2012 Coffee Service Industry Report: Rebound continues for the second straight year

Last year, the headline was, “A new professionalism defines OCS.” This year, the Automatic Merchandiser State of the Coffee Service Industry Report confirms that a new professionalism has in fact taken hold, and OCS has established an identity as a service that American businesses understand and appreciate.

OCS has come of age. The products and delivery systems have evolved. Operators have learned through trial and error how to use these tools to provide an important service in the work place. One that enhances employee productivity.

This evolution, supported by the specialty coffee industry’s efforts in recent years to educate consumers to appreciate better quality coffee, has resulted an OCS industry capable of maintaining a healthy growth curve in a challenging economic environment.

The 12-month period ending June 2012 delivered the second consecutive 5-percentage point gain in OCS sales, according to the Automatic Merchandiser State of the Coffee Service Industry Report. In the last 24 months, OCS operators more than recovered the revenue they lost in the prior 24-month period caused by the recession. The 10 percentage point loss in the prior two years was caused by a fallout in worksite populations and massive budget cuts borne of business uncertainty.

The report is based on returned email surveys sent to more than 9,000 emails identified as OCS operators and vending operators with OCS in the Automatic Merchandiser database.

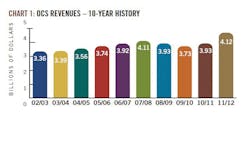

In the recent 12-month period, OCS sales reached a record $4.702 billion, surpassing the pre-recession level, indicated in chart 1. For the second consecutive year, the majority of operators reported higher sales than the prior year, indicated in chart 2.

Driving the growth once again was price increases. Operators overwhelmingly noted that customers were willing to pay more for better quality service, despite economic uncertainty.

The rising consumer appreciation of good coffee has benefited just about all retail coffee segments, including OCS.

Daily coffee consumption soared by 7 percentage points, moving coffee well ahead of soft drinks in 2012, according to the 2012 National Coffee Drinking Trends from the National Coffee Association (NCA). Total coffee jumped from 68 percent to 73 percent for past-week consumption and from 76 percent to 78 percent for past-year consumption.

Daily coffee consumption, long neck-and-neck with soft drinks, moved into a solid lead by more than 10 percentage points in 2012, NCA noted. Gourmet coffee consumption also grew, moving from 37 percent of all cups of coffee consumed in the U.S. in 2011 to 46 percent in 2012.

Price increases drive growth

In 2011/2012, for the second straight year, the majority of OCS operators reported raising prices, indicated in chart 4a. The number of operators raising prices was less in the recent 12-month period than the prior year, but a sizeable majority raised prices in both years.

A key difference in 2011/2012 was the OCS coffee price increases were less driven by manufacturer price increases. Coffee roasters raised prices in 2011, but in early 2012, national name brand roasters announced price decreases.

The retail coffee price decreases did not cause OCS operators to lower prices.

The fact that most OCS operators continued raise prices in 2012 demonstrates they have educated the customer base about the value of the service they provide. These price increases enabled OCS operators to recover some of the coffee margin erosion they suffered in recent years.

Another significant factor has been the customer’s growing appreciation of single-cup systems. In recent years, Green Mountain Coffee Roasters Inc., the nation’s leading single-cup player, made a major push into the consumer market. While some OCS operators viewed the move with suspicion, it has delivered a massive adoption of homeowner single-cup systems and greater appreciation of single-cup coffee.

Ownership of single-cup systems jumped to 10 percent from 7 percent in 2012, according to NCA, and 36 percent of those said they have owned their single-cup brewer for less than six months.

Perception of the quality of coffee from single-cup systems continued to improve in 2012, with 25 percent rating the brewers as “excellent” versus 15 percent who did so the prior year, according to NCA. By combining those who consider single-cup brewers as “excellent” and “very good,” 57 percent were positive in 2012 versus 45 percent in 2011.

OCS less affected by economic woes

The OCS industry has fared much better during the nation’s recession than the vending industry, which lost revenue every year since the recession began in late 2007. A key reason being that OCS sales do not rely on consumer confidence as much as vending sales do. The OCS buyer, unlike vending purchaser, is not the end user.

OCS sales are affected by employment levels. Fewer people in the work place translates into less demand for work place services such as OCS. In addition, employers scrutinized all their costs in an effort to improve their profitability. In some cases, they eliminated or reduced spending on OCS.

But as employment levels have improved in the past year, (the nation’s unemployment rate fell from a high of 10 percent in the first quarter of 2009 to a low of 8.1 percent in April 2012, rising to 8.2 percent in May and June), OCS has been quicker than vending to recover. As noted in the Automatic Merchandiser State of the Vending Industry Report, the employment gain did not benefit vending as much as some expected since many workers were less willing to spend money due to uncertainty about their employment security. This dynamic did not affect OCS for reasons stated above.

Another difference between vending and OCS is that the former service has a larger minimum population requirement. The fallout in large worksites has undermined vending far more than OCS.

Employer cost consciousness continues to restrain some employers from spending more on OCS. While many employers stopped cutting their payrolls in the last year, most have not restaffed to pre-recession levels. And while many employers want to provide OCS to improve the work environment, some companies have opted not to have OCS and other benefits until they are able to rehire more laid off employees.

OCS operators face higher costs

Chart 11 notes that more OCS operators were forced to absorb higher operating costs in 2011/2012 than any of the last four years.

On the positive side, fewer operators reduced staff this past year than any of the past four, indicated in chart 11a, and a 62 percent majority noted no staff changes.

In each of the last 12-month periods, operators who added staff most frequently added delivery personnel, indicated in chart 11b. This indicates a healthy level of business expansion.

Another positive sign, indicated in chart 11c, is that OCS staff reductions, where they occurred, did not include sales people. This demonstrates the high level of importance that operators place on sales in their operations.

While fewer operators offered customers ordering online, indicated in chart 13, more are using social media, indicated in chart 14a. Operators interviewed noted they view social media as a customer relations tool more than a sales tool.

More OCS operators billed customers for fuel in 2011/2012 than the prior, indicated in chart 9a, reversing a decline in the prior year. Operators have increasingly billed for fuel on a selective basis, indicated in chart 9b.

Single-cup resumes rapid growth

One of the most significant signs of OCS strength in the last two years has been the return to a steep growth of single-cup brewers, indicated in chart 8. The growth slowed in the prior two years when locations were more cost conscious. Since then, locations have become more willing to spend for good quality OCS. Further strengthening this demand has been rising consumer appreciation of single-cup driven by a rapidly growing homeowner market.

While the homeowner single-cup has created some additional pricing pressure for OCS operators, the increased awareness resulted in a more vigorous worksite demand for single-cup.

Many operators who worried about the margin erosion of single-cup caused by competition from the homeowner market noticed that the rising demand for single-cup delivered higher volume which in many cases offset the impact of lower profit margins.

Single-cup brewers have become the fastest growing retail coffee format. The single-cup category rose 105 percent in U.S. food stores over the last year for the period ending June 10, 2012, according to Symphony IRI Group, Inc. Single-cup was the second fastest growing sub-category overall in dollar sales within total U.S. grocery.

It has created new opportunities for OCS as well as a new source of competition.

Retail competition for single-cup cartridges became fiercer in the last year as more retailers began carrying single-cup products.

This downward price pressure resulted in a slight decline in single-cup prices, noted in chart 4c. The decline from 42.5 cents to 41.8 cents per cup was not significant and, at 0.7 cents, it falls within the margin of error. The fact remains that single-cup coffee, the fastest growing OCS category, did not net higher prices in a year in which overall OCS prices increased.

The inability of OCS operators to raise single-cup prices challenges operator profitability.

The growing customer demand for single-cup coffee delivered volume gains for some operators that were significant enough to offset the lower margins. Some operators believe that gross dollar gains are more important than margins.

The dollars versus margins debate is not new in OCS.

Another positive result from the growth of single-cup was the price differential between single-cup and fraction pack coffee. Rising customer awareness of single-cup coffee, with its higher prices, gives fraction pack coffee a stronger cost/value perception since it is less expensive. This, coupled with the increased offerings of retail coffee brands in OCS with perceived high product quality, supported higher fractional pack prices.

Chart 4c indicates consistently higher prices for fraction pack coffee through the recession. The traditional “five cents a cup” mantra that ruled OCS in its earlier years has long been relegated to the history books.

Fraction pack sales also carried higher profit margins than single-cup sales. A sizeable portion of fraction pack coffee is private label, which is more profitable than national brand coffee.

Falling green coffee prices in 2012, indicated in chart 3, benefitted private label profitability.

National brand coffee rises

The growth in single-cup contributed to the gain in national brand coffee for the second straight year, indicated in chart 6. The dominant and fastest growing single-cup systems are cartridge-based systems, such as Keurig, Flavia and Tassimo, which carry national brand coffee.

National brands have posted a slight comeback since the recession began. National brands lost market share in 2009/2010 for two reasons. One reason, already noted, was that the demand for single-cup slowed in the first two years of the recession, curtailing the growth of national brands.

The second reason was that green coffee prices remained steady through most of 2009/2010, encouraging OCS operators to offer more profitable private label alternatives. By offering private label, operators could provide coffee that was both less expensive to themselves and their customers.

In the last two years, single-cup has rebounded rapidly, reviving national brands and rechallenging OCS operator profitability.

Single-cup systems that allow operators to use private label coffee, such as hopper-based and soft pod-based systems, also increased in recent years, indicated in chart 8. However, the cartridge-based systems (Keurig, Flavia and Tassimo) increased the most. Keurig and Tassimo also have strong market positions in the homeowner market, which points to continued growth in the work site environment for these products.

The growth of the homeowner market has created a new market opportunity for some OCS operators. While many operators complained about competition from the homeowner market and a new reason for customers to pilfer coffee at work, some operators turned this perceived threat into an opportunity for ancillary sales.

Such operators gain incremental sales by inviting customers to place coffee orders at the work site for home use. Operators offer the coffee at competitive prices and provide the convenience of delivering it at the customer’s work site. Operators deliver these orders on their routes, incurring almost no additional labor cost.

Operators noted that coffee pilferage does require policing, but this issue predates single-cup coffee and has not become noticeably worse because of it. Operators also noted the issue is often a greater concern to the location manager than reality merits. In such cases, operators are able address the concern through communicating with location managers.

A bigger operator concern is pricing pressure from retailers on Keurig K Cup®s, the dominant single-cup product, both at retail and in OCS. Symphony IRI Group, Inc., the retail research firm, noted the K-Cup® packs from Green Mountain Coffee Roaster's sold through the grocery channel hold a clear leader over other single-cup beverage packs.

Equipment manufacturers and coffee roasters have developed K Cup®s alternatives to offer OCS operators a more profitable alternative. These efforts increased in the past year in anticipation of the expiration of patents in September, 2012 on some earlier K Cup®s. (See story on page 12).

Whether or not competing products can offer the same popularity as K Cup®s remains to be seen.

Alternatives to cartridge systems emerge

Manufacturers of soft pod-based, single-cup systems have attempted to offer a more profitable alternative to Kuerig and other cartridge systems for several years.

The soft pod-based systems offer much of the same benefit as cartridge systems in that they have portion and brewing control, but offer the added benefit of allowing operators to source coffee from different suppliers. The soft pod-based systems also have the advantage of being biodegradable.

Many operators agree that the soft pod-based systems have improved in quality in recent years. However, these systems are hampered by the following: 1) The initial systems introduced to market several years ago were mechanically faulty and delivered negative customer experiences that need to be overcome and 2) The cartridge-based systems have already secured market dominance.

In addition to these concerns, given the current dominance of the established single-cup systems, any new systems will require OCS operators to invest in additional product and equipment and manage additional inventory.

Some OCS operators are nonetheless enthusiastic about soft pod-based systems on the basis that some of the newer systems deliver a superior tasting product.

Environmental concerns continue

The number of operators offering products that address environmental concerns did not increase in 2011/2012, despite widespread publicity about environmental issues. For the second straight year, operators interviewed noted that consumers say they are concerned about environmental issues but are not willing to pay extra for environmentally-friendly products.

Technological innovation continues in OCS equipment. Brewers have been introduced with remote monitoring capability that makes OCS management more efficient. Brewers have also been introduced with video touchscreens, similar to some of the new vending machines.

These and other innovations continue to emerge at OCS industry trade shows. Operators are evaluating new tools and comparing them to those they already have to meet the customer’s demand for good quality coffee in the work place.

The new delivery systems are finding a place as OCS operators find these tools allow them to provide customers a high quality refreshment experience at an affordable price in the work place.

OCS acquisitions drive national players

The last 12-month period witnessed a more than usual amount of OCS acquisition activity. In late 2011, Aramark Corp. acquired the Filterfresh office coffee services business from Green Mountain Coffee Roasters, Inc. In early 2012, DS Waters of America, Inc. agreed to acquire the assets of The Standard Companies Inc.

In addition to the growth of these two nationwide concerns, Canteen Vending Services Inc. has emerged as national OCS player in recent years.

About the Author

Elliot Maras

Elliot Maras served as the editor of Automatic Merchandiser magazine from 1993 to 2012. To reach the current editor of Automatic Merchandiser and VendingMarketWatch.com, email [email protected].