he noted, is the sales lift and the amount of cannibalization of cash sales. “If there’s enough lift (and minimal cannibalization), it’s probably going to make sense,” Garson said.

Garson said the calculator is an important tool since it allows an operator to alter the numerous variables affecting profitability.

Interchange rate poses challenge

“The interchange rate (charged by the card issuers) is the biggest challenge to the rapid adoption of cashless vending,” said John Powell, a St. Louis, Mo.-based consultant who has worked to develop and implement a number of cashless vending systems. Given current interchange rates, Powell thinks the business case for cashless vending will be difficult to justify for machines with an average vend price below $1.75. This will be especially challenging for operators trying to implement cashless across a vend bank with different machine types and average vend prices.

Despite the fact that interchange fees have changed in recent years,

“I don’t think there’s been a substantial shift in the business case,” said Chris Mumford, a NAMA Knowledge Source Partner for Technology. “You can get too concerned about all the fee structures.”

Bob Donnelly, executive director of campus and community card solutions at Heartland Payment Systems, a cashless processor, said under the current business model, cashless makes more sense for vend prices of $1.25 and above.

Donnelly, who served as New England general manager at Betson Enterprises before joining Heartland in 2003, said he initially thought the point at which cashless will become “heated up” in vending is three to five years away, but the level of interest is rising so fast that he thinks that point in time could be sooner.

Mike Lawlor, senior vice president of sales and business development at USA Technologies Inc., thinks the 20 percent incremental sales lift is a low number. He said cashless will be profitable for any machine that can deliver $1,000 per year in cashless sales.

Verification and reconciliation

Verification and reconciliation of cashless sales is another issue for operators to consider. While this is not a complicated task, it requires attention to detail.

The cashless deposits, like cash collections, must be matched with the transaction reports.

The bank deposits the cashless funds into the operator’s account electronically. Because the relationship between the bank and the operator is a private matter, and the cashless service provider does not have access to that information, it is difficult to automatically merge cashless transaction data with the vendor’s route accountability software.

One aspect that might be confusing to operators is that some companies are playing more than one role in the cashless processing chain.

InOne Technology LLC is a vending software provider, a cashless hardware provider, a telemetry provider, and a cashless payment gateway. Gene Ostendorf, company president, said that while his company can provide all these roles, it can also provide the communication and gateway services for vending operators using other companies’ card swipes (Coinco and MEI).

Acting as a payment gateway, Ostendorf said his company offers a fixed rate model.

Ostendorf noted that his cashless product sales have increased 35 percent for the second straight year.

Cantaloupe Systems, a telemetry service provider, also acts as a cashless payment gateway in addition to being a hardware provider and telemetry provider. The company recently introduced its Seed cashless solution, which it offers to existing Seed customers.

Anant Agrawal, chief marketing officer at Cantaloupe, said he expects to offer operators different cashless processors on his company’s Seed telemetry platform. “Hopefully, this will open up the game for different processors to offer their services to our clients rather than locking them into only one option,” he said.

Cantaloupe’s telemetry fee at $6.00 per month is lower than the other gateway providers. However, this is only available to existing Cantaloupe customers.

Agrawal said given all of the costs involved, cashless makes the most sense for operators who are using telemetry for other purposes in addition to cashless.

Open cashless and prepaid cashless

One opportunity that has emerged from the establishment of cashless payment gateways is the ability of these gateways to support both “open” and “closed” cashless systems. The advent of “open” cashless payments in vending is viewed as an opportunity to make vending more popular to consumers. However, the fact that these gateways also support prepaid cashless presents an additional incentive to vending operators who may also want to offer stored value options.

Heartland Payment Systems, a card processor, has been marketing its prepaid cashless products to the vending industry for years.

Agrawal at Cantaloupe Systems noted that his Seed cashless program has already found the Heartland prepaid card offering successful.

Heartland has an online replenishment option for prepaid cards.

“It’s a great way to incent the consumer to use the card,” Agrawal said.

The Vend Marketing Institute coalition of vending operators has developed a host of product manufacturer sponsored promotions for a proprietary prepaid card supported by Heartland’s payment gateway. The Vend Marketing Institute has packaged a proprietary loyalty rewards card called “Sprout.”

A key benefit to the prepaid cards is there is no interchange fee. There is a fee for the card, typically $1 to $2, but the card can hold a lot of buying value on one card.

Another benefit is that unlike prepaid card systems that don’t replenish value via an Internet-based gateway, there is no revaluing station needed near the vending bank.

Other “open” cashless system providers also support prepaid cashless. (See article on page 20.)

As the rate of investment in cashless increases, vending operators will realize that more customers are being offered cashless options.

Vending operators must invest time in learning the credit/debit transaction process. They will also find it worthwhile to use the available calculators to determine if and when a cashless installation makes sense.

Fortunately, there are system suppliers available that are committed to help them succeed.